In a week full of unexpected turns, financial markets demonstrated their inherently volatile nature. Among these shifts, China's equity markets rebounded, along with cryptocurrencies and tech stocks, showcasing a notable recovery. However, not all assets shared the same fate. We delve into the trend reversal experienced by long-term government bonds this week and its implications for ETF investors.

Downside for Long-Term Treasuries

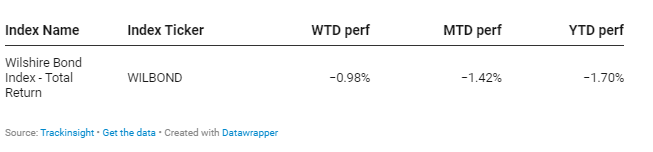

While last week painted a rosy picture for long-term government bonds, this week tells a different story. A significant rise in Treasury yields hit the longest-term government bonds, illustrating the inverse relationship between bond yields and bond prices. Specifically, the yield on the 10-year & 30-year Treasuries leapt by an impressive 15 basis points.

Impact on ETFs

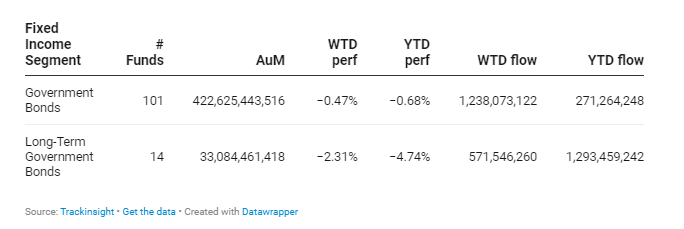

Particularly hit were long-term government bond ETFs, which have a higher duration compared to their shorter maturity counterparts. Consequently, these ETFs bore the brunt of the yield spike, marking a decrease of 2.31%, while government bonds of all maturities together experienced a less severe drop of 0.47%.

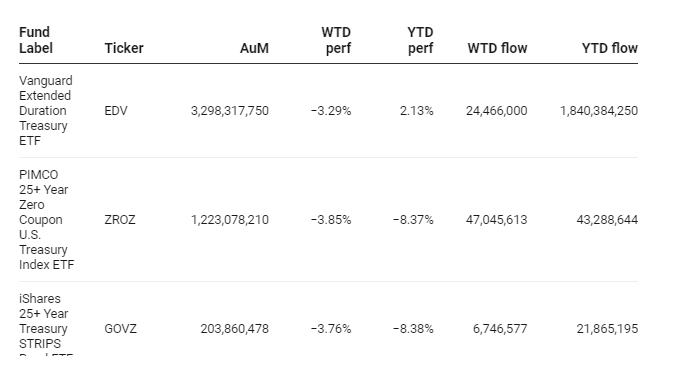

Leading the downward movement were the Vanguard Extended Duration Treasury ETF (EDV) and the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (ZROZ). These ETFs, once celebrated as last week’s top performers, found themselves on the opposite end of the spectrum this week, losing 3.29% and 3.84% respectively.

Group Data

Index Data

Funds Specific Data