Utility shares are typically among of the most popular buy-and-hold stocks. Irrespective of the state of the broader economy, consumers will always demand the services that utilities provide.

This low-demand elasticity attracts especially passive-income seekers, as dividends paid out by utilities tend to be stable. Interest rates are at record-lows in many countries. As a result, dividend-paying stocks are ever-more important for many long-term investors.

Today we introduce two FTSE 100 utility companies that investors may want to keep on their shopping list. They are UK-based SSE (LON:SSE) (OTC:SSEZY) and Severn Trent (LON:SVT) (OTC:SVTRF) (OTC:STRNY). As dark winter days continue, Britons, like billions of global citizens, have been spending many hours indoors. Usage of electricity, gas and water are likely to be at high levels.

With that information, let's see if either of these shares deserves to be on investors’ radar.

SSE

The company focuses on regulated electricity networks and renewable sources of electricity. This objective fits well with the recent actions of the UK, which in 2019 became the first major economy to legislate for "net zero" emissions by 2050.

Governments and businesses are discussing how the economies might recover from the various adverse effects of the pandemic. SSE’s management is motivated by the potential of "green economic recovery." The business wants to bring all greenhouse gas emissions to net zero. For instance, SSE is building the world’s largest wind farm off the east coast of Yorkshire. It has recently joined the UN Global Compact’s Race to Zero pledge—committing to achieving net zero for emissions by 2050 at the latest.

On Nov. 18, SSE released interim results for the six months ending Sept. 30, 2020. Operating profit declined 15% year-on-year (YoY) to £418.3 million (or $573.9 million). Keeping net debt levels under control has been a priority during the difficult days of the pandemic.

More than a third of its current profits come from renewables. Management wants to increase the percentage in the near future. We believe the company could well become a green powerhouse.

Over the past 12 months, the stock is down approximately 2.7%. On Jan. 28, SSE shares closed at 1,492.5p ($20.65 for U.S.-based shares). The current dividend yield stands at about 5.5%. The FTSE 100 average yield is less than 3.0%

Forward P/E and P/S ratios are 15.72 and 2.32, respectively. We like SSE. It is a robust investment in the future of renewable energy in the UK. Potential investors could consider buying the dips.

Severn Trent

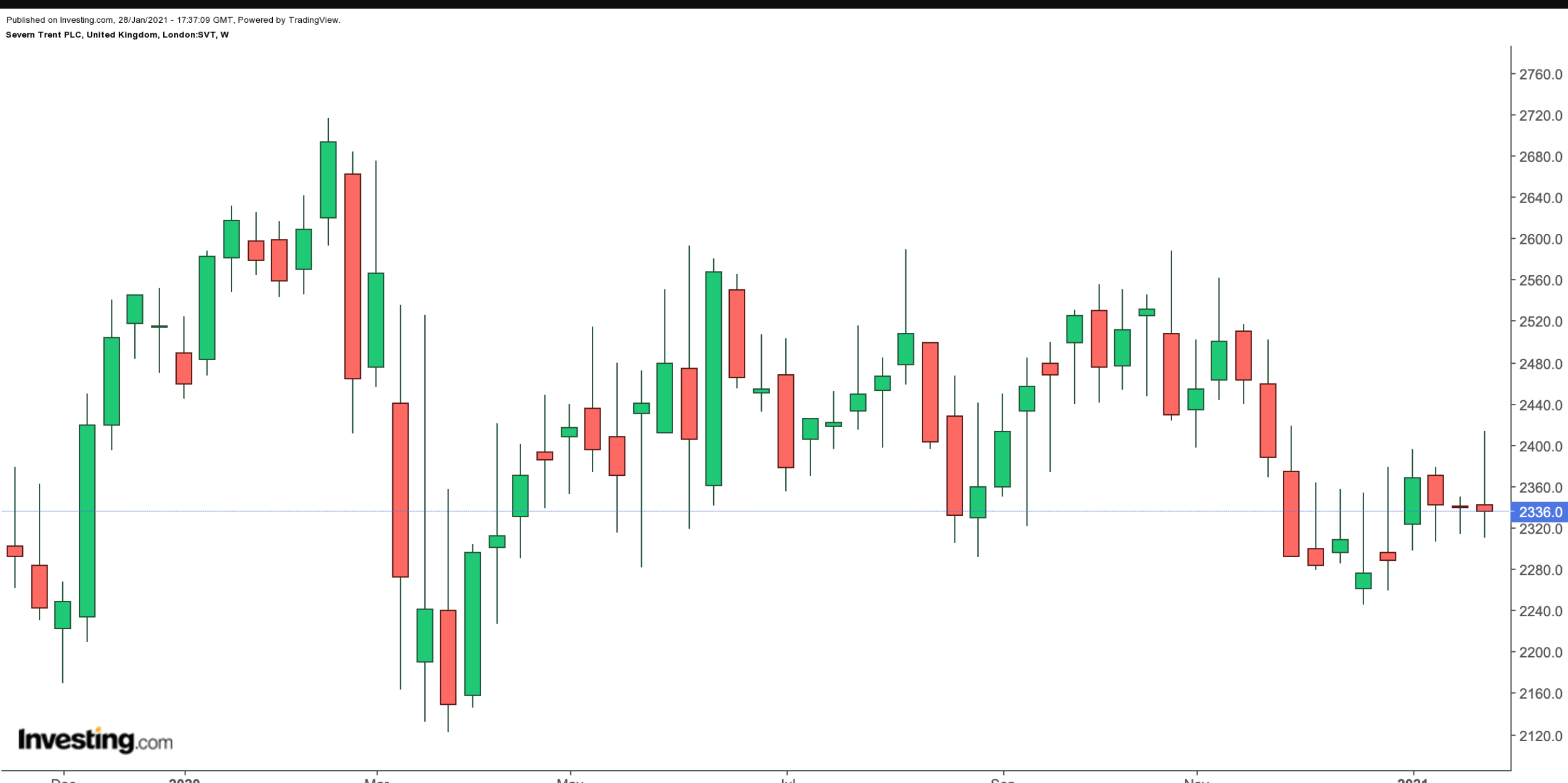

Severn Trent is a water utility company, providing vital water and waste services in the UK to more than 8 million people. Currently, it has a valuation of £5.58 billion with a dividend yield of 4.3%. On Jan. 28, SVT shares closed at 2,336p ($32.91 for U.S.-based shares). Over the past year, the shares are down about 8%.

The challenge the company has had for years is managing the cost for maintenance and infrastructure. Balancing large capital expenditure costs (capex) with competitive prices and a continued service to customers are the main goals.

Severn Trent has been given the go-ahead to safeguard the next 100 years of water supply to Birmingham City with a major infrastructure scheme. The group does not plan to make any of these major changes to infrastructure in the next five years. It is instead choosing to focus on reducing costs incurred to the business through leakages and maintenance.

Management has also joined in the Race to Zero campaign, which aims to rally leadership across businesses, cities, regions and investors for a healthy, resilient, zero-carbon recovery.

In late November, the group announced half-year results. Due to the pandemic, turnover declined by 2.4% YoY. Profit before interest and tax (PBIT) was also down 19% YoY.

SVT stock’s forward P/E and P/S ratios are 18.55 and 3.12, respectively, putting the valuation on the frothy side. We like the stock as a steady dividend play. A potential drop of 5%-7% would offer a better margin of safety for long-term investors