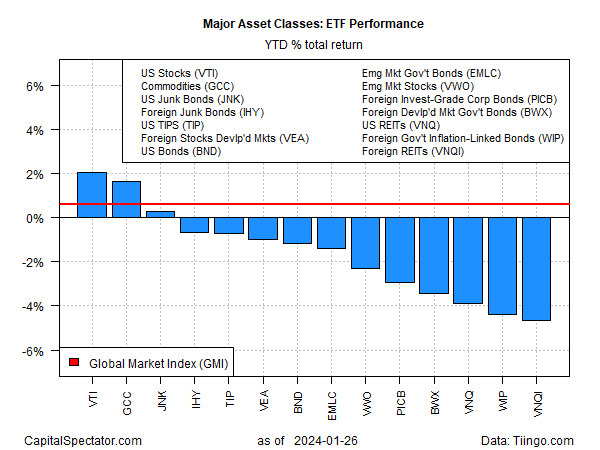

Red ink dominates 2024’s opening month for most of the major asset classes.

The upside exceptions for the performance profile so far: US stocks, commodities and junk bonds. Otherwise, year-to-date losses prevail, based on a set of ETFs through Friday’s close (Jan. 26).

Following last year’s broad rally that lifted every primary market category except commodities, animal spirits are taking a breather for the most part in January.

American equities, once again, are the leading upside outlier—with a twist. Commodities are a close second year-to-date performer.

Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) is up 2.1% so far in 2024, building on the fund’s stellar 26.1% surge last year.

So far in 2024, US shares have performance competition via commodities (GCC), with a 1.7% year-to-date gain.

US junk bonds (JNK) are a distant but positive third-place performer with a fractional 0.3% rise so far this year.

The rest of the field is posting losses in the early going for 2024.

The biggest loser: global real estate shares ex-US via Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:VNQI), which has slumped 4.7% since 2023’s close.

The Global Market Index (GMI) has extended its sizzling 19.2% rally in 2023 with a 0.6% increase so far this year.

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

The jump in commodities prices in January aligns with some forecasts that see this slice of the major asset classes rebounding after last year’s decline.

The expected catalyst: a “super squeeze” that’s driven by supply disruptions and low investment in new production capacity, according to one analyst’s view.

“For some time now we have described global commodity markets as being in a ‘super-squeeze,’” says Paul Bloxham, HSBC’s chief economist.

The phenomenon is defined as a rise in prices due primarily to supply constraints rather than demand growth, he advises.

“If it’s a supply constraint that’s driving high commodity prices, it’s a very different story for global growth,” he adds.

In an interview with CNBC last week, Bloxham explains that higher prices driven by a super squeeze are “not as positive” compared with demand-driven growth.