Stocks finished little changed on Wednesday, ahead of ISM services data today and, of course, the employment report on Friday.

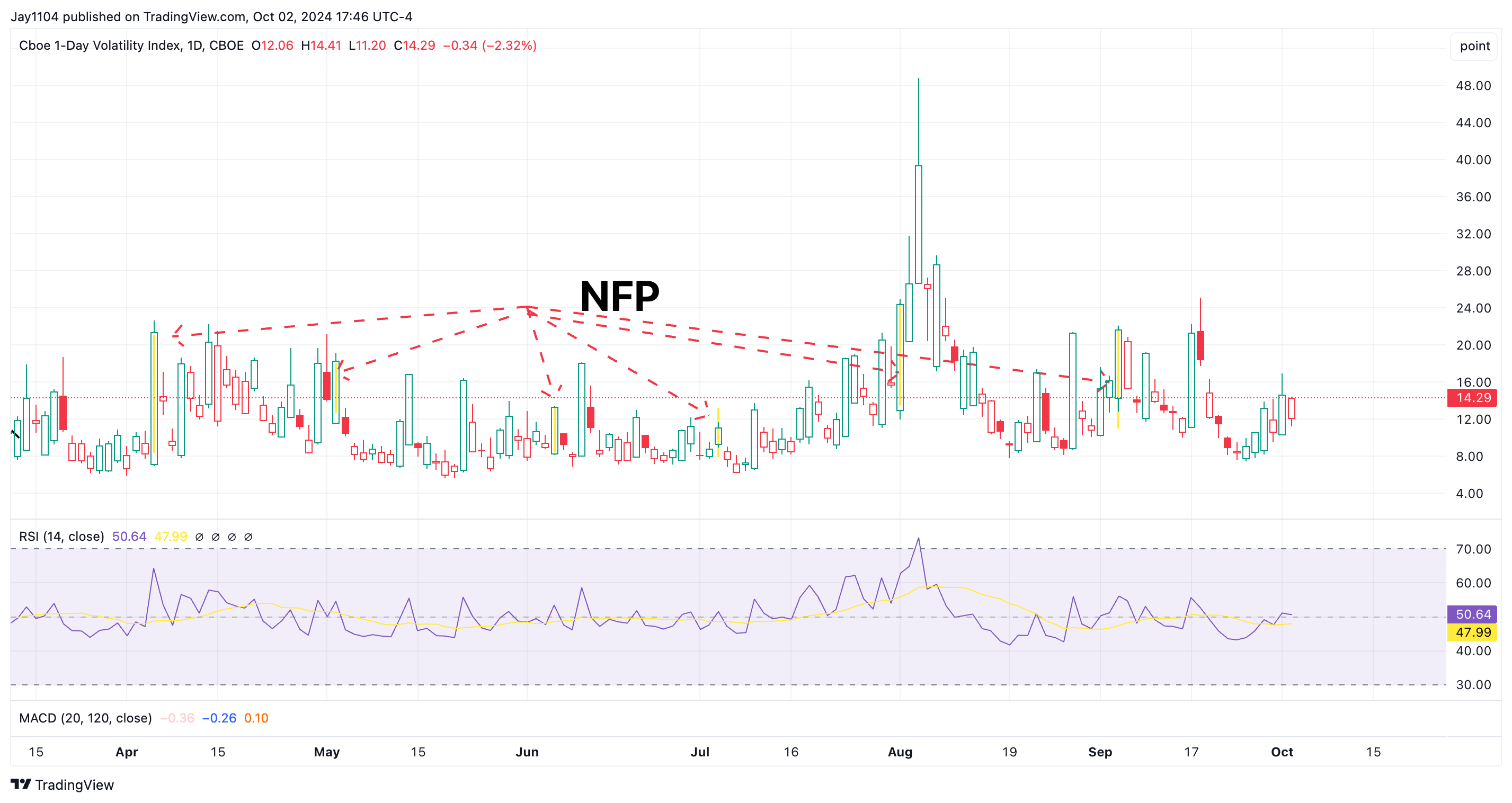

The VIX—1Day closed yesterday around 14, and given the importance of the job report on Friday, I would be shocked if it doesn’t climb to 20 or higher today.

Whether the market sells off today depends entirely on whether the VIX Index rises.

If it goes up, along with the VIX 1-day, the market will sell off sharply one day. If the VIX 1-day goes up, and the VIX 30 is down or flat, the market probably does nothing.

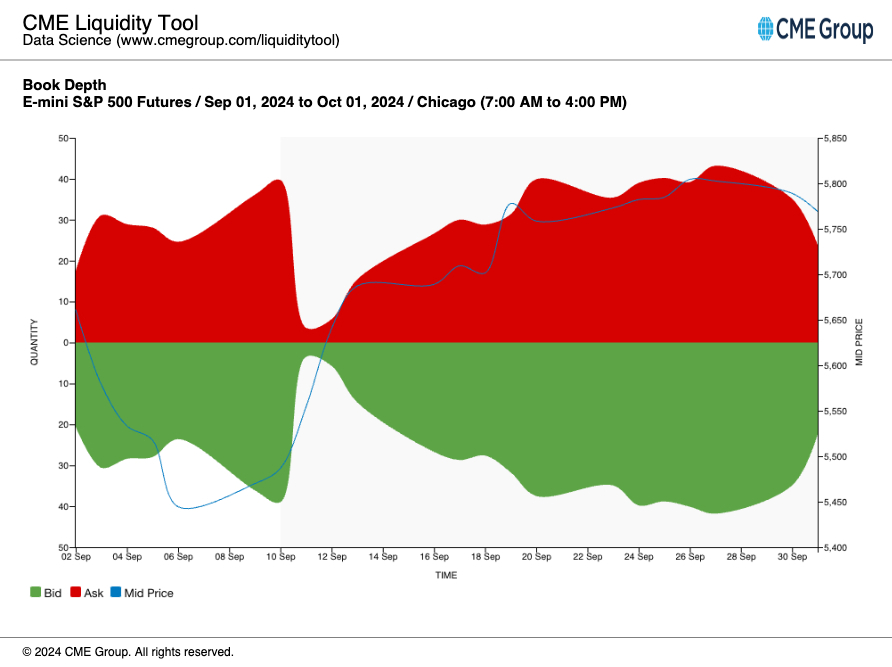

The one apparent thing is that the top of the book continues to be a problem for the market and is very thin.

This just means it is much easier for the market to move around, and without the JPM Collar to hold things together, we are seeing bigger price swings throughout the day.

The S&P 500 index opened lower by 60 bps yesterday, finishing the day flat.

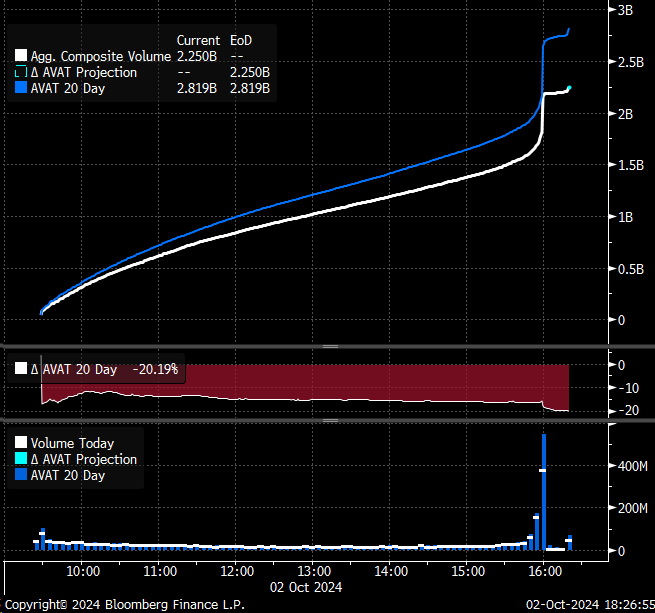

Volume yesterday was also 20% below the 20-day average.

Overall, the volume of S&P 500 futures was also much lower than yesterday, when the sellers were out in force.

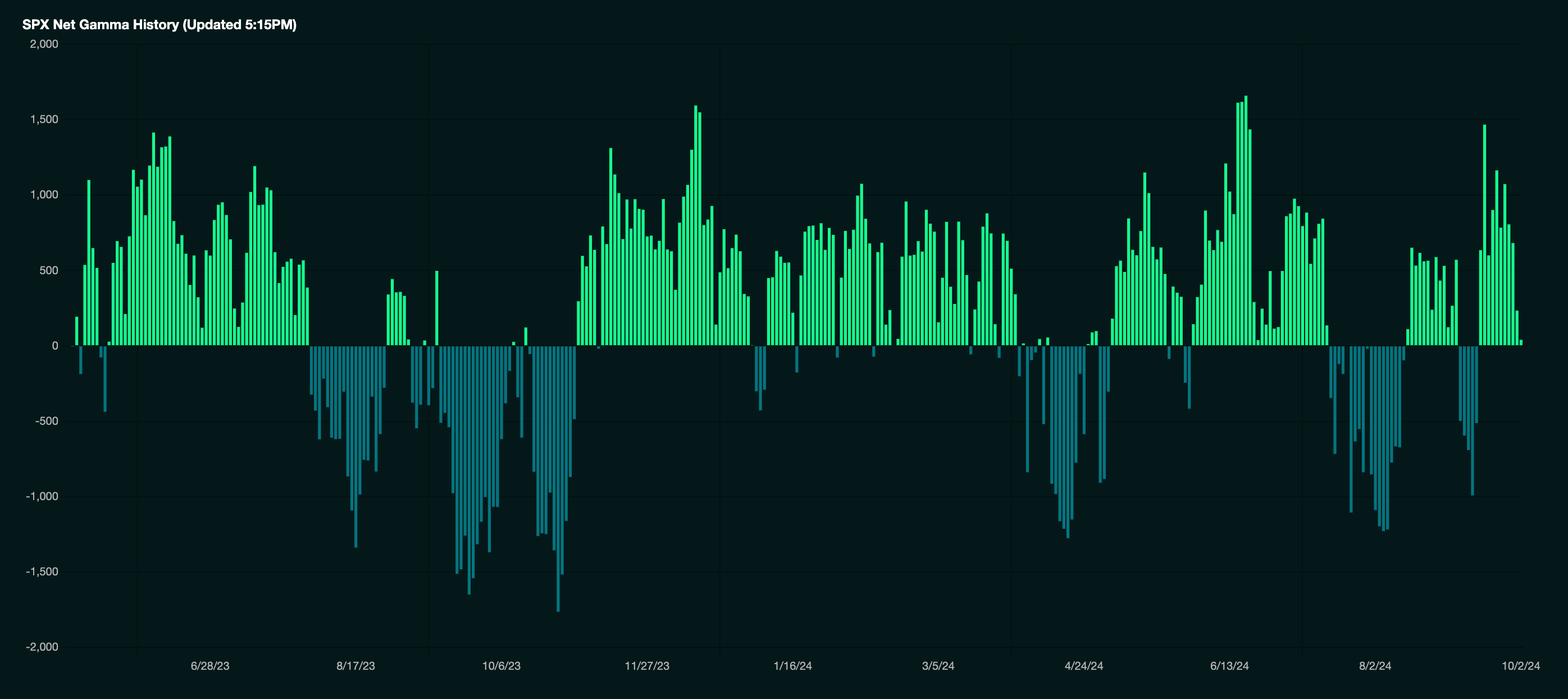

Also, gamma levels are significantly reduced and basically at zero. That positive gamma mean-reverting force that had been in place for two weeks is gone.

When you put all of the pieces together, yesterday’s price action tells you that the sellers were mainly absent. Even on a day when the sellers were mainly absent, the bulls could do little to lift the market, even in an environment where sweeping the top book could probably easily push it higher. All the sellers have to do is show up, and if they show up, I think there is little to hold this market up at this point. It is too thin, and buyers look tired.

The most bullish thing right now is the gap left open from yesterday’s opening. With a potential diamond bottom, that gap could be filled sooner rather than later.

But if implied volatility is bid today, then that gap may have to wait until after the job report comes on Friday, or it may not be filled anytime soon at all.