AI is a game of kings, and OpenAI knows it

Introduction

Lumen is a special case, a convincing deservice opportunity that is getting out of the crash, trading at bumps. It is led by management quality, strategic transformation, and the undervalued private infrastructure assets. The fiber network, which encompasses a total distance of 450,000 miles, is an abundant and growing digital infrastructure viewed positively in the era of AI and edge computing. The company’s strategic plan focuses on the expansion of Lumen’s edge computing, where its distributed fiber network makes the company unique for low-latency applications addressing a $12 billion edge computing market. In addition, the company earns revenue with the help of its 5G infrastructure, which is the only service provider in regional markets, and at the same time, it creates a stable income stream. Furthermore, the usage of direct cloud connection and hybrid infrastructure services by enterprise digital transformation creates extra demand for those services. The increased AI infrastructural necessity resonates in the additional value of Lumen’s fiber network for data center interconnection and AI workload support.

Growing the Fiber Network Infrastructure

The fiber optic network of Lumen is the primary engine of this company generating profit by the global serving of the 450,000 route miles. This fiber, as the primary related technology, depends on it to deliver high speed, low latency services that are primordial for the new digital applications. The company’s decisive move in respect of the fiber network, especially in demography and enterprise development, ensures the firm with a great strategic advantage over copper-based legacy networks.

Besides, the fiber network can now deliver ultra-reliable, low latency applications in addition to just basic connecting network services. Among the numerous advantages of fiber, only fiber can be used in signal quality, bandwidth capacity, and electromagnetic interference resistance to be avant-garde technologies. It is the preferred medium of backhaul 5G, cloud, and live data analytics applications.

Lumen’s fiber infrastructure investments also support network slicing capabilities, allowing the company to partition network resources for specific customer requirements or service types. This technological flexibility enables customized service offerings that can command premium pricing while optimizing network utilization across diverse customer segments.

Edge Computing Platform Development

The development of edge computing platform at Lumen is a technological effort, which changes things dramatically in the field of networking and cloud computing at the same time. Besides, by bringing computing resources to be closer to the end users and data sources, Lumen’s edge infrastructure not only cuts the latency but it also improves the application’s performance and provides new categories of real-time applications.

Lumen’s edge computing nodes are strategically located within its fiber network footprint, creating a distributed computing architecture that can support latency-sensitive applications such as autonomous vehicles, industrial IoT, augmented reality, and real-time analytics. This edge-to-cloud continuum provides customers with flexible deployment options that optimize performance and cost characteristics based on specific application requirements. The platform’s integration with major cloud providers through direct connectivity and peering arrangements creates hybrid and multi-cloud capabilities that address enterprise requirements for workload portability and vendor diversification. This technological approach enables Lumen to participate in the growing edge computing market while leveraging its existing network infrastructure investments.

Software-Defined Networking (SDN) Implementation

Lumen’s implementation of software-defined networking technologies transforms its traditional network infrastructure into a programmable, agile platform capable of rapid service provisioning and dynamic resource allocation. SDN capabilities enable automated network management, real-time traffic optimization, and on-demand bandwidth allocation that significantly improves operational efficiency and customer experience. The SDN architecture is a platform that supports network function virtualization (NFV). This means Lumen can deploy network services as software applications instead of hardware appliances. This kind of approach is not only entailed by the lower capitalization of expenses, but it is also characterized by the quick service deployment and the service customization for the enterprise customers. Through software-defined networking, network-as-a-service offerings can also be made available, which will enable customers to provision services on a self-service basis while subscribing to a usage-based pricing model. These features are of utmost importance to customers that have changing bandwidth requirements or are trying to avoid fixed infrastructure costs.

Conventional Competitors

Lumen’s most direct rivals are the traditional telecommunications carriers such as Verizon (NYSE:VZ), AT&T, and Comcast (NASDAQ:CMCSA), who have not only equivalent network infrastructures but also relationships with enterprise customers. These market players are worthy of competition with their strong financial means, large fiber subscriber networks, and long-term customers, thus triggering a tough competitive environment for Lumen in the field of core connectivities. The most outstanding asset of Verizon is its being the best in wireless network leadership and enterprise mobility solutions together with a strong fiber infrastructure that supports both wireless backhaul and direct enterprise connectivity. AT&T is putting its massive customer base to use since it is providing integrated wireless-wireline options, which means the company has the chance to address the integration broadband communication needs of customers. Comcast’s cable infrastructure and business services division compete directly with Lumen in metropolitan markets.

Lumen’s Response Strategy: Lumen, on the other hand, considers this competition as a possibility to find a difference through technology in the network reach and edge computing capabilities. The company’s vast fiber footprint, which is most visible in secondary markets and rural areas, gives geographic coverage advantages overlooked often by bigger firms. Lumen’s priority to fast, low-latency connectivity and edge computing services offers such technical differentiation that is not seen in traditional connectivity products.

However, Lumen’s success in this competitive area is a mixture of good and bad. While the company secures strong positions in specific geographic markets and customer segments, its overall market share is being clobbered by large companies taking advantage of the superior financial resources and wider service portfolios. The company’s enterprise customer base cushions the blow to some degree, whereas the pressure from competitors on the pricing and the service mix also persistently challenges its growth potential.

Cloud Service Provider Competition

Amazon (NASDAQ:AMZN) Web Services, Microsoft (NASDAQ:MSFT) Azure, and Google (NASDAQ:GOOGL) Cloud Platform are cloud service providers that have turned on the player because of the infrastructure expansion and direct connectivity services they offer. These super cloud platforms have huge amounts of financial resources and they are able to exploit their worldwide data centers to give networking and cloud services in an integrated way.

AWS’s Direct Connect, Microsoft’s ExpressRoute, and Google’s Dedicated Interconnect services are the products that compete directly with Lumen’s cloud connectivity offerings. These companies have the capability to package the networking services together with the cloud computing resources so that they can present the integrated solutions which seem to the customer more affordable than the networking and cloud services independently.

Lumen’s Response Strategy: Lumen’s strategy was to position itself as a neutral connectivity provider, meaning that it would not become a competitor of the aforementioned major cloud platforms, but rather work with them instead. The company’s multi-cloud connectivity sets apart Lumen’s clients from the clouds and therefore by using one network relationship they are able to access multiple cloud providers.

This partnership model has been successful to a large extent, as shown in the area of Lumen’s interconnectivity of relational with renowned cloud providers. The company’s edge computing projects also go side by side with hyperscale cloud services because they concentrate on the applications that take benefits from the distributed computing resources which are available only by low latency.

Lumen’s Replacement Cost:

Physical Infrastructure Layer

In any telecommunications network, the foundation is the physical infrastructure, which comprises actual cables, conduits, and pathway rights. For Lumen’s fiber network, specifically, you will require the securing of rights-of-way for traversal of hundreds of thousands of miles. This is also the place where the historical side comes to play. To note, the majority of these rights-of-way have been obtained more than a couple of decades, and some even over a century, ago. Their grants were often made through regulatory frameworks, now non-existent, and no cost of reproduction would be today equivalent.

Just think of this: if you were to seek building a transcontinental fiber network from the beginning this time around, you’d extremely likely suffer from issues like environmentalist reviews, urban planning restrictions, property acquisition costs, and regulatory hurdles that were not there when a lot of the original pathway infrastructure was laid. The switch expense for the rights and permits themselves would easily top out at tens of billions of dollars.

Fiber Infrastructure Alone

These days, it costs roughly $10,000 to $30,000 per mile of installation depending on ground and town vs. country building conditions to set up modern optical fiber cables. The figure would be between $4.5 billion to $13.5 billion just for the fiber installation alone if Lumen laid out 450,000 route miles. But, sincerely, it is actually this part of the physical equation that is the lesser one.

Network Equipment and Technology

The next topic is undoubtedly more of a technology’s standpoint but on the flip side could be also finance’s. In a certain way, even the replacement cost would be lesser as the new one is much more powerful and efficient. The fiber optic systems of today can overwhelmingly more data even than those systems which have been running for a decade before. A solitary fiber strand is able to handle multitasking terabits of data today that would have been supported by a mega-corporation’s infrastructure before.

Nonetheless, you’ll still have to get thousands of network nodes, switching equipment, data centers, redundancy systems, and more. Some estimates from the industry indicate that this may add a further $20-30 billion to the replacement cost.

The Hidden Value: Network Effects and Interconnection

In this case, the reasoning becomes more complicated. You should notice that the base telecommunications network profit is not just from its physical components per se-who will connect to other networks and whom will it get customers from, and operational systems which is Lumen’s structured network connects to other carriers-internet service providers-and enterprise customers. The network of Lumen connects to the hundreds of participating Internet service providers, enterprise customers, and carriers. Doing so would mean replicating these interconnection agreements and relationships, which could take numerous years and in some cases may be unfeasible because of the conditions that have to be met initially.

You can think of it as if you were to try to recreate an entire town’s road infrastructure. One could feasibly build these roads (or at least the majority of them), yet it is another challenge altogether to recreate all those businesses, the inhabitants, and the economic activity that goes through those roads and thus, makes them valuable.

Assembling a Realistic Estimate

The price tag to produce Lumin’s core network infrastructure like as a key player would be easily estimated to reach between $50-80 billion if we are to rely on benchmarks of the industry and consider all these points. This number will be divided among the physical infrastructure, equipment, current costs for rights-of-way acquisition, time for customers, and carrier relationship building.

But, being practical, the main takeaway from this analysis on the replacement cost is clear; this is the reason the dominant telecommunications companies trade at marked premiums over their underlying asset value. The entry barriers are really huge, affecting not only funds but also practically and regulatorily.

Key Risks

Revenue Decline and Customer Attrition Risks

Lumen has a hard time bearing the pressure of revenue coming from the legacy service division that is competing with other markets. As more customers opt for newer technologies and competitors provide better prices or bundles than traditional voice and data services, they are still afflicted by the secular challenge. This

is the situation they are in because of the fact that the fixed network costs are still more or less the same, thus making the dependency on operational leverage harder, while the revenue decreases.

The customer’s concentration-risk is one more vulnerability, as the company could suffer heavy financial consequences if important corporations were to leave. Contracts with companies usually span for several years, however, contract switching in the period of renewal affects considerably the company’s income volatile, which is hard to be compensated by bringing in new clients in fierce competition.

The company’s consumer sector is burdened by the issue of cord-cutting trends where Lumen Broadband offers tough competition, alongside government regulatory pressures on pricing. Additionally, Lumen’s reliance on rural markets also exposes it to the risk of financial troubles stemming from the agricultural and energy sectors which constitute large chunks of its customer base in specific areas.

Technological Obsolescence and Infrastructure Risks

The fast-moving technology development in telecommunications introduces the risk of infrastructure obsolescence and stranded asset values. Lumen’s vast copper network infrastructure represents a huge investment of several billion which could turn into a loss if fiber and wireless technologies keep on evolving. The question then is whether the transfer of the customers under technology is going to be done by Lumen at the right time without increasing service costs and production costs.

Network security is always a concern whenever essential infrastructure is being served by enterprises and government customers. Psychological issues like natural disasters, cyber-attacks, equipment glitches, or human imprudence can induce service outages that will, in turn, translate into customer frustration, regulatory fines, and distortion of image. The redundancy of the company’s network and their recovery plans are both massive but they still cannot wholly remove the operational risks.

Counterproductive cybersecurity actions become a major problem as the whole network system transforms into an attractive target for the state, criminals, and hacktivists. The impacts of possible breaches include loss of customer data, disruption of service delivery, regulatory penalties, and customer mistrust. The hacking arena is becoming more sophisticated both in instrumentality and occurrence, hence the call for constant upgrading of security measures and employment of personnel.

Guru

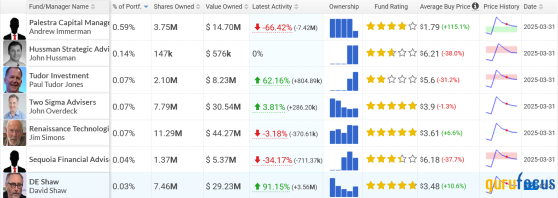

While the institutional ownership data reflects the different perspectives of two finance managers about Lumen’s future. Palestra Capital Management’s biggest shareholder Andrew Immerman holds 3,750,000 shares worth $14.70 million and his holding is 0.59% of the total portfolio. At the same time Palestra has shown its tremendous concern regarding the investment, as it has sold a very considerable 66.42% of the stake it held, that is 7.42 million of shares. Such drastic sell-off move conveys the idea that they are losing hope in Lumen’s recovery storyline, although Immerman with the average price per buy of $1.79 was obviously the first one to trust the new narrative.

On the other hand, John Overdeck of Two Sigma Advisers holds a smaller but more stable position of 7.79 million shares for $30.54 million. The company marginally raised its stake by 3.81%, buying an additional 286,200 shares pointing to confidence about Lumen’s opportunities, albeit moderate. The average cost of around $3.90 indicates their high price purchases, Nevertheless, acquisition suggests the sustained belief in Lumen’s investment case by them.

Valuation

Snapshots of Lumen’s data reflect a twisted narrative of the organization, as they capture both the financial obstacles and the potential value-moment. The P/E ratio of -12.41 implies that the company is presently not profitable on a net basis, which presents distasteful conditions on the subject of fundamental valuation. The shortfall clearly comes as a result of the huge debt load of Lumen, depreciation costs of the obsolete infrastructure, and costs associated with the restructuring of the company.

Notwithstanding, the PEG ratio of 2.74 shines a more multifaceted light on the matter. Although this seems high compared to normal growth stock benchmarks, it should be seen within the context of Lumen’s conversion narrative. The PEG computation indicates the situation where even in times of losses, the market will come to realize revenues that are going to be more than sufficient to cover the costs. The metric that looks ahead incorporates the expectations that Lumen is going to move away from traditional phone services to the more profitable edge computing and digital infrastructure lines.

The coupling of negative current income and positive PEG ratio gives a quite interesting investment set up. It literally means that in the short-run Lumen is undergoing cash flow challenges but, the marketshope for a turnaround due to the stabilization in the revenues and the growth of the new businees. It, therefore, provides the investors a turnaround situation where the current financial numbers may not do real justice to the company’s actual real value creation that will will be seen when the transformation starts to work and the efficiency goes up.

Recommendation

From the standpoint of valuation, Lumen is at the graveyard lows trading at an EV/EBITDA multiple of about 4x. This obviously shows the legacy business worries while the transformation business gets ignored. The company is cash rich as it produces around $2.3 billion of free cash flow on an annual basis, which it can use both in debt pay-down and the execution of new projects. Moreover, the company’s hefty $35 billion debt load, which limits its financial maneuverability, and the legacy revenue outflow accompany Lumen’s investment dilemmas. However, some bright signals come from core business stabilization and better edge computing business prospects. The infrastructure of the enterprise, which is the backbone of the company, coupled with the innovative growth factors, and the discounted valuation creates a situation of risk-reward, the variant of which is only for the patient investor, who is ready to endure the short-term execution hazards.

This content was originally published on Gurufocus.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?