Based on my valuation model, LVMH (LVMHF) (LVMUY) is likely to deliver an 8% enterprise value CAGR over the next five years, with a negative margin of safety of -6%. The rebound following the 16.5% decline over the past 12 months is expected to stem largely from improved sentiment for LVMH stock in late 2025 and 2026, driven by macroeconomic factors such as a potential recovery in China's luxury consumerisma critical factor in LVMH's decline in 2024. However, the return prospects are not particularly compelling, and I believe there are better opportunities to generate alpha in the market.

Operational and financial analysisLVMH's recent contraction in earnings has been the dominant reason for the decline in the company's valuation over the past 12 months. The company's earnings have been affected by a decline in demand from Mainland China, one of its most important markets. This led to a 3% organic decline in total sales in Q3 2024, a stark contrast to the anticipated 2% growth cited by Barclays (LON:BARC). Additionally, the company reported an 8% decline in profit from recurring operations in the first half of 2024, despite modest organic revenue growth of 2%. These figures reflect the challenges LVMH faces in maintaining profitability amid slowing sales growth.

However, the outlook for the coming years appears more promising. While demand from Mainland China remains subdued, recovery potential exists as economic conditions stabilize and consumer spending rebounds. Likewise, improved conditions in the European and U.S. markets, driven by lower interest rates and stronger macroeconomics in 2025 and 2026, are likely to contribute to better revenue growth for LVMH.

According to Statista, the luxury goods market worldwide is expected to grow at a CAGR of 4.04% from 2024 to 2029. Thus, during this period of lower sentiment for LVMH stock due to temporary demand weakness primarily caused by macroeconomic factors, a buying opportunity has emerged amid the company's better valuation.

LVMH is a standout luxury company with unparalleled leadership in the luxury goods market. It is the world's largest luxury goods company, boasting 75 prestigious brands, including Louis Vuitton, Christian Dior (EPA:DIOR), Tiffany & Co., Bulgari, Moet & Chandon, and Sephora. Despite global economic uncertainty and geopolitical tensions, LVMH demonstrated resilience in 2024 with 41.7 billion in revenue for the first half of the year achieving 2% organic growth even in a challenging environment is quite impressive.

Valuation analysisMy conservative valuation model spans only five years, considering the elevated risk posed by the current macroeconomic and geopolitical environment. Projecting beyond this timeframe would ignore the uncertainty of macro catalysts that could disrupt valuations across many industries.

For December 2029, I conservatively estimate that the company will achieve a total annual revenue of $122 billion, which represents a 6.56% CAGR from the consensus estimate of $88.79 billion for Fiscal 2024. This reflects moderate growth related to macroeconomic recoveries across the company's core markets over the period following 2024's -4.9% revenue contraction, but also accounts for market saturation.

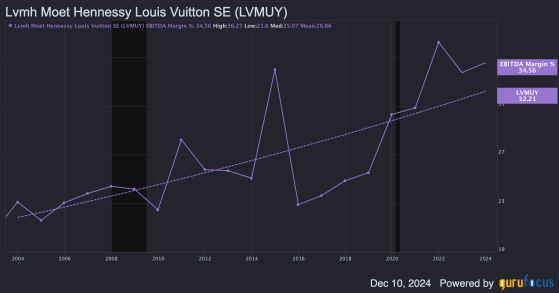

The company's EBITDA margin has exhibited significant volatility over the last 15 years but also shows a long-term uptrend. To remain conservative yet optimistic, I am using a terminal EBITDA margin of 35%. Thus, my forecast for the company's December 2029 EBITDA is $42.7 billion. While this could expand higher, it could also drop, opening up weakness in the investment thesis in the next five years. I expect that such a contraction could become most likely during a severe recession, which does not seem improbable to me during the valuation timeframe I have used. Inflation is still an underlying issue that hasn't been totally solved with higher interest rates in 2024.

The company's 10-year median EV-to-EBITDA ratio is 13.97, while the current ratio is 12.11. Although growth rates may improve over the next year compared to 2024, they are unlikely to expand significantly and may remain more moderate compared to its long-term history due to market saturation. Therefore, I estimate the company's EV-to-EBITDA ratio for December 2029 to be the midpoint of its 10-year median and current ratios13. Accordingly, the company's December 2029 enterprise value is estimated at $555.1 billion. With a present enterprise value of $377.50 billion, this implies a five-year CAGR of 8.02%. However, this estimate significantly depends on the company managing to grow more robustly toward the end of my five-year period, otherwise, such a high terminal multiple is unjustified. The company's 10-year annual revenue growth rate is 11.2%, compared to a 6.6% revenue CAGR in my five-year forecast.

LVMH's weighted average cost of capital is 9.37%, with an equity weight of 88.55% and a debt weight of 11.45%. The cost of equity is 10.31%, and the cost of debt is 2.86% after tax. Discounting my forecast for the December 2029 enterprise value back over five years using the weighted average cost of capital as the discount rate results in a present-day intrinsic enterprise value of $354.72 billion. This calculation reveals an implied negative margin of safety of -6.04%.

Risk analysisLVMH's Chief Financial Officer recently highlighted that consumer confidence in Mainland China is currently aligned with the all-time lows seen during the COVID-19 pandemic, a weakness examined in my operational and financial analysis. This reflects broader economic challenges, including high youth unemployment and a struggling real estate sector, which have dampened spending on discretionary items like luxury goods. While Beijing has introduced measures such as lowering interest rates and injecting liquidity into the economy, these efforts have not significantly boosted consumer spending. Initial optimism about China's stimulus announcements in September 2024 quickly faded as disappointing economic data emerged, eroding investor confidence in a near-term recovery. Therefore, the Chinese luxury market may only recover meaningfully by late 2025, delaying LVMH's full turnaround back to earnings growth.

LVMH also faces brand-specific issues. Christian Dior has shown signs of consumer fatigue, despite efforts to drive growth through new collections like the Miss Dior line and high-profile exhibitions such as L'Or de Dior in Beijing. Louis Vuitton has similarly experienced softer consumer demand in key markets like China and faced economic pressures in other regions. Furthermore, the Wines & Spirits segment has underperformed, and the departure of Philippe Schaus after 8 years as the division's CEO raises concerns about continuity in addressing the challenges. However, the leadership of Alexandre Arnault, transitioning from his position at Tiffany & Co. to become deputy CEO of Moet Hennessy, shows promise for the future.

ConclusionMy valuation model indicates LVMH will deliver a moderate five-year enterprise value CAGR of just 8% and currently has a negative margin of safety of -6%. While it may be a relatively stable investment, its total return, including a dividend yield of 2% (1.6% as a 10-year median), is unlikely to exceed 10% annually over the next five years. Since this aligns with the typical long-term average annual return of the S&P 500 (SPY (NYSE:SPY)), LVMH cannot be considered an exceptional investment at this time. Its valuation, though seemingly appealing after the recent pullback, is less attractive upon deeper analysis from my perspective.

This content was originally published on Gurufocus.com