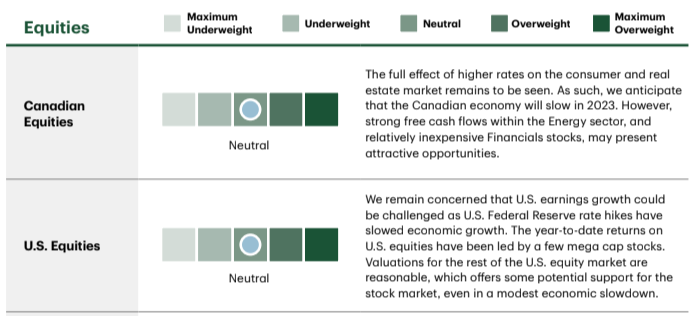

• Our equity positioning remains at a modest underweight; we are cautious over the short term as we anticipate better entry points to come. Market leadership has broadened slightly but remains narrow and continued strength in global equity prices, combined with rising long term bond yields, have compressed equity risk premiums further. Historically, valuations around current levels have suggested limited potential returns in the near term unless earnings growth reaccelerates.

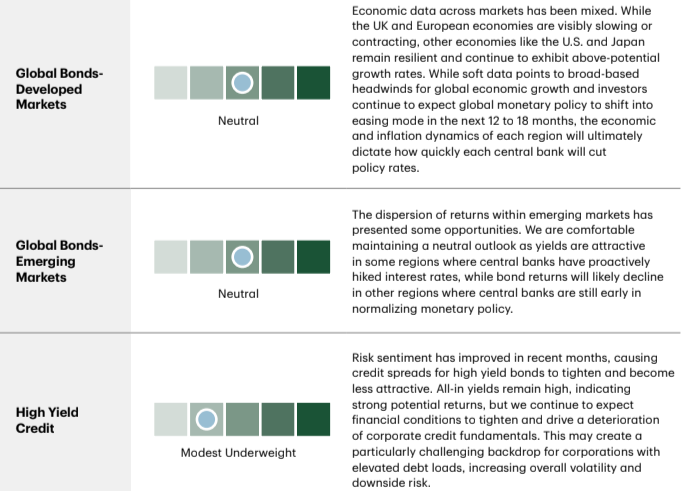

• As resilience in the labour market persists and inflation continues to normalize in line with the expectations of the Bank of Canada, we believe monetary policy pivoting to rate cuts over the next nine to 12 months is less likely than is currently priced by investors. This may translate into a slower decline in interest rates. On the flipside, this may also imply higher for longer income returns within the asset class. We continue to believe that fixed income will outperform equities over the next 12 months and that bonds can still provide diversification benefits, reduce overall portfolio volatility and preserve capital.

• We believe that an allocation to alternative assets can benefit diversified portfolios especially when implemented over the long-term. Alternative assets can provide inflation protection and attractive absolute returns, while acting as long-term portfolio stabilizers via their diversification benefits and less correlated income streams.

• In recent months, the yield on cash and equivalents has risen alongside further rate hikes from the Bank of Canada. As key economic data continues to normalize further, the risks of additional monetary policy tightening are now balanced. If monetary policy takes longer to ease than investors currently expect, there would be less reinvestment risk associated with today’s yield on cash and equivalents. Therefore, we have a neutral allocation to cash & equivalents.

Quarter In Review

Over the quarter, investors and markets alike continued to be consumed by questions of timing. When will we see inflation finally begin to recede, and when will economies truly enter the slowdown that indicators seem to have been anticipating for months now? Answers remain thin on the ground as indicators remain divided on what the exact path will be going forward, but we may have seen some early signs of movement during the quarter and believe we can expect market volatility to persist for the near term.

In Canada, second quarter gross domestic product (“GDP”) contracted by 0.2%, easing some concerns that growth had accelerated substantially above trend in early 2023 (which would have had negative inflation implications). This GDP contraction reflected a marked weakening in consumption growth and a decline in housing activity, but it also meant that the Bank of Canada (“BoC”) was able to hold interest rates in their September announcement. This hold may not be a sign of ongoing relief from hawkish policy, however, as the BoC has stated that it remains concerned about core inflation and persistent inflationary pressures. Markets are still pricing in the potential for additional interest rate hikes before the year is out which could have a meaningful effect throughout the Canadian economy as the debt burden for Canadians remains high.

The U.S. is currently in a resilient position with respect to the rest of the world, exhibiting modest economic growth, but it is not out of the woods yet. Core inflation still remains above the U.S. Federal Reserve’s (“the Fed’s”) targets. Tightening credit conditions are weighing on economic activity, hiring and inflation, and the extent of the effects on growth are yet to be seen. Job numbers in August were strong but manufacturing activity continued to contract for the tenth consecutive month. Overall government and consumer spending has strengthened the U.S. economy, but the Fed is still on guard for shifts in the sand and isn’t counting out additional interest rate hikes either.

Global growth slowed in the second quarter of 2023, largely reflecting a significant deceleration in China. With ongoing weakness in the property sector combined with domestic consumer spending challenges, confidence in the growth prospects in China have diminished. New policies to support the real estate sector as well as the sales of electric vehicles have been announced, but there is skepticism about how meaningfully these moves will buoy consumer confidence.

During the quarter, we were positioned to defend against continued uncertainty in the market, with a maximum overweight to fixed income. In August, we downgraded to a modest overweight in fixed income and strategically increased our allocation to cash & equivalents in order to increase optionality and to be ready to take advantage of opportunities as they make themselves clear going forward. With respect to equities, we currently favor North American equities over the Eurozone, where the growth outlook remains particularly weak.

Overall, while we cannot create an exact timeline, we do not expect the slowdown or the recovery to be a perfectly straight line. Based on the available indicators, we anticipate upswings and downswings

of sentiment and challenging times ahead. This continues to emphasize the importance of active management to manage risk, reduce volatility and provide the potential to deliver attractive returns. Our experienced investment teams at TD (TSX:TD) Asset Management Inc. (“TDAM”) continue to focus on how to appropriately allocate assets within portfolios while zeroing in on companies that can generate consistent profits and provide the best opportunity for outperformance. As a part of this process, we consider new innovations, such as artificial intelligence (“AI”), that are likely to disrupt their fields and create opportunities going forward. In the next section, we will highlight some of the ways in which we believe we will see AI challenge existing models of business and what we are watching for going forward.

The Impact of AI: A Data-Driven Future

AI might seem as if it has appeared overnight, but that’s not quite true. Academics have been discussing it for almost a century now, and machine learning, which is the branch of AI most of us think of when we think of AI, really started to gain interest and traction in the mid-2000s. So why are we only hearing about it now? Simple: in 2023, metamorphic advances in generative AI technology allowed it to become meaningfully useful for real world applications, rather than just interesting in a theoretical test environment.

What we are all currently witnessing is the embryonic stages of an AI adoption transformation that we believe will profoundly alter the operational dynamics and growth trajectories of countless sectors. AI can process vast volumes of data, extract meaningful insights and execute tasks with precision. It has already begun to infiltrate industries and will only continue to do so in the coming years. To really wrap your mind around how broad the implications are, try and think about how different the world was before and after the internet became mainstream. While we are in the middle of the AI changeover right now, we believe this is how we will likely feel about AI in the coming years. And we should also remember that this technology is only in its infancy. Today, all eyes are on what generative AI can do to supplement human ingenuity and productivity; tomorrow will invariably bring even further advances and breakthroughs in new areas of this exciting field. It’s a long and promising journey that we here at TDAM are watching closely.

Below we have highlighted some sectors where we see AI having an impact in the near term and will outline how we believe this new technology will create value for quality companies ready to utilize the tools of the future.

AI and Agriculture

Farming has traditionally been a manual and labour intensive industry with significant environmental and social impacts. While responsible for sustaining human life, agriculture, forestry and related land use account for nearly a quarter of greenhouse gas emissions. Despite prolific advances in crop and farming science and technology, 25% of the global population still faces food insecurity. Globally, the industry is under substantial pressure to feed a growing population while using less energy, less water and with a shrinking farm labour force.

The requirement for ever-increasing efficiency makes agriculture an industry ripe for AI disruption. We believe there is a strong opportunity for AI-driven improvements in yield, emissions and biodiversity.

Precision agriculture is the concept of leveraging large amounts of data to improve the productivity and precision of farming practices. Companies like Deere & Company (NYSE:DE) (“John Deere”) have made significant investments to precision agriculture, establishing the building blocks for a high-technology and autonomous future in farming equipment. Through the integration of sensors, software and data analytics, John Deere’s machinery and software stack helps farmers create a digitally informed ecosystem around their farm. On the machinery side, innovation goes beyond simply autonomous tractors. For instance, John Deere’s See & Spray technology will leverage computer vision and machine learning to precisely identify weeds and spray herbicides in a targeted manner, avoiding spraying the intended crops entirely. This reduces herbicide use, increases crop yields and improves crop and food quality for consumers.

This is just one example of the numerous innovations of applied AI in the agriculture industry.

Farmers will be able to leverage data to better allocate resources, optimize planting and harvesting schedules, improve crop yields and reduce resource consumption, bringing the industry one step closer to reducing hunger and improving carbon footprints.

From an investment perspective, precision agriculture and AI-enabled farming technology will be transformative to the business model of companies like John Deere. By 2030, Deere aims to generate 10% of total enterprise revenues from recurring revenue streams. The company sees a future where farmers will pay a per-acre fee to implement and support a technology stack behind a connected network of tech-enabled farm equipment. Investors have seen value created in the software space as companies transitioned to recurring revenue models, and John Deere seeks to follow in those footsteps. John Deere is just one example of a long-standing and entrenched business model on the brink of transition driven by AI and complimentary technologies. As seen here, we believe there is a lot to gain from being aware of the impact AI will have on business models across all sectors of the economy.

AI and the Consumer

Not only can AI quickly understand and influence the consumer experience by being able to predict your next favourite movie or put together a personalized playlist just for you, AI has also started to impact the fundamentals of consumer companies. AI applications can have significant implications on both revenue and earnings across consumption stages: pre-purchase, during-purchase and post-purchase.

Pre-purchase:

• eCommerce continues to collect tremendous amounts of data, and the ability to utilize machine learning algorithms to harness it will only further enhance customized recommendations for consumers. Even now early adopters are using AI tools to track down the best prices on the web, but if a business can offer the convenience of solving a complex and undefined search from seemingly limitless options (e.g. “I have $200, what are the most popular headphones I can buy?”) to a convenient and customized online shelf for that customer, that will have a significant positive impact on their experience (and thereby likelihood of purchase and return business). If you are in the business of selling products online, AI will also be able to help draft product descriptions, design a logo, write a blog post or interpret customer behaviours all removing supply frictions.

• On the product discovery side, AI can push the boundaries of human limitations. Using the fashion industry as an example, creativity is key in driving brand value over time but even the most creative minds occasionally hit a wall. AI may be able to forecast fashion trends and give fresh perspectives with nearly infinite patterns and styles after analyzing vast amounts of data from social media and other platforms. New ideas can be quickly visualized and adjusted, saving time and money in drafting new products.

During purchase:

• The lodging industry has truly been embracing AI for revenue management. For a long time, hotels have set real-time pricing. Using predictive modeling to forecast demand and manage room availability can significantly enhance revenue by selling more rooms at higher prices during peak periods, and reducing inventory during off-peak periods. For example, Hilton Hotels & Resorts has done a good job of factoring in historical data, market demand, local events and competitor prices and this has been a benefit to them.

• Inventory management is one of the most challenging tasks in the consumer sector, especially when dealing with large volumes. Fast Retailing Co. Ltd., the parent company of Uniqlo Co. Ltd., manufactures many products in lots of 1 million units so operational costs swing significantly based on demand variability. They have been leveraging AI in forecasting the right demand at the right time for the right location, towards the goal of optimizing order fulfilment in the most profitable way.

Post-purchase:

The proliferation of counterfeit goods has been a persistent challenge for the luxury industry. With increasingly sophisticated methods to replicate products, traditional detection techniques often fall short. AI has emerged as a game changer in the fight against counterfeit products. For instance, AI-powered systems can compare material textures against authentic items to ascertain legitimacy. It can integrate with blockchain technology to trace and authenticate products.

AI and Health Care

In the Health Care sector, use cases for AI enhancement range from (I) diagnostics and treatment planning in areas like cancer, (II) predictive analytics to help intervene earlier in a disease’s progression, (III) AI-driven virtual assistants which can potentially improve patient access while helping labour-constrained healthcare systems in triaging patients and (IV) improving surgical outcomes through more precise robotic surgery.

That said, out of all the potential use cases, using AI to improve drug discovery is arguably the biggest opportunity for Health Care.

Developing a new drug is a difficult endeavor; it’s expensive, time consuming and the failure rate is high (approximately 90% of drugs that enter Phase 1 clinical trials ultimately fail). Drug discovery is a multi-factorial problem, with scientists trying to solve for drug potency, solubility, selectivity, toxicity and other constraints all at the same time. Tweaking for one variable can impact another, making drug discovery kind of like solving a giant Rubik’s Cube. The average cost to bring a new drug to market is approximately $3 billion ($US) today compared to approximately $1 billion ($US) at the turn of the century.

While AI-driven drug discovery has been talked about for 30 years, innovation in the field will likely accelerate over the next decade, encouraged by two key drivers. The first driver has been the emergence of powerful and cost-effective GPUs and scalable cloud infrastructure, which is needed to process the billions of calculations needed to model potential drugs in a virtual environment. The second driver has been the emergence of more accurate application layers, which can model how potential drugs may interact in the human body.

Put together, AI-driven drug discovery has the potential to shave 2–3 out of the 10 years needed on average to bring a new drug to market, cut the number of drugs that need to be tested in the lab by stress-testing them in a simulated environment ahead of time, and increase the number of drugs that ultimately succeed.

For pharmaceutical and biotechnology companies, this can ultimately shave hundreds of millions off the cost of discovering a new drug, while also accelerating revenue growth by driving new discoveries. This is also a big win for society as accelerated drug discovery holds the promise of developing new cures for previously unmet needs, ranging from cancer to Alzheimer’s.

What does this mean for Investors?

AI is here to stay. While the buzz may be starting to die down, and it is possible that those who overestimated how quickly AI would be implemented may start to feel disappointment in the coming months, we believe that AI innovation will continue to see growth and contribute to corporate success in the coming years. We will continue to monitor the ways in which this theme will impact portfolios.

As always, we use a combination of proprietary models and a long history of investment experience to help us assess fundamentals and navigate towards quality. AI is not alone and improving itself in a vacuum; its possibilities are being ever further expanded by a robust technology system enabled by enormous contributions from the fields of semiconductors, telecommunications and machine vision, among others. We continue to believe companies who are able to innovate and move with, rather than against, technological change will continue to outperform companies who remain static and stuck in the past.

Asset Class Assumptions

To close out the quarter, we were modest overweight to fixed income, modest underweight to equities, a neutral allocation to alternatives and a neutral allocation to cash and cash equivalents. The TD Wealth Asset Allocation Committee meets monthly and will make necessary strategic adjustments to asset class views as the environment unfolds