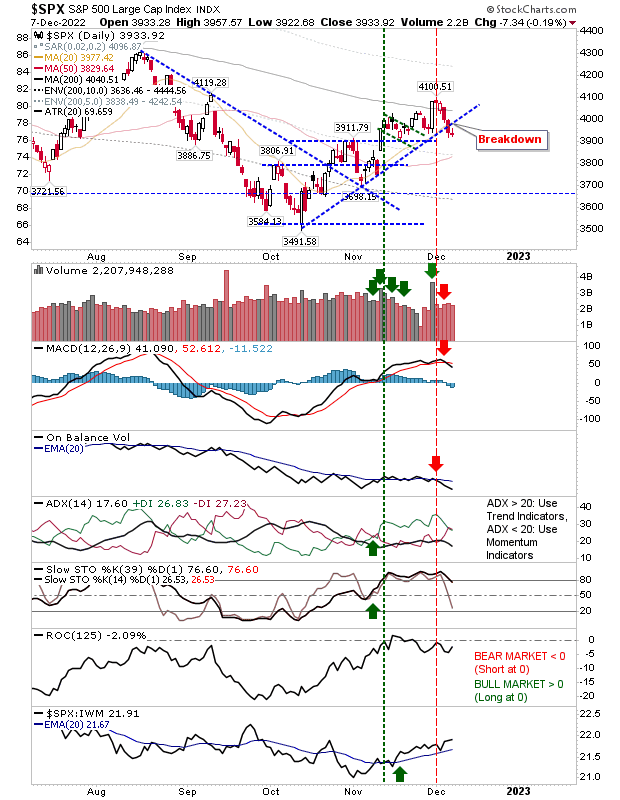

Last Friday, I stated that the second half of the forthcoming trading week would be key for the market's direction. As things stand now, we are looking at a bearish reversal at the resistance that points to a larger retest of the October low. However, all is not lost.

The S&P 500 finished today with a Doji following two days of selling, concluding with a break of rising trendline support. There is a MACD and On-Balance-Volume 'sell' trigger to work off if there is to be a bullish finish to the week. If bulls are to pull this off, tomorrow must see buying throughout the day and at least a close above the 200-day MA.

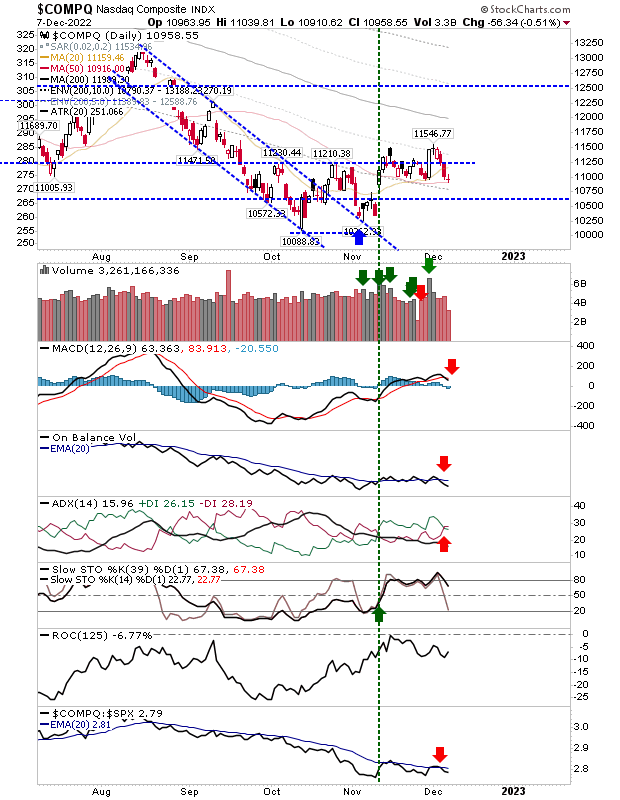

The Nasdaq 100 also closed with a Doji, but it was able to defend 50-day MA support in the process. Given the index is a long way from challenging the last major swing high, we may instead be looking at an extended trading range with the upper bounds shifting from 11,200 to 11,550.

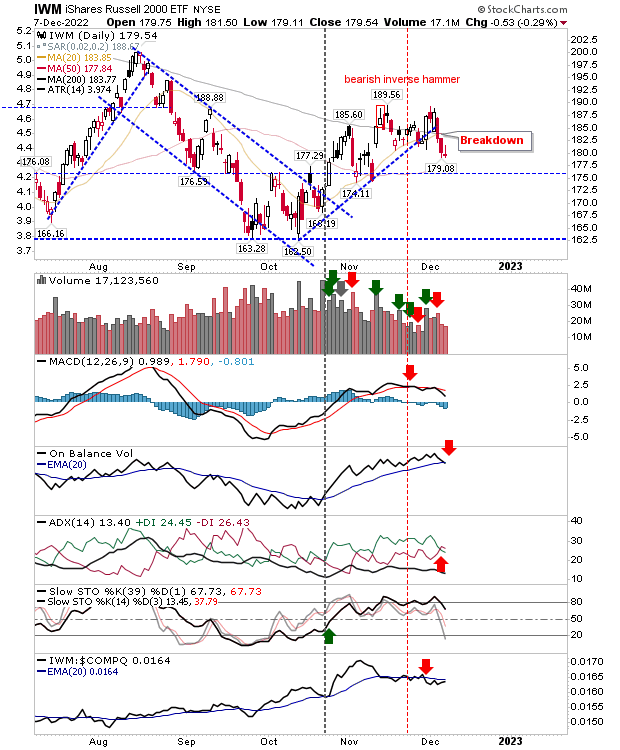

The Russell 2000 ($IWM) broke below rising support as part of a rejection of its 200-day MA. Today's losses came with a 'sell' trigger in On-Balance-Volume and ADX. Things are getting a little scrappy for growth stocks; attention to focus on Large Caps.

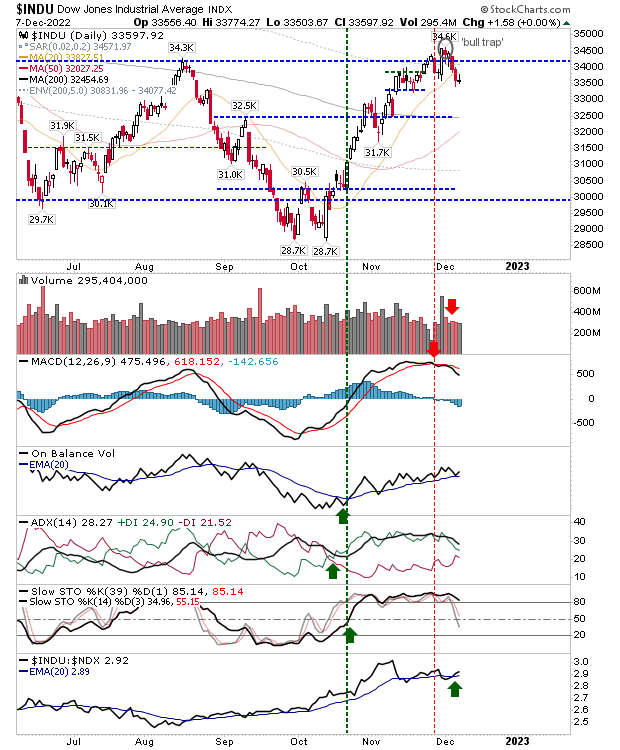

The Dow Jones Index has been the leading index of its peers, but it hasn't escaped selling. Because it managed to make a new 52-week high, the losses of today count as a 'bear trap.' This index looks the most vulnerable to further losses, with the 50-day MA the next support target.

Bulls need gains on Thursday and Friday to maintain the bullish momentum from last week's end-of-week close. As things stand now, we have a rejection at resistance on the weekly S&P and a potential 'bull trap' in the Russell 2000 - neither of which we want to see with the few weeks left in the year.

The first part of this bear market has developed into one of substance (lasting more than a year), and the next part will determine how it bases; this may have started already, but if we do see a return to loss on a weekly timeframe we will want to see how well the prior swing lows hold up on the test.