Boeing reports second-quarter revenue that tops estimates, sending shares higher

US Aggregate Bonds: A look at current performance

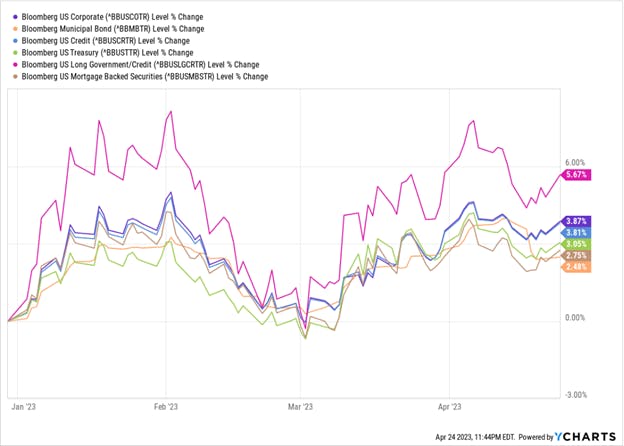

The year-to-date performance for the various segments of the US Fixed Income asset class has been largely positive, despite the heightened uncertainty that has been present within capital markets. As illustrated in the following chart, the performance of various fixed income indices provides insight into the current performance of each fixed income type. Presently, the performance of the US Long Government/Credit segment has done exceedingly well, whereas municipal bonds have provided a modest return; relative to its immediate peers.

While the current top-line performance of an individual fixed income segment may influence an investor to add said exposure to their portfolio, a dutiful question to ponder is its suitability within one’s portfolio and if there is an efficient way to gain fulsome exposure to all segments of the bond market – not just one particular area.

Assessing the current fixed income landscape

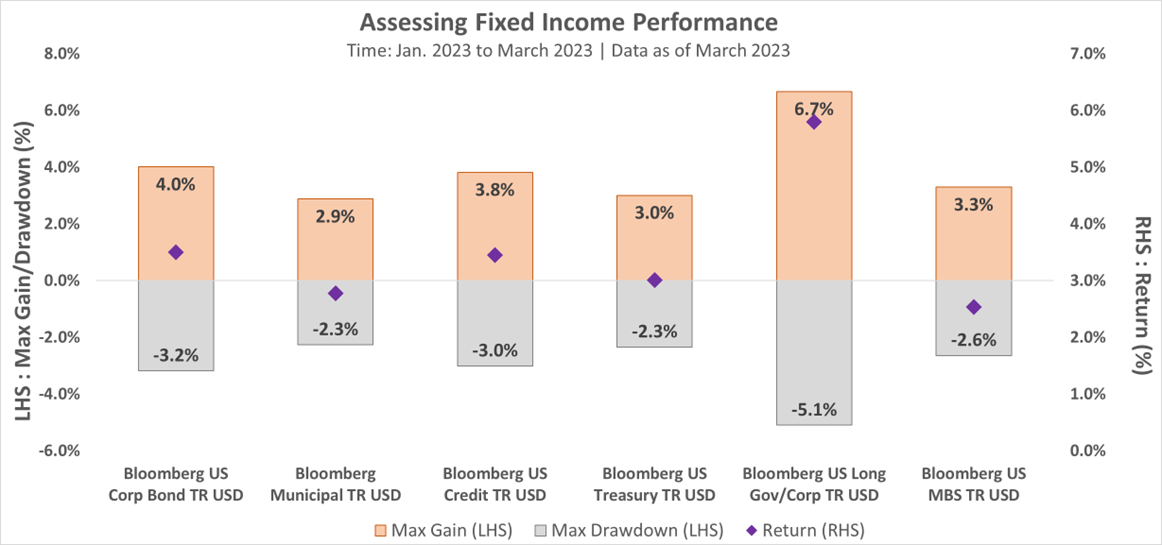

Though fixed income is broadly characterized as a safe haven asset class, investors should always remain cognizant of the fact that each fixed income type is distinctly unique and their performance will reflect this over time. The following chart illustrates the recent investment experience of the identified fixed income types, as of March 2023.

In contrasting the relative riskiness of one fixed income type versus another, the Max Gain and Max Drawdown investment metrics are able to provide some insight, as they look at the peak-to-trough performance of an investment during a specified record period, with the former focusing on incline periods and the latter on decline periods. As observed from the chart, while the return performance of the US Long Government/Credit segment has been noteworthy, its large swing in performance over the three-month period does not make for an ideal investment experience. Conversely, while the swing in performance for Municipals has been less volatile than the aforementioned fixed income segment, their return performance has been below the 3% threshold.

Invest in the whole, rather than the sum of its parts

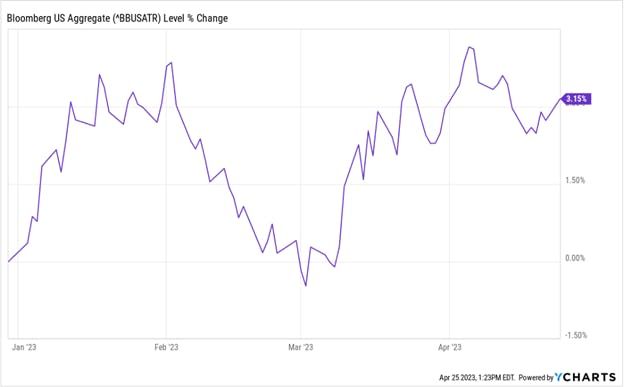

For investors seeking broad exposure to the investment grade segments of the US Fixed Income market, US Aggregate Bond solutions are an avenue through which they can achieve said objective in a comprehensive fashion. In looking at the Bloomberg US Aggregate Bond index, a benchmark for investment grade bonds within the United States, the year-to-date performance has been compelling, from a comparative standpoint.

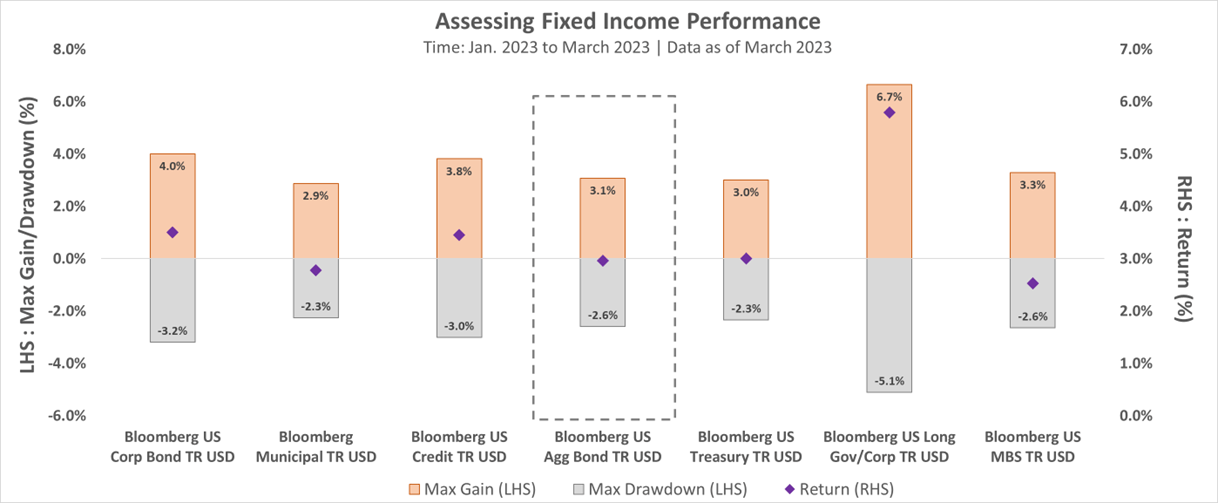

Because US Aggregate Bond solutions are innately diversified, investors are not only provided with exposure to investment grade corporate debt – but also government debt, mortgage-backed securities, asset backed-securities and many other fixed instrument types. This broad composite enables investors to benefit from the strong performance in most investment grade fixed income segments, while mitigating the under or muted performance in others. In looking at the Max Gain and Max Drawdown chart for the index as of March 2023, year-to-date, the asset class has exhibited both a moderate drawdown and a meaningful gain during the period in question, while also having a materially significant performance.

Given the risk profile and range of return outcomes for each fixed income type, investors that are not intimately knowledgeable in a particular fixed income segment will benefit from broad exposure to each segment within their portfolio. To gain said exposure, investing in US Aggregate Bond solution is a worthwhile consideration.

JPST: A diversified, single-ticket fixed income solution

For investors interested in a diversified, investment grade focused fixed income solution – the JPMorgan Ultra-Short Income ETF (Ticker: JPST) provides exposure to short-term, investment grade fixed- and floating-rate corporate and structured debt while actively managing credit and duration exposure.

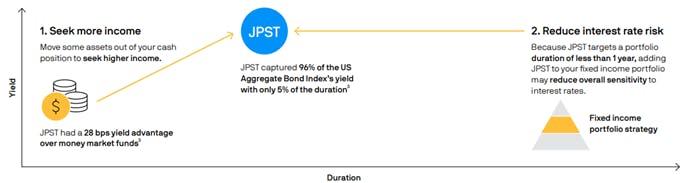

JPST can be a beneficial inclusion within one’s portfolio in two distinct ways:

- Alternative to cash, as the ETF has a 28-basis point yield advantage over money market funds.

- Interest rate risk mitigation, because the ETF targets a portfolio duration of less than 1 year, adding JPST to your fixed income portfolio may reduce overall sensitivity to interest rates.

Source: JP Morgan (NYSE:JPM) Asset Management. April 2023.

Given JPST’s stated investment objective and strategy, and the current rising interest rate environment, this solution’s ability to provide current income while also seeking to maintain a low volatility of principal makes it an additive component to a balanced portfolio.

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI