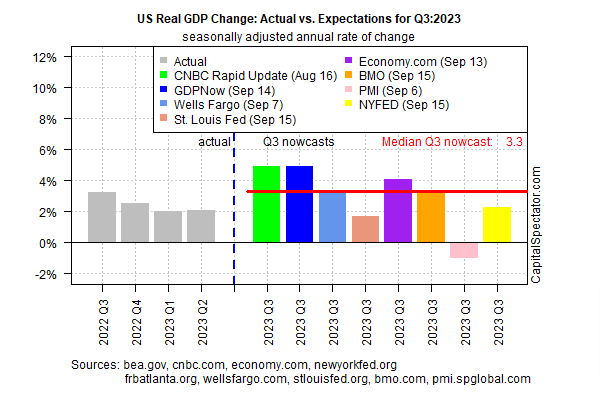

The government’s third-quarter economic report appears to be on track to report that US output accelerated to 3%-plus, based on the median estimate via several sources compiled by CapitalSpectator.com. Although some forecasters are warning that a recession is lurking down the road, the latest numbers strongly suggest it won’t start in Q3.

Today’s revised data indicates that economic activity for the July-through-September period will rise increase by 3.3% for GDP’s real seasonally adjusted annualized change. This median nowcast reflects a strong improvement over the 2.1% increase reported by the government for Q2.

Notably, today’s revised nowcast also reflects a jump from the previous 2.9% estimate for Q3 published on Sep. 7.

If the current median forecast is correct, GDP will rise in Q3 at the strongest pace in a year. But with ongoing uncertainty about the Federal Reserve’s plans for interest rates, there’s plenty of room for debate about how US economic activity will fare in Q4 and 2024.

Nouriel Roubini, a.k.a. Dr. Doom, has become a bit sunnier lately on his US economic outlook. A year ago, the CEO of Roubini Macro Associates thought it would be “mission impossible” for the US would avoid a severe recession in 2023. Fast forward to this week, and he admits that the US has dodged a business-cycle bullet.

“The good news is it doesn’t look like we are going to have a real hard landing,” he told Bloomberg on Monday. “The question is whether we are going to have a soft landing or a bumpy landing—a bumpy landing being a short and shallow recession—and on that debate, we don’t know yet.”

Meanwhile, recession forecasts persist, although the forecasters keep pushing the presumed start date further into the future as the economy continues to show resilience.

“I expect a recession in the first half of 2024, but not in 2023,” says Jeffrey Gundlach, founder and chairman of Los Angeles-based DoubleLine Capital.

Maybe, but there’s little sign of trouble for the upcoming Q3 GDP report scheduled for release by the Bureau of Economic Analysis on Oct. 26.