- Meta exceeded analyst expectations in Q4 earnings, reporting revenues of $40.1 billion, a 2.4% beat, and announcing a net profit of $14 billion.

- The social media giant revealed its first-ever dividend starting March 26, and initiated a buyback program, boosting investor confidence.

- Given the strong earnings report, could the stock continue its meteoric rise in the coming years?

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Meta Platforms (NASDAQ:META) outperformed analyst estimates in its fourth-quarter earnings, exceeding expectations on both the top and bottom lines.

The social media giant not only provided a robust outlook for the current quarter but also introduced new shareholder return initiatives.

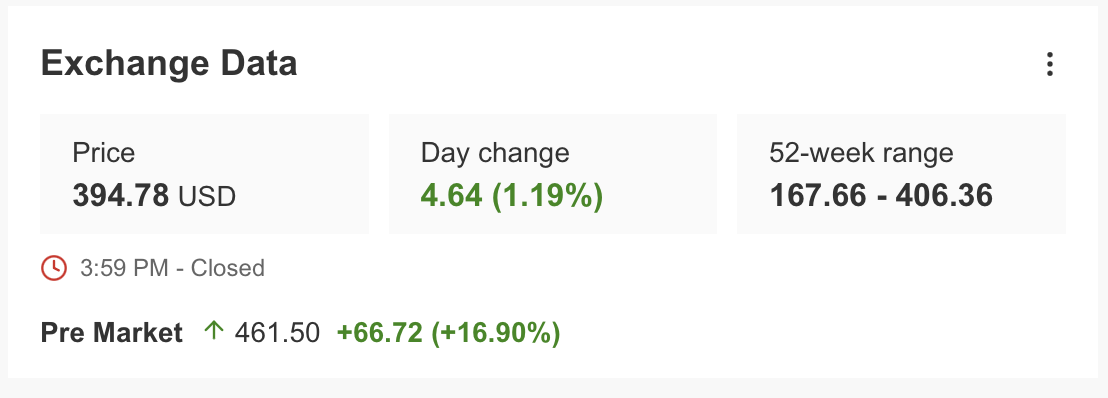

As a result, the stock surged by more than 16% pre-market, reaching as high as $461.

But how would you know enough to buy it ahead of the report?

Well, our predictive AI tool, ProPicks, did. By compiling a multitude of factors, including the long-term history of the stock market and state-of-the-art fundamental analysis, ProPicks was able to include Meta in its Beat the S&P 500 strategy earlier in the day, providing its users an incredible start to the month.

Want to get more stock picks like Meta? Subscribe now for up to 50% off as part of our New Year's sale for a limited time only!

Meta Earnings: Key Financial Metrics

This report came a day after CEO Mark Zuckerberg was grilled by lawmakers for ignoring the severity of child exploitation on the company’s family of apps.

The company announced an extremely strong earnings report for Q4, as well as its first dividend payment and the start of a buyback program, which excited investors.

Source: InvestingPro

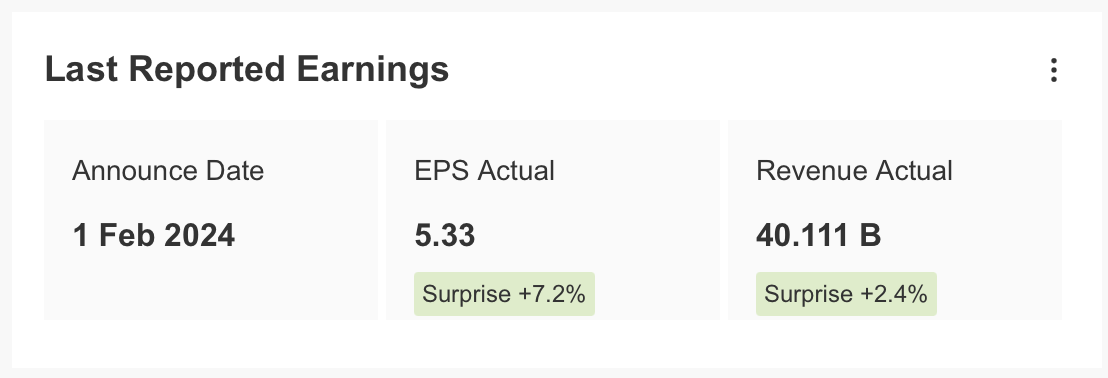

For the last quarter of 2023, Meta announced revenues of $40.1 billion, 2.4% above InvestingPro expectations.

In addition, the company increased its net profit by 200% compared to the same period last year and announced a net profit of 14 billion dollars.

Earnings per share came in at $5.33, about 7% above expectations.

Meta released an earnings report on the same day as another technology giant Apple.

The report showed that it was in a much better position, rising 1.2% in the session yesterday, trading at $394, while it jumped more than 15% in pre-market.

Source: InvestingPro

In addition, the company announced its first quarterly dividend of 50 cents per share, which will begin on March 26.

The social media giant also said that it will start a $ 50 billion buyback program served as an additional catalyst for the rise.

What's Next for the Social Media Giant?

In a statement after the earnings report, Mark Zuckerberg said that the austerity policy they implemented last year will help future periods, which he emphasized as uncertain.

Zuckerberg also signaled that long-term investments in artificial intelligence and the metaverse will continue, once again emphasizing his ambitions in this area.

Appearing a bit pessimistic about the future, Zuckerberg stated that the 10-year period could be volatile and unpredictable and that they will focus on increasing profitability as much as possible to get through this process healthily.

Source: InvestingPro

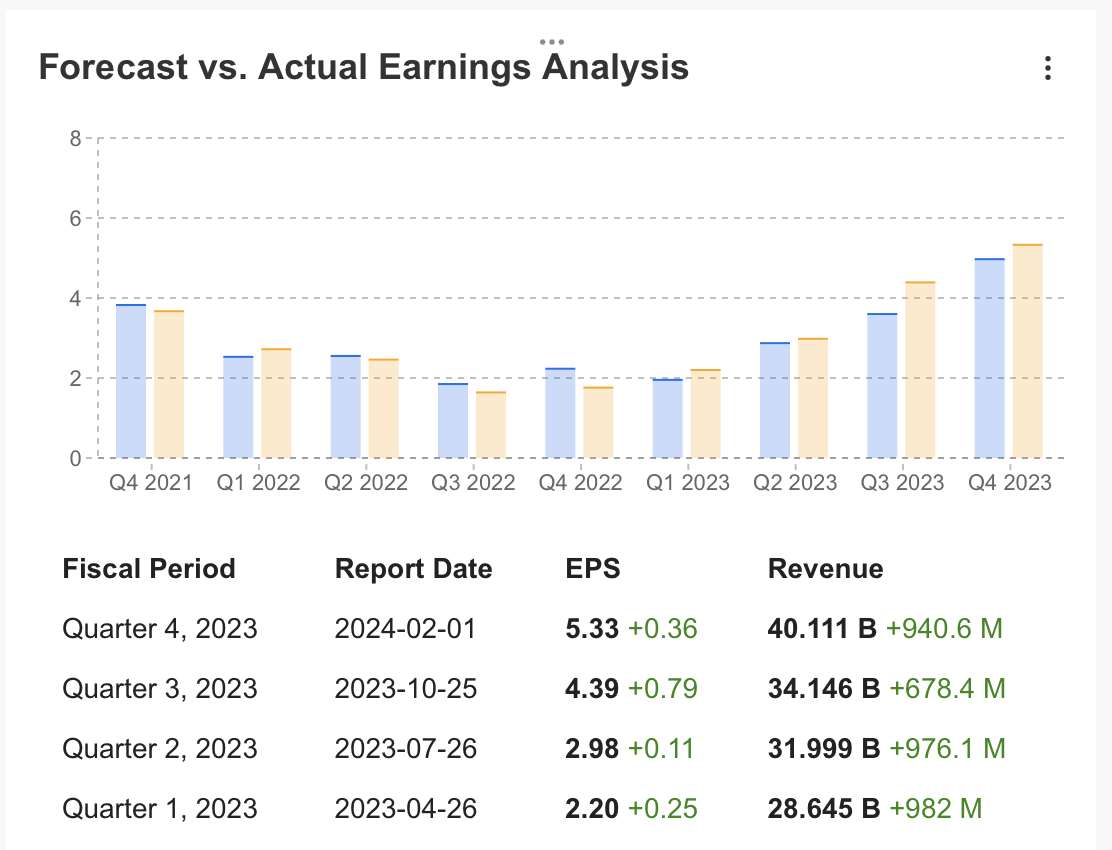

Announcing strong financial results for the last quarter of 2023, the company's expectations for 2024 were also revised upwards.

As can be seen on InvestingPro, 10 analysts revised their expectations for the first quarter upwards.

Accordingly, Meta is expected to announce EPS of $4.97 for the first quarter, up 91% compared to the same period last year, and revenue of $39.17 billion, up 13%.

While Meta has steadily increased its revenue and profit throughout 2023, the policies that were implemented have borne fruit.

So much so that the company started the year with a move that reassured its investors by showing its strength with its dividend breakthrough and buyback program.

Source: InvestingPro

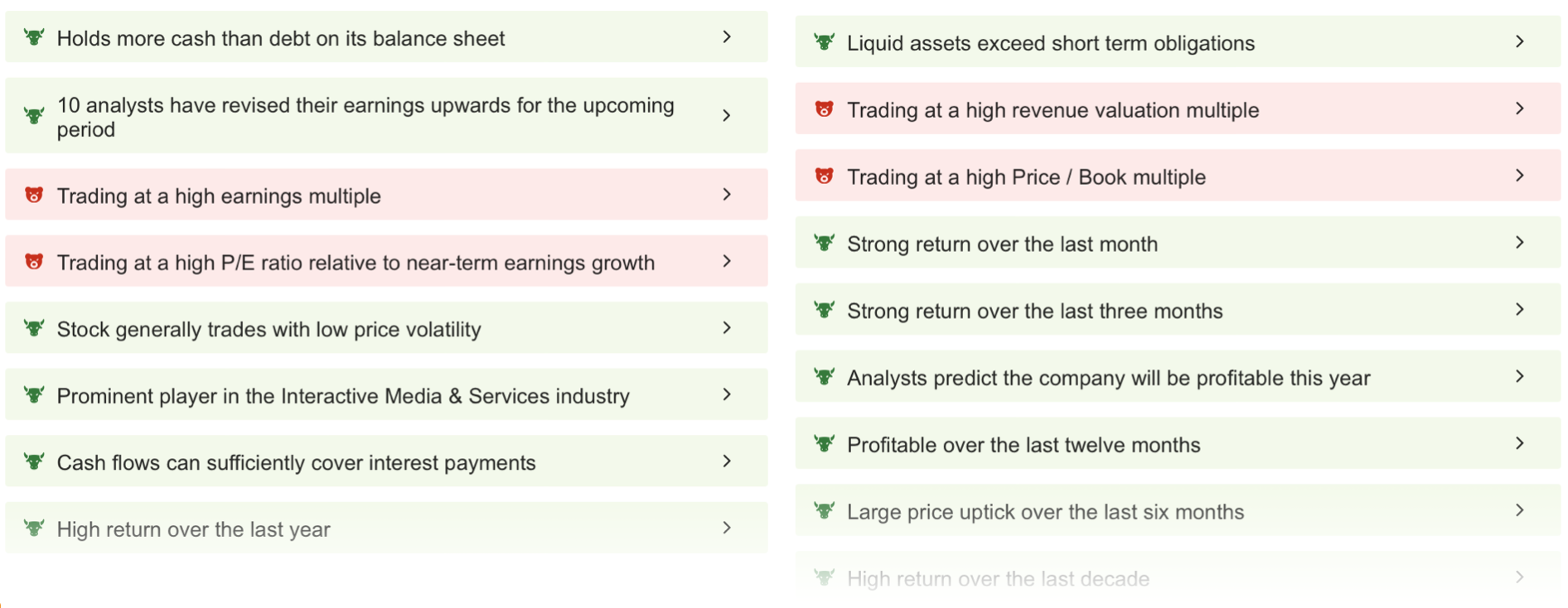

It is possible to identify Meta's strengths and weaknesses at a glance with the ProTips report via InvestingPro.

At first glance, ProTips shows that Meta has more positive aspects that support its strong financials.

If we look at the details; the fact that the amount of cash on the company's balance sheet is above its debt is the first positive factor.

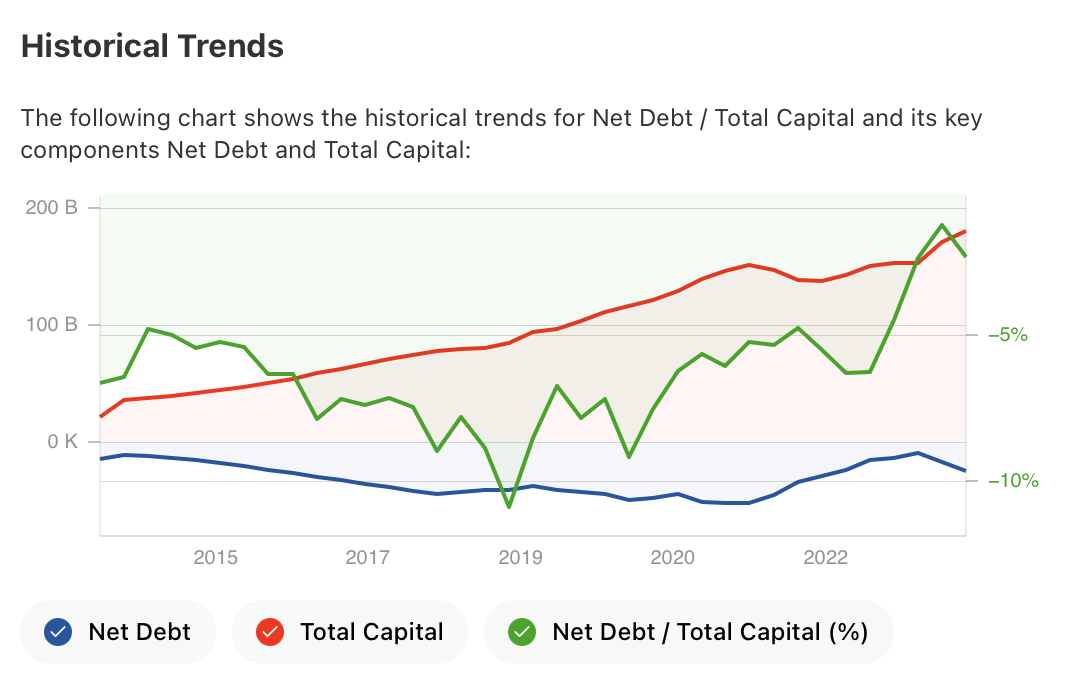

This value, measured by the Net Debt / Total Capital ratio, explains the impressive performance, especially in 2023. It shows that total capital has a better momentum than net debt.

In addition, the fact that cash flow is sufficient to cover interest expenses is one of the items that strengthen the balance sheet.

Source: InvestingPro

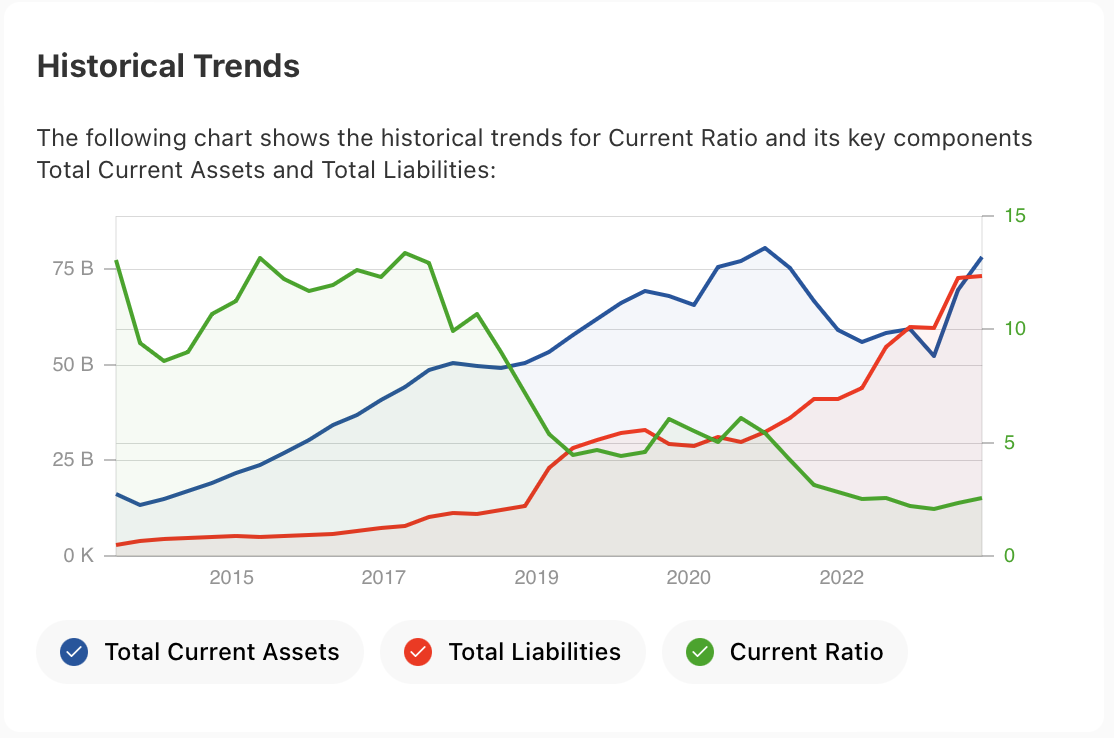

The balance sheet is also considered very safe for short-term activities.

Meta's current ratio is very healthy at 2.6X. This indicates that the company's liquid assets are above short-term liabilities, indicating that the company's liquidity structure is strong.

In addition, according to the current ratio value, we can also mention that the company uses its liquid assets relatively efficiently.

On the other hand, the company's steady growth throughout 2023 was also very effective in keeping expectations high for 2024.

Source: InvestingPro

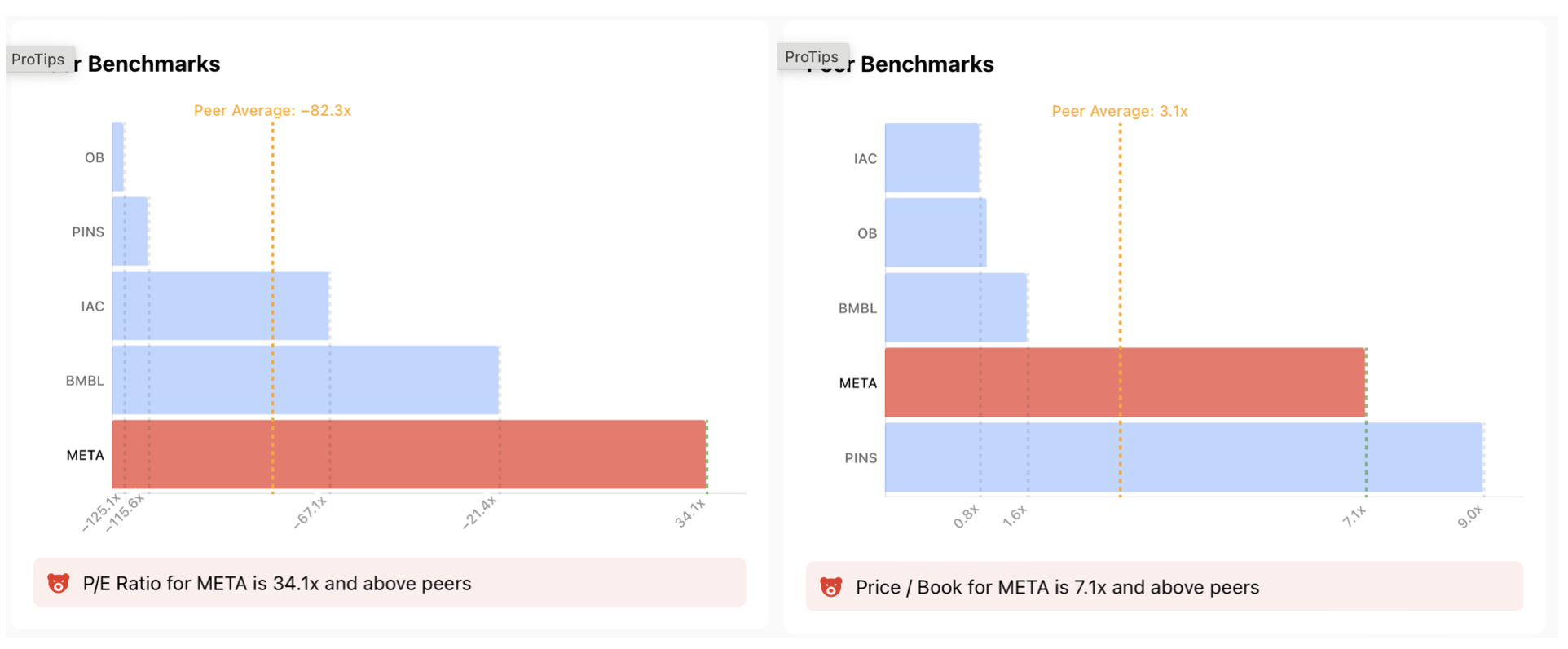

The factors seen as warning signs for Meta in ProTips are listed as high P/E and P/B ratio. The company currently has a P/E of 34.1X, well above the peer average.

While this is an indication that the stock may be overvalued, on the other hand, it shows investor confidence.

Therefore, as long as Meta continues to turn its sanctions into profits through 2024, this ratio may not be a disadvantage for the company.

Similarly, the P/B value, which currently stands at 7.1X, is a financial model that raises the investment risk profile.

Source: InvestingPro

As a result, Meta, with a robust balance sheet, is reinforcing its positive outlook by declaring quarterly dividend payments in March and enhancing it further through a $50 billion buyback program.

Source: InvestingPro

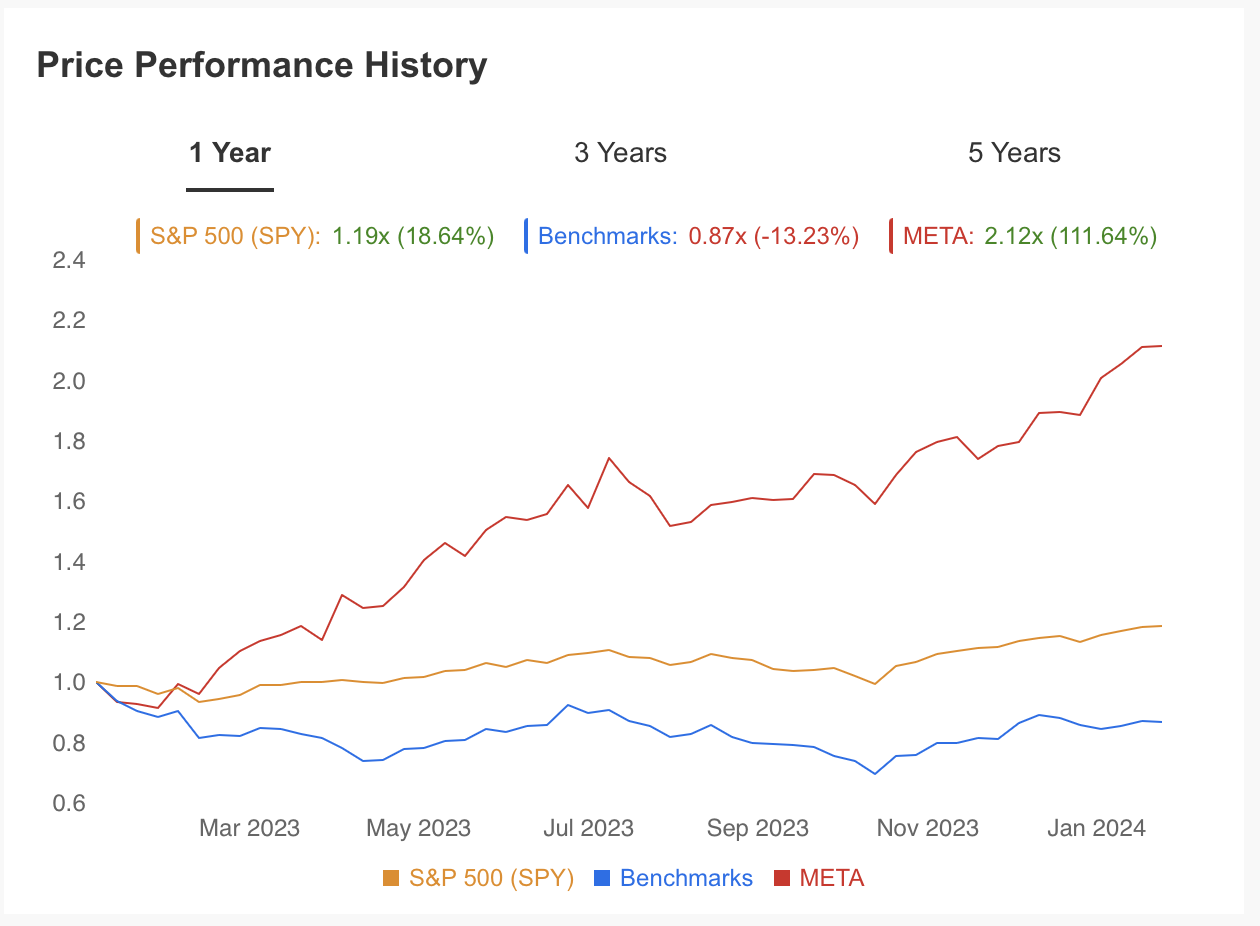

In light of all these developments, it will be exciting to watch whether META stock, which doubled its value last year, will continue its return performance in 2024, well above the S&P 500 index.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Don't forget your free gift! Use coupon code Canada2024 at checkout to claim an extra 10% off on the Pro.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.