- Elon Vs. Mark might or might not happen in reality

- But, a Meta vs. Tesla 'financial' cage fight is certainly possible

- Using InvestingPro, we compared Tesla and Meta over various financial metrics to determine a winner

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

- Meta 1 - Tesla 0

- Meta 2 - Tesla 0

- Meta 2 - Tesla 1

- Meta 3 - Tesla 1

- Meta 3 - Tesla 2

- Meta 4 - Tesla 2

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Elon Musk and Mark Zuckerberg have been taking shots at each other on social media lately. The latest development in their rivalry came on June 21, when Musk challenged Zuckerberg to a cage fight. Zuckerberg responded by posting a screenshot of Musk's tweet with the caption, "Send me location."

While the likelihood of a cage fight actually happening is slim, the challenge has sparked renewed interest in the two companies' respective financial performance. Using InvestingPro, we compared key financial metrics and target prices of Tesla (NASDAQ:TSLA) and Meta Platforms (NASDAQ:META) to determine which company is currently in a stronger position.

By the way, you can do that too, for any company of your choice. InvestingPro is currently hosting its Summer Sale, offering massive discounts on subscription plans.

This is your chance to access cutting-edge tools, real-time market analysis, and expert opinions at a fraction of the price.

Hurry, the Summer Sale won't last forever!

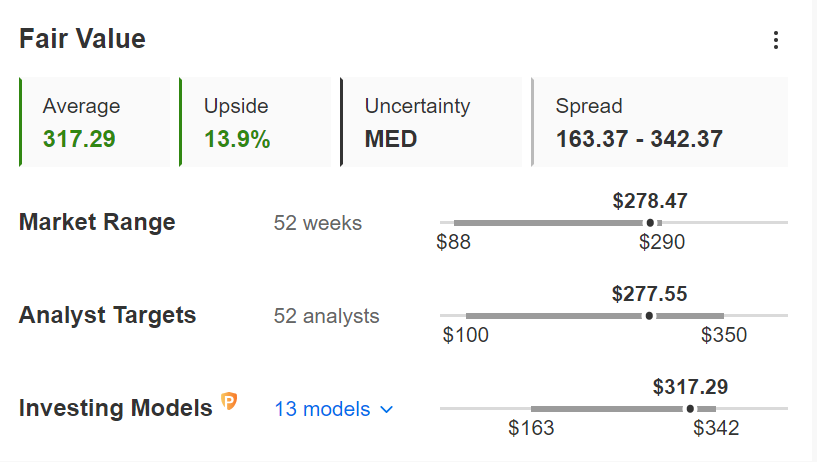

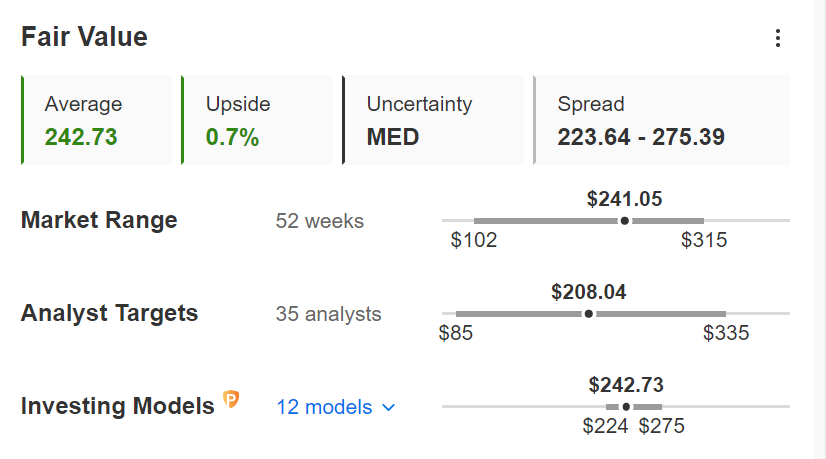

Round 1: Fair Value

Based on InvestingPro's mathematical models, Meta demonstrates a more significant discount compared to Tesla at the Fair Value level. Meta presents a potential upside of 13.9%, whereas Tesla lags behind with only 0.7%.

The social media giant appears to have the edge over the automaker in this metric.

Source: InvestingPro

Source: InvestingPro

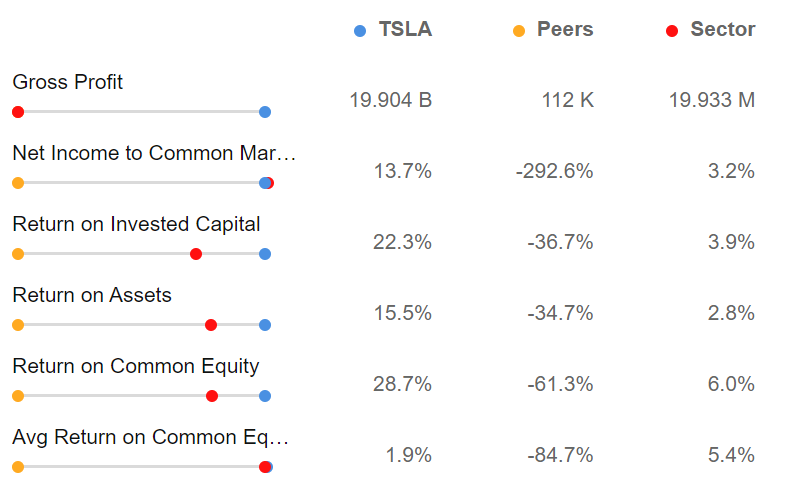

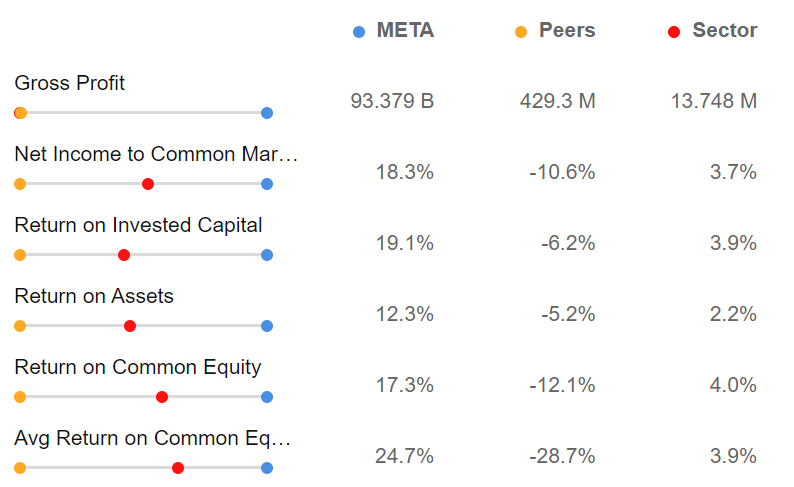

Round 2: Profitability

When considering key profitability metrics from InvestingPro, specifically Return on Equity (ROE), Return on Assets (ROA), and Return on Invested Capital (ROIC), the average of these three metrics indicates Mark's triumph.

Meta achieves an average of 22.16%, while Tesla trails behind with an average of 16.23%.

Source: InvestingPro

Source: InvestingPro

Round 3: Growth

In terms of annualized diluted earnings per share (CAGR) growth, Elon narrows the gap between him and Mark.

Over the past 10 years, Tesla has achieved a growth rate of 64%, surpassing Meta's 34%. Tesla emerges as the winner here.

Round 4: FCF Yield

Meta Platforms has an FCF Yield of 2.7% versus 1% Tesla, based on end-2022 values.

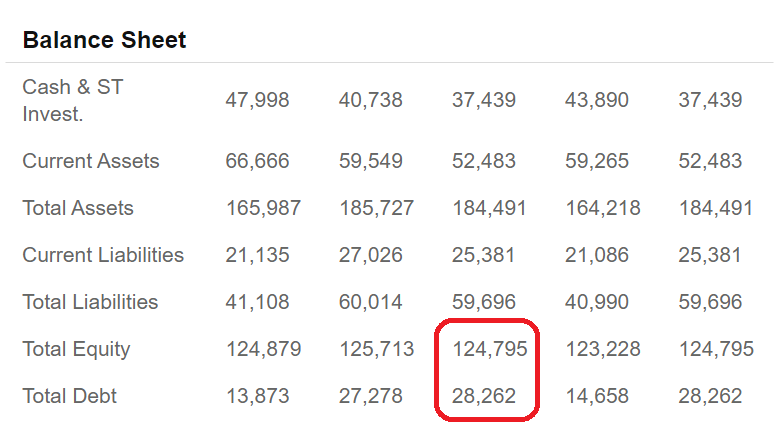

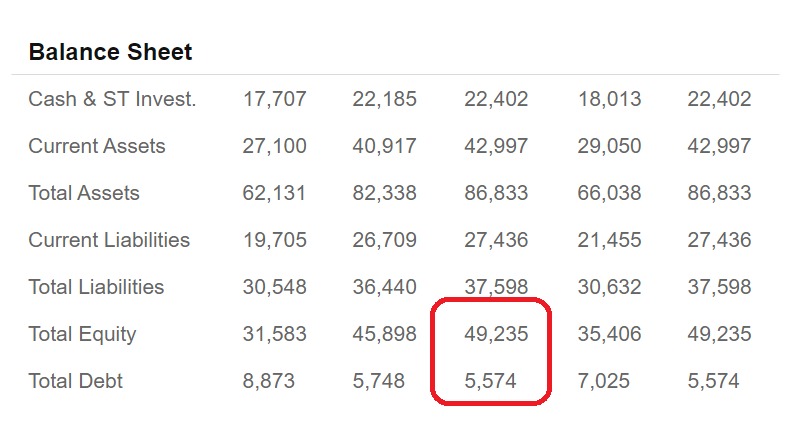

Round 5: Debt

When evaluating the debt-to-capital ratio, it becomes evident that Elon's company outperforms Mark's. While Meta Platforms showcases a commendable debt-to-capital ratio of 22.6%, it is noteworthy that Tesla boasts a more favorable ratio of 11.3%.

Source: InvestingPro

Source: InvestingPro

Round 6: Technical Chart

Since the beginning of the year, Meta has rallied by 155%, outperforming Tesla, which surged 101%. Meta is the clear winner in the parabolic rally battle.

Conclusion - Meta Emerges Victorious!

According to InvestingPro, Meta emerges as the victor in this hypothetical cage fight challenge, reflecting a better performance on various metrics.

And, it turns out Meta's CEO, Mark Zuckerberg, is a black belt in jiu-jitsu. This could give him a significant advantage in a cage fight against Tesla CEO Elon Musk, who recently claimed to have had received training in some forms of martial arts as a child, if an actual fight were to take place.

Of course, a cage fight is just hypothetical at this point.

Get ready to boost your investment strategy with our exclusive summer discounts.

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and the best expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis."