Meta Platforms Inc.'s (NASDAQ:META) rapid expansion, the fastest since 2021, has been driven by aggressive monetization and deep artificial intelligence integration into its platforms, including Facebook (NASDAQ:META) and Instagram.

Its AI-powered recommendations have significantly increased user engagement, with 30% of Facebook posts and 50% of Instagram stories utilizing these systems. This surge in AI use has also boosted ad revenue.

Despite the premium valuation, the company's strong performance underscores its position as an AI leader, signaling additional upside for the stock.

How AI-driven monetization doubles Meta's profitabilityMeta, which owns some of the most popular social networking apps, recorded year-over-year top-line growth of 27% for the first quarter, coming in at $36.46 billion and topping the Street's estimates of $36.14 billion.

The company achieved its fastest period of expansion since 2021 on the back of aggressive monetization in its suite of applications and deep integration of AI features into its leading platforms. For example, Facebook reported that 30% of the posts used a certain kind of AI-powered recommendation system. Similarly, AI ensures it keeps 50% of stories on Instagram parallel to users' requirements, enhancing engagement and promoting more advertising campaigns.

The overall revenue increase was less spectacular. Still, Meta's bottom line effectively doubled, with net income hitting $12.37 billion, or $4.71 a share, versus $5.71 billion, or $2.20 a share, in the prior period. This leap was driven by a 16% reduction in sales and marketing costs, lower restructuring expenses and decreased professional services and marketing use.

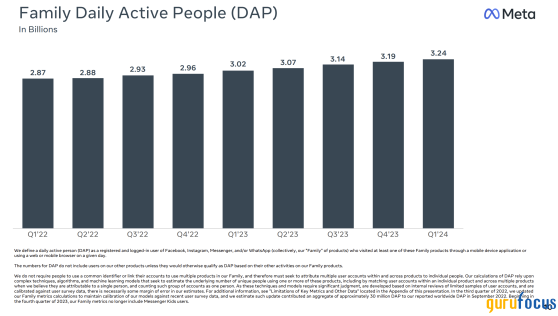

Although Meta does not report daily and monthly active users for its individual platforms, the company had more than 3.24 billion daily active people across its family of apps, creating strong momentum in which it offers one of the few brand-safe environments where advertisers can spend money to effectively reach this massive user base.

Consequently, the family average revenue per person declined by 9% quarter over quarter to $36.46 billion; still, the number suggests growth of 18% from the prior year. This describes how Meta monetizes its consumer base and generates revenue.

Additionally, the 20% increase in ad impressions was primarily driven by Asia-Pacific and the Rest of the World. However, most of this came from Asia-Pacific, where ad impressions grew 28% compared with 16% growth in North America and 20% growth globally. However, this marked a deceleration from the growth of 34% recorded in the first quarter of 2023. Meanwhile, the company witnessed a 6% rise in the average price of ads.

Finally, major Chinese e-tailersfor example, Temu and Sheinimmensely helped to accelerate ad impression in the Asia-Pacific region on Facebook for selling inexpensive products to American and European clients, accounting for approximately 10% of the company's total profit.

Meta Projects strong revenue amid rising costs and AI investmentsFor the second quarter, Meta expects revenue in the range of $36.50 billion to $39 billion, offset by a 1% currency headwind. The company expects expenses between $96 billion and $99 billion, up slightly from the impacts of infrastructure and higher legal charges vis-a-vis prior guidance. Operating losses by Reality Labs are expected to balloon because of investments in the development of products and their scale.

The full-year 2024 capital expenditures guidance has been raised to $35 billion to $40 billion.

The company also remains vigilant regarding regulatory headwinds in the European Union and the U.S. It was a solid start for the year, with momentum through the Family of Apps and significant progress on AI and Reality Labs initiatives that have the potential to change the way people interact for years to come.

Additionally, generative AI is an inherent part of Meta's investment to create value in the long run. At least one significant player includes Meta, which boasts a vast AI team and robust computing infrastructure. The company has introduced a new model of generative AI technologies called Llama 3, which makes it an active assistant to create means for building new models. Therefore, such integrations of AI enhance targeted advertising, Meta's primary revenue source. AI will make the Facebook, Instagram and Reels interface very engaging to the user by basing personal content around user preferences.

According to AI and tech expert Puneet Gogia, AI chat tools for businesses on WhatsApp saw a 40% increase in paid messaging, with potential for ad integration. Enhanced tracking tools like Event Measurement improved ad performance, increasing sales by 9.50% and trackable sales by 20%. Lastly, efficient investments in AI systems, public code sharing and AI chip development strengthened the company's financial stability, positioning it as an AI leader.

Ad competition amid AI investments and economic risksCompetition in digital advertising has to be one of the most significant risks standing in the way of Meta Platforms achieving its desired growth rates. The company does not operate a monopoly in the lucrative field. Still, it faces stiff competition from Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) (NASDAQ:GOOGL), which invests heavily in artificial intelligence to strengthen targeted advertising on search and YouTube.

Additionally, deterioration in the growth prospects of the U.S. economy could also pose significant risks to Meta Platforms' lucrative advertising business. Given that the company generates 98% of its sales from advertising, any economic downturn could be followed by significant cuts in ad spending, which could spell trouble for the company's revenue base. Thus, the company has also warned that it continues to watch the EU and U.S. regulatory landscape, which could impact its business and financial results.

An over 41% rally year to date has left Meta Platforms trading at a forward price-earnings multiple of 25. Nevertheless, compared to its peers, the stock appears to be trading at a discount, going by the average price-earnings ratio of 31 for the tech-heavy Nasdaq 100. Given the double-digit percentage growth in revenue and earnings, it is justifiable for the company to trade at a premium given the solid underlying fundamentals.

The company is also sitting on a boatload of cash. It ended the first quarter with $12.5 billion in free cash flow, allowing it to aggressively invest in high-growth initiatives, such as augmented and virtual reality devices, the metaverse and AI.

Backed by a solid balance sheet, Meta Platforms has returned value to shareholders through stock buybacks and dividends. For starters, it repurchased $14.64 billion in shares in the first quarter, reducing its shares in circulation, which is expected to bolster earnings per share in the long run. The company also paid $1.27 billion in dividends for a dividend yield of 0.41%.

Bottom lineMeta's direction has been explosive, rallying more than 58% over the past 12 months. The rally was backed by solid underlying fundamentals, including substantial user growth numbers in its family of apps, which drove revenue up 27% in the first quarter. The company is also seeing a better balance between ad impressions and price, which allows it to generate more revenue.

The company is becoming more efficient and attractive to advertisers by integrating AI tools to enhance advertising campaigns, which affirms its long-term growth prospects. Given the stock is trading at a discount, it remains a solid long-term play amid the AI frenzy, having reiterated its commitment to returning cash to shareholders through buybacks and dividends.

This content was originally published on Gurufocus.com