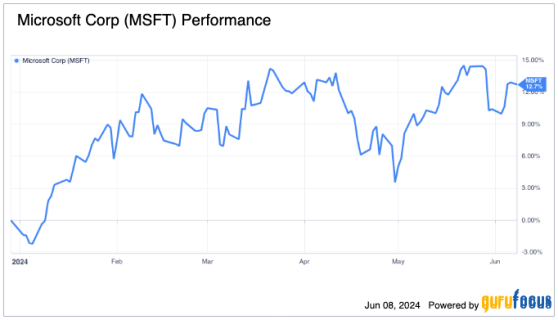

With a market capitalization of approximately $3 trillion, Microsoft Corp. (NASDAQ:MSFT) holds the title of the largest publicly traded company globally. Following its acquisition of OpenAI, the software giant has aggressively expanded its customer base and significantly enhanced its overall performance. The company's shares have surged in recent quarters, surpassing expectations and delivering substantial returns. I expect this trend to persist, as Microsoft continues to lead in the artificial intelligence space and invest heavily in new AI initiatives, building on the success achieved with OpenAI.

Figure 1: Microsoft shares have surged since late 2023

Microsoft has strategically positioned itself ahead of its competitors through massive research and development spending, large acquisitions and strategic partnerships with external companies. These maneuvers have provided the company with a competitive edge, enabling it to outshine rivals and roll out AI services to end users more quickly and effectively. The intensifying competition between Google's (NASDAQ:GOOGL) updated Gemini and OpenAI's flagship GPT-4 underscores the evolving landscape of generative AI. As more multi-modal interactive platforms are launched, it is clear we are witnessing a three-horse race in the generative AI arena. Microsoft is likely to benefit temporarily from its early investments in OpenAI, solidifying its position as a leader in the field.

The driver behind Microsoft's cloud dominance Microsoft is actively deploying AI-as-a-service features on its Azure cloud computing platform, which has become one of the company's largest revenue generators, surpassing even its Office software suite. The launch of Azure in 2010 marked a pivotal change in the company's revenue trajectory. Seven years post-launch, it saw significant revenue jumps, largely driven by the success of Azure. This trend continues today, with Microsoft's cloud computing services contributing substantially to its financial growth.

Figure 2: Azure has been the key driver of Microsoft's revenue growth

Given Azure's significant contribution to Microsoft's revenue, it is crucial for the company to continuously attract new customers to sustain the expected growth. Microsoft is well-positioned to achieve this, as evidenced by Azure's capture of 25% of the cloud market, even as Amazon's (NASDAQ:AMZN) AWS has seen a slight decline in market share. The ongoing cloud super-cycle and the generative AI boom have been key factors in Azure's growing market share, which now stands at 25%, gradually closing the gap with AWS, which holds 31%.

Figure 3: Azure inches closer to market leader AWS

With the increasing demand for cloud services and AI capabilities, Microsoft is poised to continue exceeding market expectations. Azure's robust performance and strategic advancements ensure it remains a critical component of the company's overall success, reinforcing its leadership in the rapidly evolving cloud and AI industries.

Strategic movesMicrosoft made headlines with its substantial acquisition of a significant stake in OpenAI back in 2019, initially investing $1 billion. Since then, the company has invested an additional $10 billion into this partnership. Beyond this major investment, it has also made several other notable investments in cloud computing and AI in recent months.

Just in the past two months, Microsoft announced a series of strategic investments: $2.9 billion in Japan to open a research center in Tokyo, $1.5 billion in the United Arab Emirates for a stake in AI company G42 and infrastructure and $3.3 billion in Wisconsin to build a manufacturing-focused AI research lab, among others. More recently, the company announced it they will invest $3.2 billion to expand its cloud and artificial intelligence infrastructure in Sweden over a two-year period. Additionally, Microsoft's venture capital fund, M12, has taken positions in several private AI companies. One of the most notable moves was a $650 million stake in Inflection AI, co-founded by Mustafa Suleyman and LinkedIn co-founder Reid Hoffman. Suleyman, a prominent figure in the AI space, is now the head of AI at Microsoft.

Figure 4: Generative AI to become a $1.3 trillion market by 2032 (according to a Bloomberg study)

With the generative AI market expected to exceed $1 trillion in value within the next decade and global IT spending is forecasted to grow at 8% this year, Microsoft is well-positioned to scale its business significantly. These strategic investments provide the company with numerous catalysts to drive growth and solidify its leadership in the AI industry for the foreseeable future.

Financial performance and outlookIn its earnings report for the third quarter of 2024, which was released last month, Microsoft reported a remarkable 17.1% year-over-year increase in revenue, reaching $61.90 billion. The company's GAAP earnings per share were $2.94. The operating margin expanded significantly from 42.30% to 44.60%, demonstrating substantial improvement for a company of its scale. This growth was achieved despite costs associated with the acquisition of Activision and an accounting change related to the useful life and depreciation of certain data center equipment. Both the top-line and bottom-line results exceeded expectations.

Figure 5: Third-quarter earnings summary

A key driver of this performance was the accelerating growth of the Intelligent Cloud segment, Microsoft's largest and fastest-growing business, which saw a 21% year-over-year increase to $26.70 billion, with operating margins expanding to 46.80% (up 4 points). Additionally, search and news advertising revenue grew by 3.30% year over year to $3.13 billion, aided by the market share gains of OpenAI-powered Bing, which reached 3.64% of the search engine market as of April 2024. As a result of these strong performances, Microsoft's quarterly levered free cash flow increased from $13.50 billion to $16.90 billion, despite a $4.30 billion increase in capital expenditures.

Figure 6: Intelligent Cloud segment revenue and operating income performance

Revenue growth is crucial for Microsoft's future success, particularly as the costs of training new AI models and improving Azure, its primary AI delivery method, continue to rise. The company has demonstrated robust growth over the past few years, with mid-teens growth in 2020, 2021 and 2022. Looking ahead to the fourth quarter of 2024, Microsoft is expected to continue exceeding expectations, with projected revenue of $64.40 billion, indicating 14.60% year over year expected growth. Adjusted earnings per share are anticipated to grow from $2.69 to $2.93, reflecting improved operating leverage. A significant driver of this growth is its flagship AI product, Copilot, which has been instrumental in scaling subscriptions and generating sales. As Copilot gains traction, Microsoft has announced new functions for its AI assistant, which could create new streams of recurring revenue. Additionally, the integration of GPT-4o into Bing is expected to attract more users and expand Microsoft's share in the search market. Bing recently captured over 10% of the search market, suggesting that Google's monopoly is being challenged.

According to management guidance, full-year operating margins are expected to increase by over 2 points despite cloud and AI investments, the impact of the Activision acquisition and changes in useful life accounting. This margin expansion highlights Microsoft's efficiency and disciplined cost management, with expectations for continued growth in cloud and AI investments next year, which are high-margin revenue streams. The same trajectory of margin improvement is anticipated into 2025, driven by these factors.

Beyond the impressive revenue and margin figures, Microsoft's free cash flow is a standout financial strength. The company is cash-rich with an $80 billion cash pile supporting its acquisition and talent hiring strategies. Last 12 months free cash flow generation reached $70.57 billion (up 22.90% sequentially), enabling aggressive partnerships and M&A activities, including the recent $69 billion acquisition of Activision Blizzard (NASDAQ:ATVI). While there was a reduction last year, the company is on track to outperform and increase its free cash flow this year, providing ample resources for future acquisitions. The gap between cash from operations and free cash flow has widened as management has invested heavily in cloud and AI infrastructure, suggesting that FCF could expand much faster in the medium to long term once the infrastructure build-out is completed.

Figure 7: CFO, FCF and capex progression

Microsoft has committed substantial resources to research and development and capital expenditures, with last 12-month R&D expenses of $28.19 billion (up 3.20% sequentially) and capital expenditures of $39.54 billion (up 51.9% sequentially). These investments ensure Microsoft remains well-capitalized to pursue growth opportunities. Management's commitment to sustaining momentum in the cloud and AI business is evident from the rapid ramp-up in investments in these areas.

As of the end of the third quarter, Microsoft had $80 billion in cash and short-term investments and $65.44 billion in long-term debt. The company's debt-to-Ebitda ratio stands at 0.60, indicating strong financial health and the ability to pay down its long-term debt efficiently.

Thoughts on valuation Although Microsoft has significant potential upside if its generative AI goals go according to plan, the stock is currently not the most affordable despite being a sensible long-term investment. It is important to note long-term plays often require substantial time to yield returns. Despite the numerous growth catalysts in its favor, the current share price offers little margin of safety to warrant a bullish rating at this juncture. While Microsoft's business has performed exceptionally well and is likely to continue thriving, there are questions about whether it is prudent to purchase shares at the current levels. Various valuation methods indicate that none provide a sufficient margin to justify buying at the current price. Even with aggressive estimates for Microsoft's growth rates, margins and free cash flow generation, it is challenging to justify a long position solely based on fundamentals.

Figure 8: Microsoft's current valuations lack sufficient upside margins

Further, Microsoft might face more intense competition in its AI business from both large companies within the Magnificent Seven and smaller, emerging players. Although the tech company is perceived as an AI leader today, this may not hold true five or 10 years from now. Additionally, economic uncertainties persist, with inflation remaining high and the possibility of the Federal Reserve raising interest rates still on the table. Microsoft's substantial spending on building its cloud platform and AI tools could be viewed unfavorably by investors if the economy deteriorates.

Given these factors, I am not assigning a buy rating to Microsoft's shares at the current price. Therefore, I recommend a hold on the stock and will monitor the price action closely. Should there be any negative movements while the current fundamentals persist, it might swing my recommendation to a buy at a lower price.

Conclusion Microsoft's impressive financial performance, strategic investments in AI and cloud computing and robust growth outlook underscore its potential for long-term success. However, given the current valuation and economic uncertainties, the stock lacks a sufficient margin of safety to justify a bullish rating at present.