Amid Microsoft (NASDAQ:MSFT) investing $100 billion in its new hyperscale AI supercomputer, Stargate, the stock appears to be 30% undervalued with a potential 15% stock price CAGR over the next 10 years. While there is competition in the AI infrastructure and cloud services market from other Big Tech companies, I dont think OpenAI should be underestimated. My outlook considers the possibility that Microsoft will remain at the frontier of global AI leadership in 10 years.

Operational and industry analysisMicrosoft is planning to build one of the most advanced AI supercomputers in the world in a collaboration with OpenAI, dubbed the Stargate Project. With an estimated cost of $100 billion, Stargate has the potential to redefine AI infrastructure and computational capabilities.

Stargates main purpose is to support the development of the next generation of AI models, including the much-anticipated GPT-5 from OpenAI. Completion of Stargate is expected by 2028it is planned to be 100 times larger than traditional data centers, housing millions of specialized AI chips and requiring the energy needs of a small city. Microsoft is exploring the use of nuclear power to meet Stargates colossal energy demands for sustainability reasons. Microsoft and OpenAIs plans dont stop there; while Stargate is planned to be the flagship installation, it will be part of a series.

Because the project is costing $100 billion, Microsoft is spending three times its 2023 capital expenditures. While this may allow it to maintain a competitive edge against Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOGL) (GOOG), the project remains high-risk, even for a company with ~$80 billion in cash and cash equivalents. In addition, Stargates estimated power requirement of five gigawatts could require five nuclear plants, raising concerns about waste management, safety, and logistics. Building nuclear reactors alone could take over a decade, potentially delaying the projects completion beyond 2028.

For Stargate, Microsoft plans to reduce reliance on Nvidia (NASDAQ:NVDA) by incorporating Advanced Micro Devices (NASDAQ:AMD) chips and custom silicon into its infrastructure. Nvidias GPUs are expensive because of high demand and performance capabilities, but Microsoft can reduce costs by using AMD chips and custom-designed silicon for specific AI workloads. Google and Amazon have already developed proprietary chips, so Microsoft following suit is an inevitable strategy to remain cost-efficient in the AI arms race. Reports indicate that AMDs MI500 GPUs will be used for Stargate, and I expect Microsofts proprietary Azure Maia AI Accelerator and Azure Cobalt CPU will be used as well.

Due to advancements in Microsoft and OpenAIs large language models, Stargate could drive significant growth in the companys Azure cloud business, and its differentiation from AWS and Google Cloud could attract more customers than its competitors. Its quite likely that by being at the forefront of the development of Artificial General Intelligence ('AGI'), the companys brand power could drive distinguished levels of financial accretion compared to its peers. I do not think OpenAI and Microsoft should be underestimated here. While xAI is making fast progress and Musk is taking Altman to court over the for-profit incentives arising at OpenAI (which was initially intended to be a non-profit enterprise), I think we should let bygones be bygones. The technology is far too important to squabble over, and at this time, the best product appears to be OpenAIs GPT series, based on my experience and feedback from others.

Valuation analysisFor my valuation model, I forecast that Microsoft will deliver a 12.5% annual revenue CAGR due to accretion from AI and automation offerings. Starting with trailing 12-month revenues of $254.2 billion, this will increase to $825.45 billion by December 2034, based on my forecast.

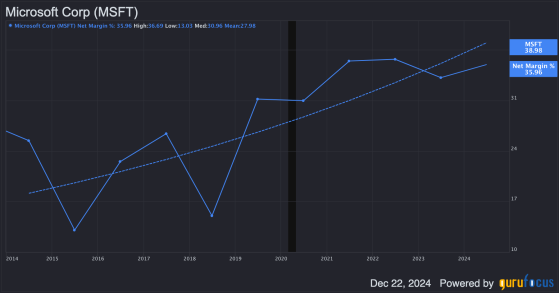

The company has a steadily increasing net income margin, and I anticipate that this will reach 42.5% by December 2034, primarily due to automation and a leaner workforce. Therefore, my estimate for the companys December 2034 trailing 12-month net income is $350.8 billion.

Microsoft has delivered a compound annual decline rate of -1.1% in its share count over the past 10 years due to buybacks, so I will forecast that the trend continues for the next 10 years. Therefore, my estimate for the companys share count in December 2034 is 6.66 billion, based on a 2014 share count of 8.3 billion and a trailing 12-month share count of 7.44 billion. My estimate for the companys December 2034 earnings per share is $52.70.

Given that I predict the companys revenue growth will remain approximately equal to the past 10 years on average, I also expect the price-to-earnings ratio to stay somewhat constant. Therefore, I will use the companys 10-year median price-to-earnings ratio of 32 for my terminal multiple. The result is a December 2034 price target for Microsoft of $1,685. The current stock price is $436, so the implied CAGR over 10 years is 14.5%. Therefore, I am highly bullish on Microsoft stock.

Microsofts weighted average cost of capital ('WACC') is 10.13%, with an equity weight of 97.7% and a debt weight of 2.3%. The cost of equity is 10.29%, and the after-tax cost of debt is 3.92%. When discounting my estimate for the companys December 2034 stock price back to the present day using the WACC as my discount rate, the implied intrinsic value is $640. Therefore, the margin of safety for investment is presently 32%, based on my model.

Risk analysisThe greatest risk to my valuation model is that the company does not achieve a 40%+ net income margin, which could result from overinvestment in AI infrastructure, like the $100 billion Stargate project, amid lower-than-expected returns in revenue growth. Its more likely that the return on investment will be delayed, causing margin instability and stock price volatility. Moreover, the market for AI could mature earlier than anticipated, and customer demand in five to 10 years may be less than currently expected. For example, specific scandals in the healthcare or defense industries related to AI errors could make the market less lucrative due to a resurgence of human labor. That said, in general, the macro trend toward autonomous operations at scale appears inevitable, and the data will most likely prove that autonomous machines are immeasurably safer than human labor in terms of mistakes and fatalities in sensitive operations.

ConclusionIm highly bullish on Microsoft stockI consider it to be one of the greatest companies in the world, particularly with Satya Nadella at the helm. If he were to leave, I would have to reconsider my sentiment, but as it stands, with the macro trend of AI and a robust partnership and stake in OpenAI, I believe there is a lot to be confident about here as an investor. For a long-term, moderate-risk equity portfolio, I think Microsoft has a place. That said, it should be hedged with a cash position, just like Berkshire Hathaway (NYSE:BRKa) (BRK.A) (BRK.B) is doing, because the general market is significantly overvalued, as indicated by the Buffett Indicator. Additionally, geopolitical uncertainties mean equity portfolios are vulnerable in general right now.

This content was originally published on Gurufocus.com