Bank of Canada preview: BofA says strong Q3 likely keeps rates on hold

- Shares of e-commerce platform Shopify (TSX:SHOP) are down over 52% since the beginning of this year.

- Investors were not impressed with the recent Q4 metrics and especially weak guidance.

- Long-term investors could consider buying the dip in SHOP stock, especially if it declines toward $600.

Canadian e-commerce infrastructure giant Shopify (NYSE:SHOP) stock recently slumped to a multi-year low of $640.42. As a result, SHOP stock is down 52.3% year-to-date (YTD). By comparison, the Dow Jones Internet Commerce Index has lost 21.3% so far in 2022.

The decline in Shopify shares occurred after Nov. 19, 2021, when the stock hit a record high. Put another way, the company lost about 62% of its value in the past three months. The stock’s 52-week range has been $640.42-$1,762.92, while the market capitalization (cap) stands at $82.7 billion.

The company released Q4 financials and FY 2021 on Feb. 16. Overall, the results were better than the consensus estimates. Total revenue in the fourth quarter was $1.38 billion, up 41% year-over-year (YoY). While major contribution to the top line came from merchant solutions revenue ($1.03 billion), subscription revenue also went up by 26% YoY.

Meanwhile, Gross Merchandise Volume (GMV) for Q4 was $54.1 billion. Adjusted net income came in at $172.8 million, or $1.36 per diluted share. A year ago, comparable numbers had been $198.8 million, or $1.58 per diluted share.

On the results, Shopify President Harley Finkelstein said:

“The last two years have been extraordinary. We nearly tripled revenue, more than doubled GMV and the Shopify team, and the number of merchants using Shopify is nearly twice as big as 2019 levels.”

However, looking forward, management forecasts revenue and earnings deceleration. According to the guidance, “revenue growth for the full year 2022 [will be] lower than the 57% revenue growth achieved in 2021.”

Investors were not pleased with the results and 2022 forecast. Prior to the release of the fourth quarter results, SHOP stock was changing hands shy of $900. Now, it is at $656.88.

What To Expect From Shopify Stock

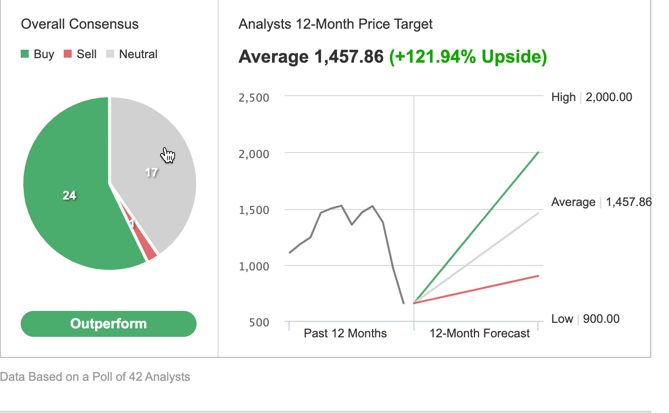

Among 42 analysts polled by Investing.com, SHOP stock has an "outperform" rating. Wall Street also has a 12-month median price target of $1,457.86 for the stock, implying an increase of more than 120% from current levels. The 12-month price range currently stands between $900 and $2,000.

Source: Investing.com

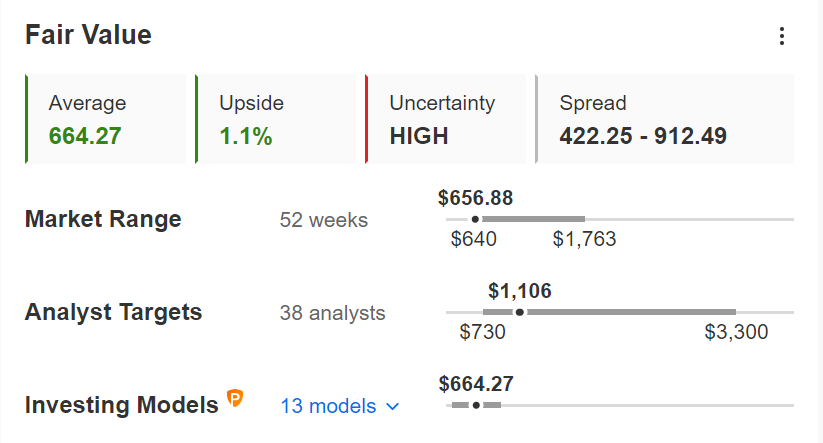

However, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for Shopify stock via InvestingPro stands at $664.27.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase only about 2% (or roughly stay flat).

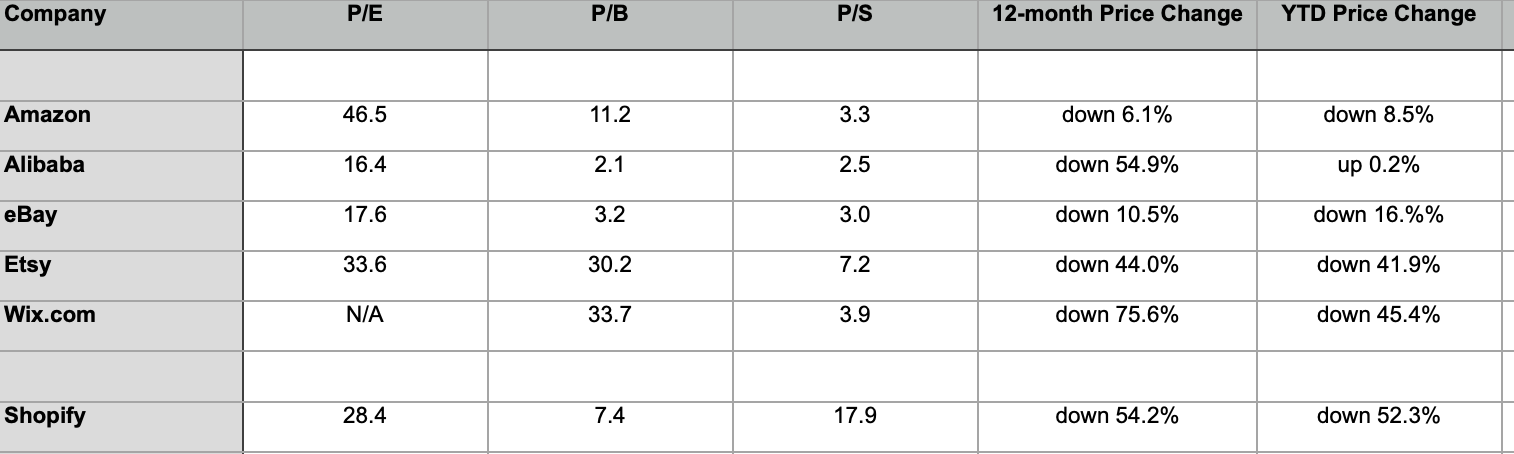

At present, SHOP’s P/E, P/B and P/S ratios are 28.4x, 7.4x and 17.9x. Comparable metrics for peers stand at 31.9x, 8.4x and 8.6x. These numbers show SHOP stock does not have a stratospheric valuation anymore.

We can also look at the fundamental numbers for several of its competitors in the online retail space, including Amazon (NASDAQ:AMZN), Alibaba (NYSE:BABA), eBay (NASDAQ:EBAY), Etsy (NASDAQ:ETSY) and Wix (NASDAQ:WIX). They are:

These metrics highlight that valuations in the e-commerce segment differ among names. Therefore, investors would need to research prospective shares more in-depth.

Another point to note is that Alibaba stands out as the only stock that is up (or flat) so far in 2022. As most of our readers would know, a large number of high-growth Chinese shares came under significant pressure in 2021, due to the regulatory crackdown by local authorities. But now, many investors wonder if China-based companies could have better returns this year.

Our expectation is for Shopify stock to trade in a wide range and build a base between $550 and $650 in the coming weeks. Afterwards, SHOP shares could potentially start a new leg up.

Adding SHOP Stock To Portfolios

Shopify bulls who believe the decline in the stock is likely to come to an end could consider investing now. Their target price would be $1,457.86, or analysts’ forecast.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has SHOP stock as a holding. Examples would include:

- ARK Fintech Innovation ETF (NYSE:ARKF)

- First Trust Dow Jones International Internet ETF (NASDAQ:FDNI)

- Franklin Disruptive Commerce ETF (NYSE:BUYZ)

- Global X E-commerce ETF (NASDAQ:EBIZ)

Although investors might want to buy SHOP stock for their long-term portfolios, they could also be nervous about further declines in the coming weeks. Therefore, some might prefer to put together a "poor man’s covered call" on the stock instead.

So, today we introduce a diagonal debit spread on Shopify by using LEAPS options, where both the profit potential and the risk are limited.

Investors who are new to the strategy might want to revisit our previous articles on LEAPS options first before reading further.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on SHOP stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Diagonal Debit Spread On SHOP Stock

Price at time of writing: $656.88

A trader first buys a longer term call with a lower strike price. At the same time, the trader sells a shorter term call with a higher strike price, creating a long diagonal spread.

Thus, the call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

Most traders entering such a strategy would be mildly bullish on the underlying security. Instead of buying 100 shares of SHOP, the trader would purchase a deep in the money LEAPS call option, where that LEAPS call acts as a “surrogate” for owning the stock.

For the first leg of this strategy, the trader might buy a deep in the money (ITM) LEAPS call, like the SHOP Jan. 19, 2024, 520-strike call option. This option is currently offered at $264.90. It would cost the trader $26,490 to own this call option, which expires in less than two years, instead of $65,688 to buy the 100 shares outright.

The delta of this option is close to 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If SHOP stock goes up $1 to $657.88, the current option price of $264.90 would be expected to increase by approximately 80 cents, based on a delta of 80. However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

For the second leg of this strategy, the trader sells a slightly out of the money (OTM) short-term call, like the SHOP Mar. 18 660-strike call option. This option’s current premium is $49.95. The option seller would receive $4,995, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point. Different brokers might offer “profit-and-loss calculators” for such a trade setup.

Maximum Profit Potential

The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So the trader wants the SHOP stock price to remain as close to the strike price of the short option (i.e., $660) as possible at expiration (on Mar. 18), without going above it.

Here, the maximum return, in theory, would be about $5,067 at a price of $660 at expiry, excluding trading commissions and costs. (We arrived at this value using an options profit-and-loss calculator). Without the use of such a calculator, we could also arrive at an approximate dollar value. Let’s take a look:

The option seller (i.e., the trader) received $4,995 for the sold option. Meanwhile, the underlying Shopify stock increased from $656.88 to $660, a difference of $3.12 per share, or $312 for 100 shares.

Because the delta of the long LEAPS option is taken as 80, the value of the long option will, in theory, increase by $312 X 0.8 = $249.6.

However, in practice, it might be more or less than this value. There is, for example, the element of time decay that would decrease the price of the long option. Meanwhile, changes in volatility could increase or decrease the option price as well.

The total of $4,995 and $249.6 comes to $5,244.6. Although it is not the same as $5,067, we can regard it as an acceptable approximate value.

Understandably, if the strike price of our long option had been different (i.e., not $520), its delta would have been different, too. Then, we would need to use that delta value to arrive at the approximate final profit or loss value.

Here, by not investing $65,688 initially in 100 shares of Shopify, the trader’s potential return is leveraged.

Ideally, the trader hopes the short SHOP call will expire out of the money, or worthless. Then, the trader can sell one call after the other, until the long Shopify LEAPS call expires in close to two years.