Based on my analysis, Monolithic Power Systems (NASDAQ:MPWR) is currently an attractive medium-term investment, with a likely CAGR of 15% or more in enterprise value over the next five years. The company is approximately fairly valued based on my valuation model, with a 4% margin of safety. Given the high growth prospects in AI infrastructure and advanced automotive, this valuation is compelling for investment.

Operational analysisMonolithic Power Systems is a fabless semiconductor company specializing in high-performance power management solutions. It is renowned for its DC-to-DC integrated circuits (which regulate voltages across electronic systems) and lighting control products (used in backlighting and general illumination applications). By outsourcing its chip production to third-party foundries, the company can focus on design innovation while keeping capital expenditures low. Its primary markets are enterprise data/storage, automotive, consumer electronics, and industrial/communications. Monolithic Power Systems maintains some vertical integration in design and testing processes, allowing for cost control here, in contrast to its outsourced chip production.

According to the latest annual report, 51.3% of the companys revenue is sourced from China, with 16.9% from Taiwan. In total, 78.5% of its revenue is sourced from Asia, making an investment in Monolithic Power Systems an intelligent investment in continued Asian technological advancement. Given that the semiconductor market in Asia is expected to grow at a 10.33% CAGR from 2024 to 2029, Monolithic Power Systems is well-positioned.

The company is currently shifting from being a traditional chip supplier to a full-fledged solutions provider. This shift is driven by management's focus on high-value sectors such as AI-driven data centers and electric vehicles. In Q3, the company achieved an 86.4% year-over-year growth in its Enterprise Data segment, which now represents 29.7% of total revenue, up from 20.8% in Q3 2023. Its automotive revenue also increased notably by 17% year-over-year.

Monolithic Power Systems is well-positioned against competitors, including onsemi (ON), Analog Devices (NASDAQ:ADI), and Texas Instruments (NASDAQ:TXN). Monolithic Powers proprietary Bipolar-CMOS-DMOS ('BCD') technology enables the integration of different transistor types on a single chip, facilitating highly efficient power management solutions and keeping it competitive. This technology, combined with its fabless model and focus on high-growth markets like AI infrastructure and electric vehicles, allows for robust free cash flow ($14 in free cash flow per share over the last 12 months, up from $4.02 in 2022). Overall, this makes Monolithic Power Systems a worthy investment to consider.

Valuation analysisAlthough a semiconductor company, Monolithic Power Systems revenues are not historically cyclical, partly due to its diversified portfolio across various applications. This diversity contributes to a stable revenue stream over time, which is especially relevant as the company transitions from a traditional chip supplier to a full-fledged solutions provider. For my valuation model, I forecast a five-year holding period, as I consider this to be the optimal growth timeframe at the current valuation.

Assuming the company achieves the December 2024 revenue consensus estimate of $2.19 billion and then grows its revenue at a 17% CAGR over the next five years, it would reach $4.8 billion in annual revenue. This somewhat optimistic projection is based on current AI and advanced automotive trends, which I believe will continue to outpace consensus growth estimates, though this remains a relatively conservative estimate.

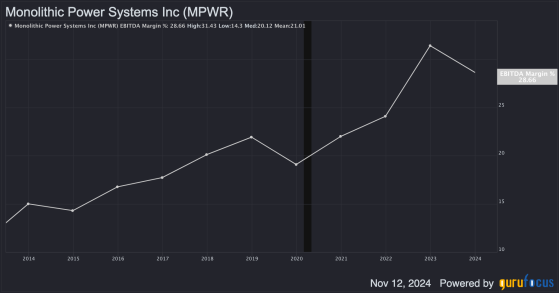

The companys EBITDA margin has shown a long-term upward trend, currently at 28.66%. Given its focus on full-service revenue, this trend should continue, as a full-service model typically provides higher value-added services, longer-term contracts, and reduced competition. While there will be short-term transition costs, I estimate a moderate expansion in the EBITDA margin to 30% by December 2029. With projected revenue of $4.8 billion at that time, I estimate EBITDA will reach $1.44 billion.

The companys 10-year median EV-to-EBITDA ratio is 51.59, though it is currently higher, at 57.59. Given the significantly slower top-line growth projected (17% five-year CAGR in my model, compared to a historical 27.8% CAGR) alongside expected moderate margin expansion, I anticipate a contraction in the EV-to-EBITDA ratio. The forward EV-to-EBITDA ratio is currently 42.19, with a five-year average of around 42. Therefore, I use 42.5 as my terminal EV-to-EBITDA multiple, allowing for a contraction in sentiment related to slower revenue growth. My conservative December 2029 enterprise value estimate for Monolithic Power Systems is $61.2 billion, compared to the current $30.07 billion enterprise value, implying a 15.27% CAGR over approximately five years.

Monolithic Power Systems weighted average cost of capital is 14.33%, with an equity weight of 99.97% and a debt weight of 0.03% (with equity costing 14.331% and debt at 0% after tax). Using this rate to discount my estimate of the companys future enterprise value of $61.2 billion over five years, the present intrinsic enterprise value is $31.33 billion. This indicates a margin of safety of approximately 4%, given the companys current enterprise value of $30.07 billion.

Risk analysisIn late 2024, Renesas Electronics (RNECY) began gaining significant traction in the digital power solutions market, particularly for AI platforms like Nvidias (NVDA) Blackwell series, a critical segment for Monolithic Power Systems. Renesas has been expanding its power management portfolio through key acquisitions, including Intersil, IDT, Dialog Semiconductor, and Transphorm, consolidating its position in high-efficiency solutions for AI servers and data centers.

Historically, Monolithic Power Systems has supplied power management ICs for Nvidias AI chips. However, in November 2024, Renesas stock surged following reports of performance issues with Monolithic Powers products on the Blackwell platform. Theres certainly a risk here that Renesas and other companies take significant market share from Monolithic Power Systems if it consistently shows performance issues in its products.

That said, Monolithic Power Systems is well-diversified and moving toward CPU servers and custom application-specific integrated circuits, which may offset risks associated with concentrated competitive pressures. The greatest long-term threat may not be isolated competitive risks in particular market segments but rather the cumulative pressure from numerous smaller competitors across its broader service offerings. Given its high valuation multiples, this opens up the potential for significant volatility in the medium-term Monolithic Power Systems investment thesis.

ConclusionMonolithic Power Systems is a Buy based on my analysis. The company is approximately fairly valued based on my conservative five-year growth and sentiment forecast. Despite rising competitive threats and present performance issues, the market remains large enough to accommodate several major players and for a healthy recovery. Monolithic Power Systems is well-positioned to compete effectively and protect its significant high-growth market share. Based on my research, a 15% or more CAGR in enterprise value over the next five years is highly likely.

This content was originally published on Gurufocus.com