My experiment in day trading continues. Having burst out of the gates with some good success I have found myself treading water the last few weeks. Today offers an opportunity to get out of this rut.

There is no significant economic data to move the needle, so action should be more technical in nature.

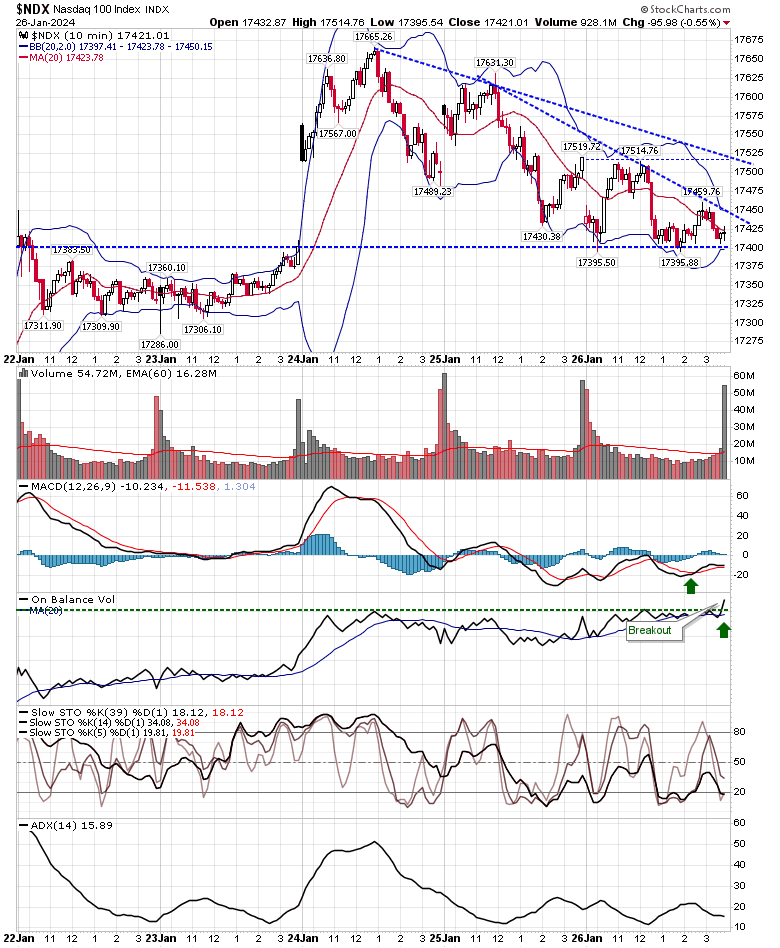

The Nasdaq 100 ($NDX) closed the price gap from January 24th in a successful test of support, but also registered a breakout in On-Balance-Volume accumulation.

Momentum is oversold and the MACD is working off an earlier 'buy' signal, although it's a signal that triggered below the bullish zero line, so it's a "weak" buy.

However, collectively, I'm optimistic for a long trade near 17,400 if you can get it with an initial target of 17,600 - although I suspect it will go higher (for a number of days).

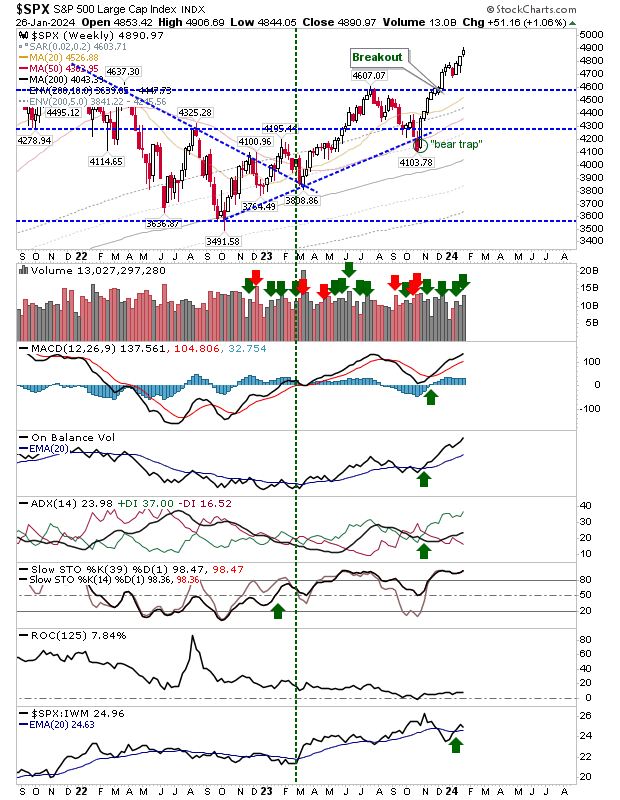

If we take a step back now and look at the weekly time frames, we had another good week, even if action on the daily time was a little disappointing into the end-of-week, on the weekly time frame it's still ranked as bullish for many of the indexes.

The S&P 500 registered an accumulation week with continued strength in technicals and relative performance to Small Caps.

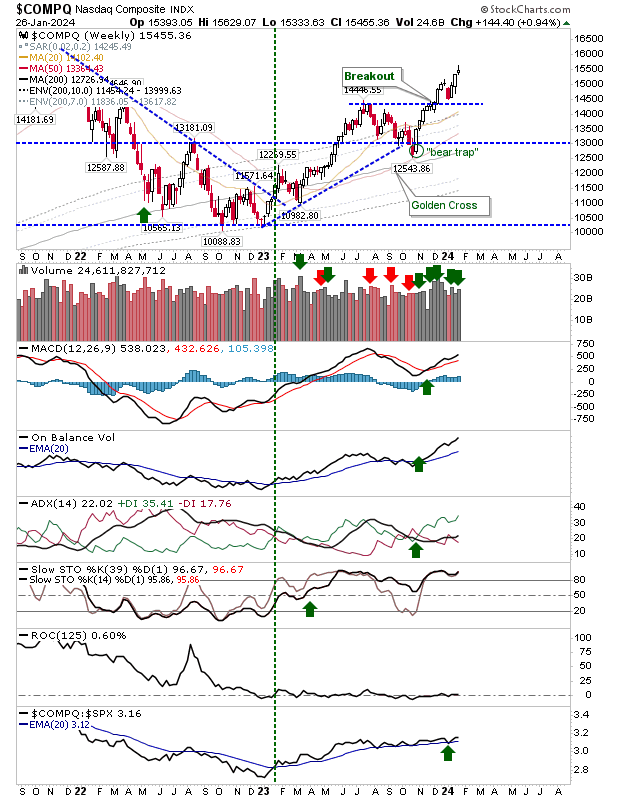

The Nasdaq also closed the week with accumulation, although the end-of-week candlestick was more neutral in nature.

Technicals are net positive and the index continues to outperform both the S&P 500 and Russell 2000 (IWM). The index hasn't yet broken to a new all-time high, but it's heading in the right direction.

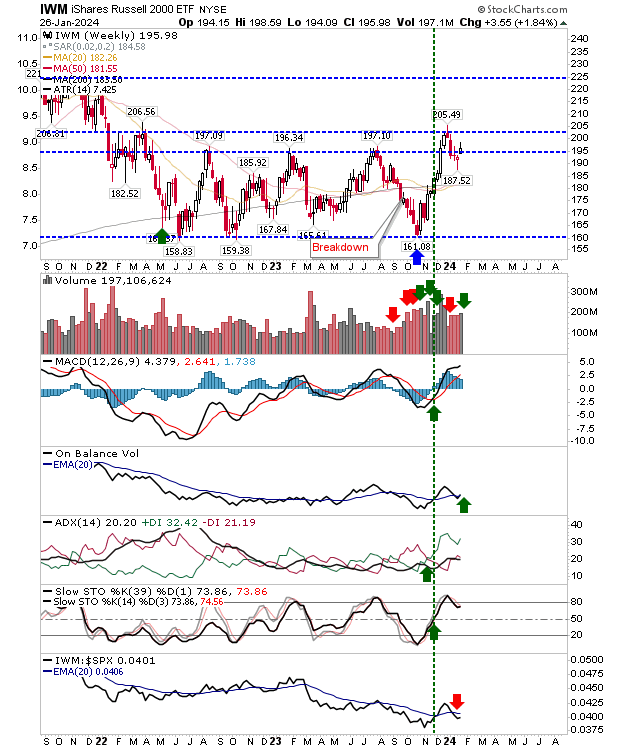

The Russell 2000 ($IWM) is still playing as the sleeper index. The index has gone from being rebuffed at $195 to now finding support at this price.

There is also a fresh 'buy' trigger in On-Balance-Volume to accompany the successful support test.

The key moving averages have all converged as the index is caught in what is now approaching a 2-year consolidation, but once it makes it move, it will have strong momentum.

Note the heavy pickup in trading volume since the October 2023 lows.

Opinion remains in a state of fear; the wars in Ukraine and Gaza, inflation, tech job layoffs, and the rise of the right (once more), but markets are poised to kick off a new bull market.

We may see some stalling around all-time highs, but my expectation is for a new secular bull market.