This week's market action could be a rollercoaster ride for traders. The Nasdaq's bearish "evening star" candlestick pattern hints at further declines, but a mid-week spike low could offer a reversal opportunity.

Meanwhile, the Russell 2000 shows mixed signals with a potential zig-zag correction, and the S&P 500 faces resistance amid light volume buying, suggesting a "dead cat" bounce and new swing lows by week's end.

Are these mere bear traps or signs of a deeper correction? We delve into the technical indicators to see what today's session might have in the offing.

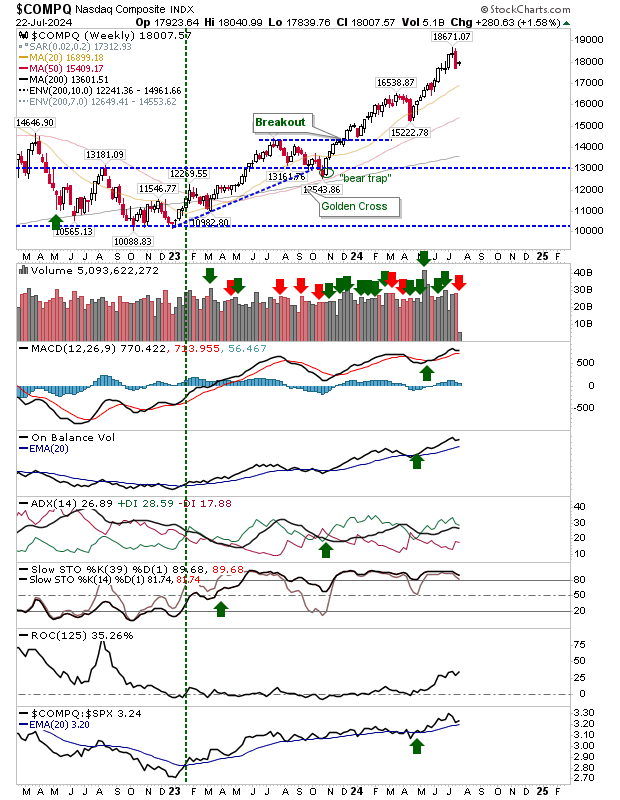

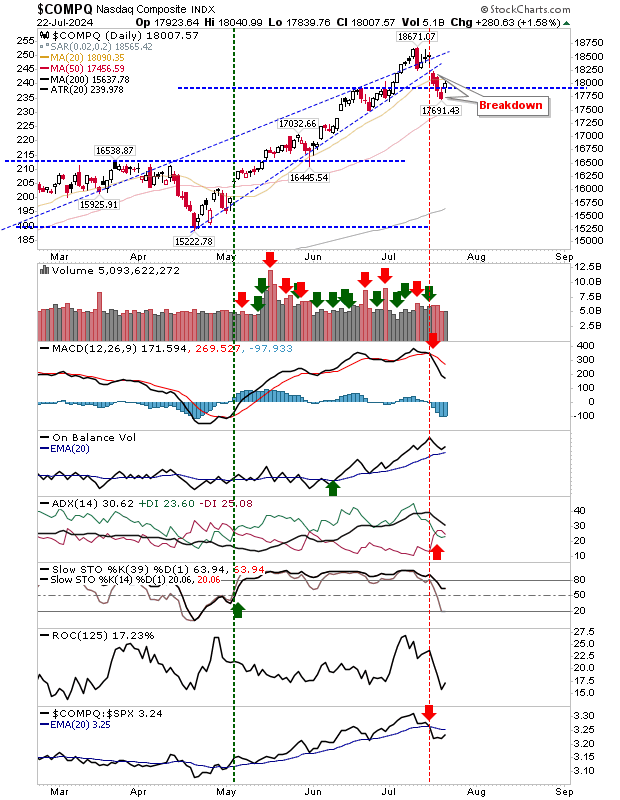

Looking at weekly charts, the Nasdaq had finished with a bearish "evening star" candlestick reversal pattern and this is typically followed by further selling.

However, while I would be looking for further weakness, we may see on Wednesday or Thursday a spike low that will deliver the aggressive reversal day traders like.

Yesterday's action in the Nasdaq could play as a "bear trap", if the index can stay above 17,900 for the next couple of days.

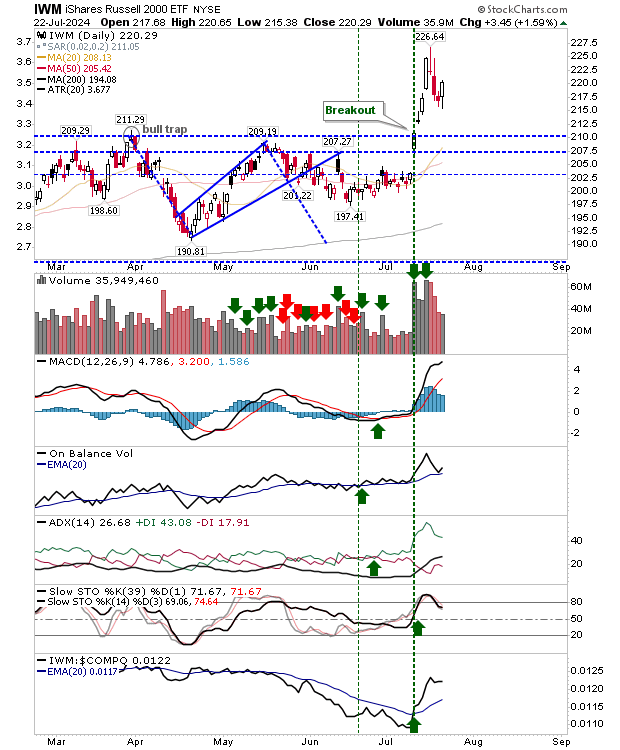

The Russell 2000 (IWM) was able to mount a bullish reversal, although I suspect we will see some form of zig-zag reversal as we enter the "zig" phase of the correction. Technicals are net bullish, although stochastics are weakening and yesterday's buying volume was light.

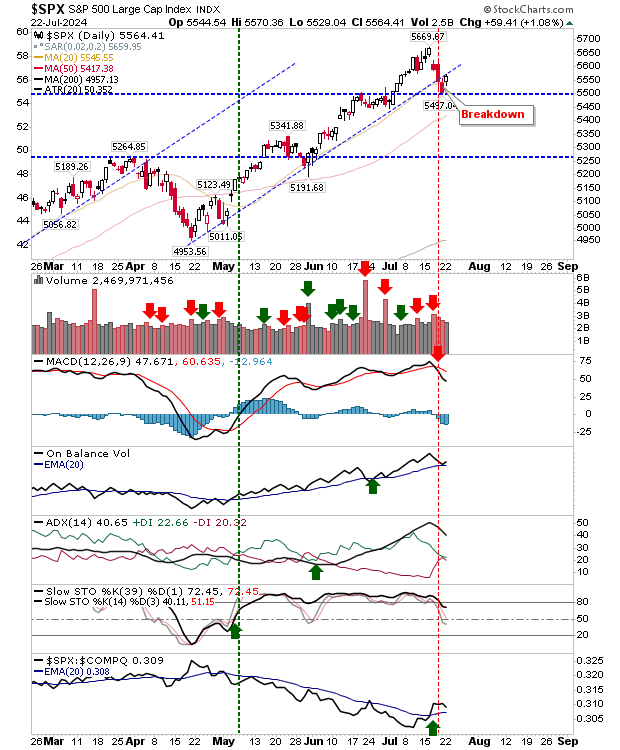

The S&P 500 played the bounce-off breakout support, although the best of the action was available pre-market.

Yesterday's finish tagged trendline resistance following Friday's breakdown; if bears are in control then look for an open near yesterday's close and then selling or flat action going forward.

The "dead cat" bounce is in play with light volume buying to start the week. I would be looking for new swing lows by the end of the week and be surprised if Thursday's lows turned out to be the actual lows for the indexes.