Given the severity of the SVB-inspired sell-off in the indices, I am highly skeptical about the validity of the recovery bounce over the last two days. Buying volume is down and has so far failed to challenge the distribution which has come before. We have had confirmed breaks of support, and those support breaks remain valid as of today.

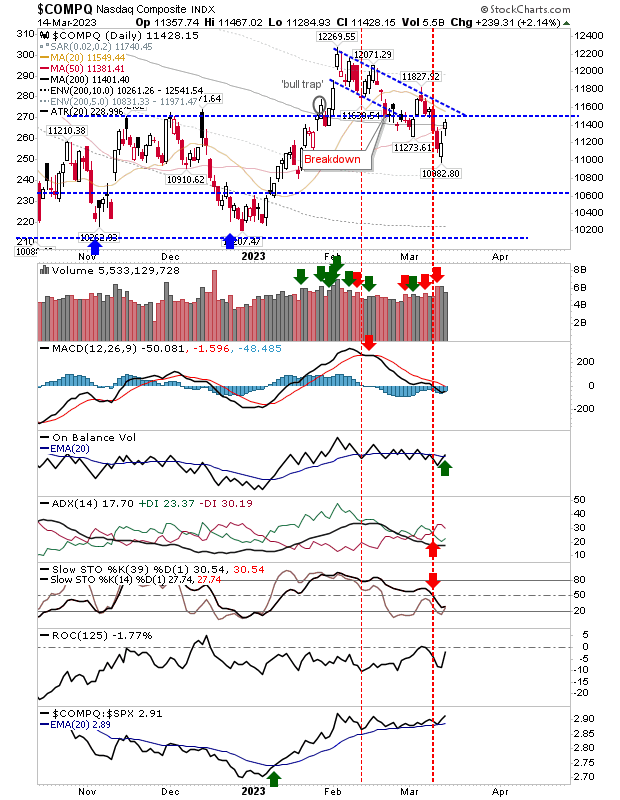

The Nasdaq lost 11,500 breakout support but has at least managed to recover its 200-day MA. Again, I would rather see breakout support regained (now resistance), but there is a chance another day's buying will deliver on this. There is a fresh 'buy' trigger in On-Balance-Volume. The index isn't really at a trade position, a short looks more favored, but it would be a noisy trade.

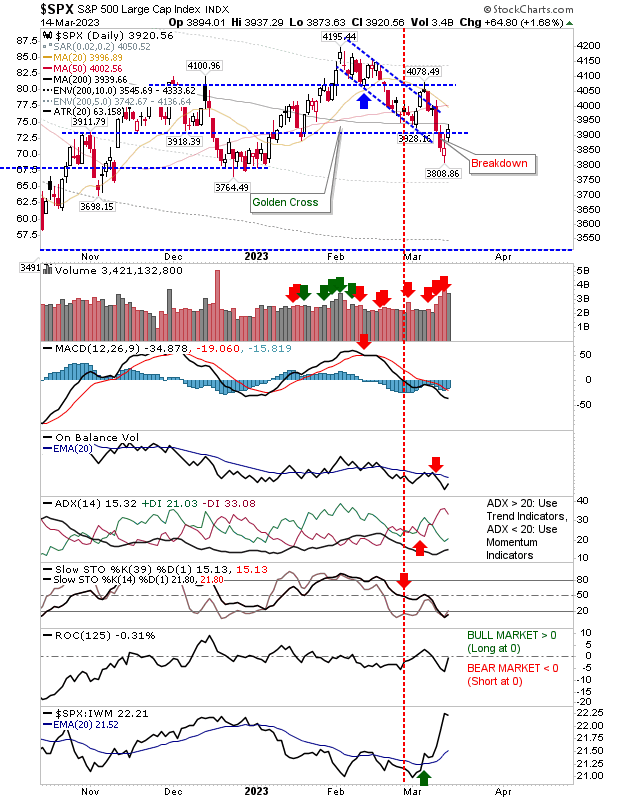

The S&P 500 stopped short of its 200-day MA. Technicals are net bearish, except for the strong relative outperformance against the Russell 2000. The index is well inside its prior range, so this will likely be a noisy action for the next few days (and weeks). I would edge bullish, and there is investment potential at current levels, but it's a difficult trade.

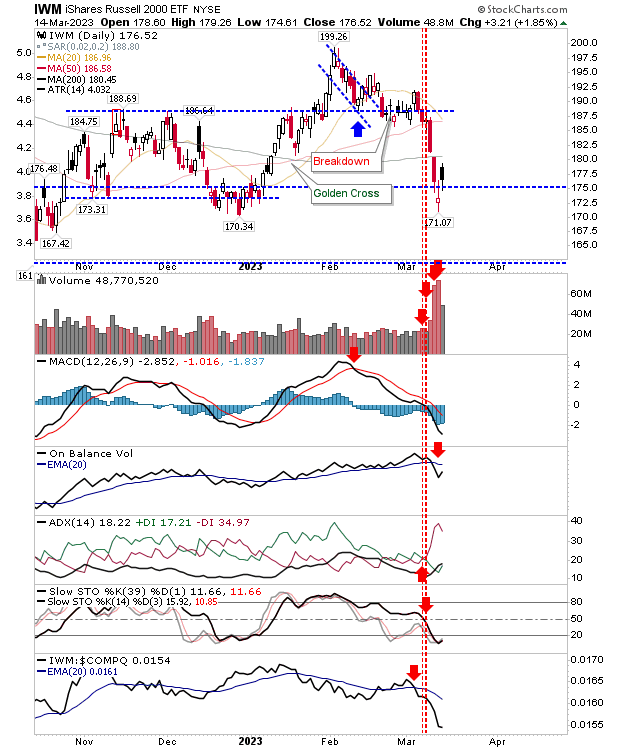

The Russell 2000 has suffered the most over the last few days, quickly going from a breakout to a move back to channel support. Technicals are net negative, and it will be long before they turn positive again.

The effect of the SVB banking crisis is to drop indices back inside prior trading ranges. It's not a crisis from a technical perspective, but if we knock out last year's lows, it will be.