Production, unable to keep pace with demand for cooling, has already taken natural gas prices to seven-year highs this summer, even before the advent of winter and its need for heating. Now enter soaring demand for LNG from overseas buyers to further vex US consumers.

Gas futures on the Henry Hub of the New York Mercantile Exchange have jumped 40% over the past four weeks, reaching a session peak of $5.644 per mmBtu, or million metric British thermal units, on Wednesday.

At this point, there seems little to stop the freight train called gas, be it pessimistic technical charts, benign weather or even a less-than-friendly weekly update on US gas stockpiles due later today.

If that isn’t enough, overseas buyers for liquefied natural gas are hopping on, adding to the pervasively bullish momentum in a market whose demand was once decided by just domestic utilities and consumers.

Charts courtesy of Gelber & Associates

The result is the prognosis that Henry Hub prices could soon reach $6 per mmBtu and double digits by the peak of the 2021/22 winter—a phenomenon last seen in 2006.

Dan Myers of Houston-based gas markets consultancy Gelber & Associates cited the worsening squeeze in the marketplace in a Wednesday note to the firm’s clients.

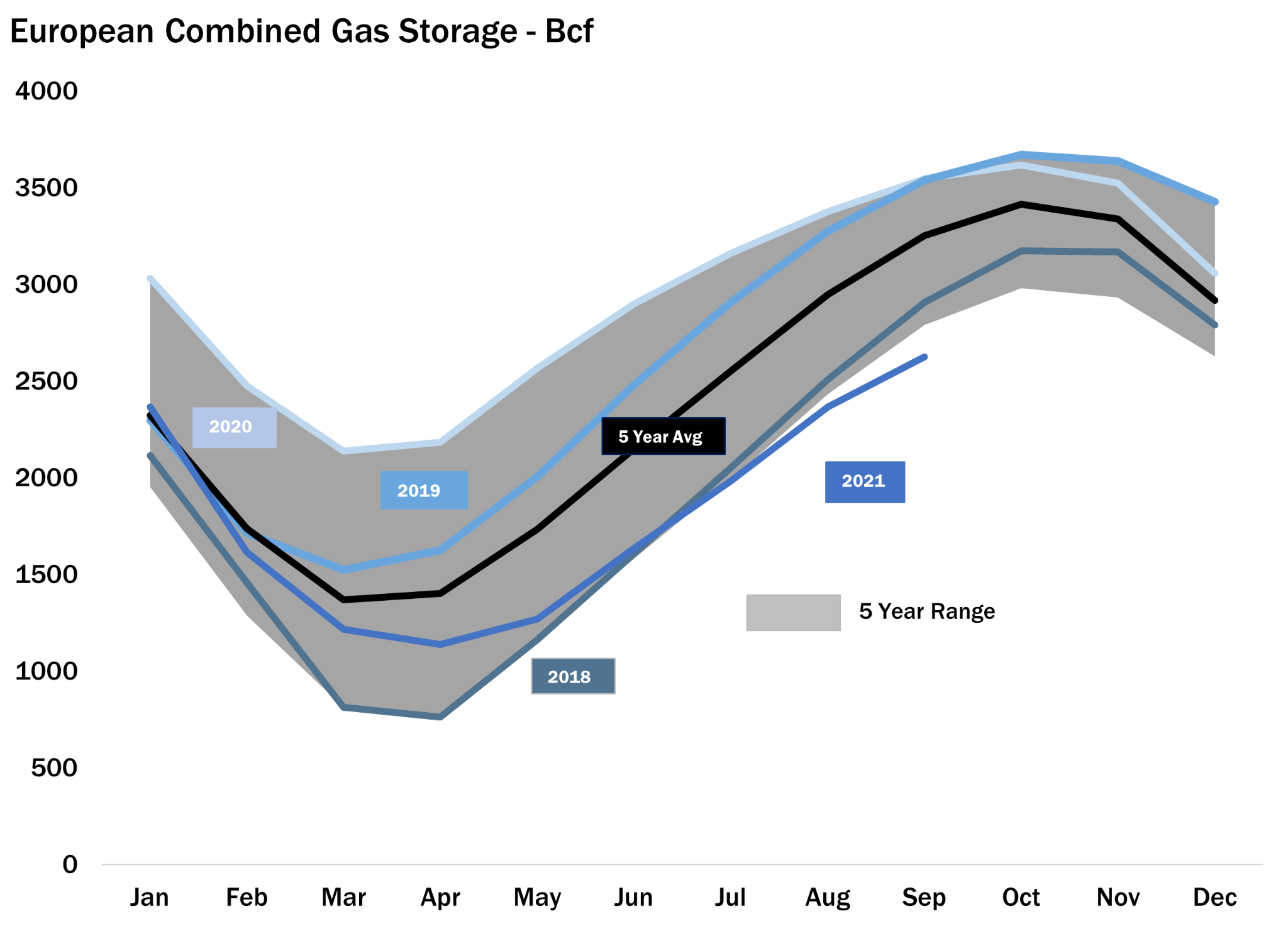

“As summer demand wanes in Asia, European buyers are growing increasingly desperate in their last-ditch attempt to fill storage before winter,” wrote Myers, pointing to European storage levels that were already below five-year monthly averages since August and continuing to dip.

Added Myers:

“It’s clear that US LNG exports will remain in high demand this winter, and the aggressive increase in international prices has continually raised the bar at which domestic consumers would need to reach to price out these exports and encourage more gas to stay State-side.”

“The US’ own lower-than-normal storage situation is not helping matters, as significant winter risk premiums are priced in across the global gas complex.”

Little Negatives Matter to a Market up 100% on the Year

Gas futures are already up more than 100% since the end of 2020. While March was the only month this year that the market took a loss (6%), there were some price bumps here and there until Hurricane Ida struck at the end of August.

As of Wednesday, two weeks after the storm’s landfall, some 878.70 million metric cubic feet of gas, or 39.4% of the output capacity on the US Gulf of Mexico, remained shut in, according to the Bureau of Safety and Environmental Enforcement.

On the heels of Ida, another hurricane—Nicholas—took a swipe at the Gulf’s energy facilities on Tuesday, disrupting power to onshore pipeline, gas and chemical plants.

While these certainly added to the upward fervor of the market, weather forecasts pointing to a moderation in temperatures from the blistering heat of recent weeks and a brief pause in exports at Freeport LNG as a result of storm Nicholas did nothing to stop the market’s surge to beyond mid-$5 pricing.

“It is all fear in the market, owing to storage levels that are viewed as less than sufficient in the event of a cold winter, not just here in the US but even more so over in Europe,” Bespoke Weather Services said in a forecast carried by industry portal naturalgasintel.com.

The Power of International Pricing

The forecaster said if US demand for heating proved exceptionally strong this winter, domestic buyers of gas may need to drive up prices even further to slow LNG exports and keep more gas in the Lower 48 US States to power homes and businesses through the coldest months of the year.

“It makes it very difficult to say when this rally could end, or how high we can go, as we have tons more upside potential if the market begins to worry more about the possibility of having to price out LNG this winter,” Bespoke said.

“Obviously, weather is going to have the final say, and we do feel warmth is more likely into October and November, which would bring headwinds to the market, but we have a few weeks to go before this will be something that is likely to move the market.”

Gelber’s Myers concurred with that view.

“If anything, the Henry Hub is moving consistently with price movement from offshore markets,” he said, noting that gas prices on UK’s NBP, or National Balancing Point, and the Netherlands’ TTF, or Title Transfer Facility, both rose by 7% in their trading sessions on Wednesday—and were promptly matched by the Henry Hub’s 6% rally.

“This is a relatively unprecedented phenomenon,” Myers said, referring to the power of international pricing in US gas.

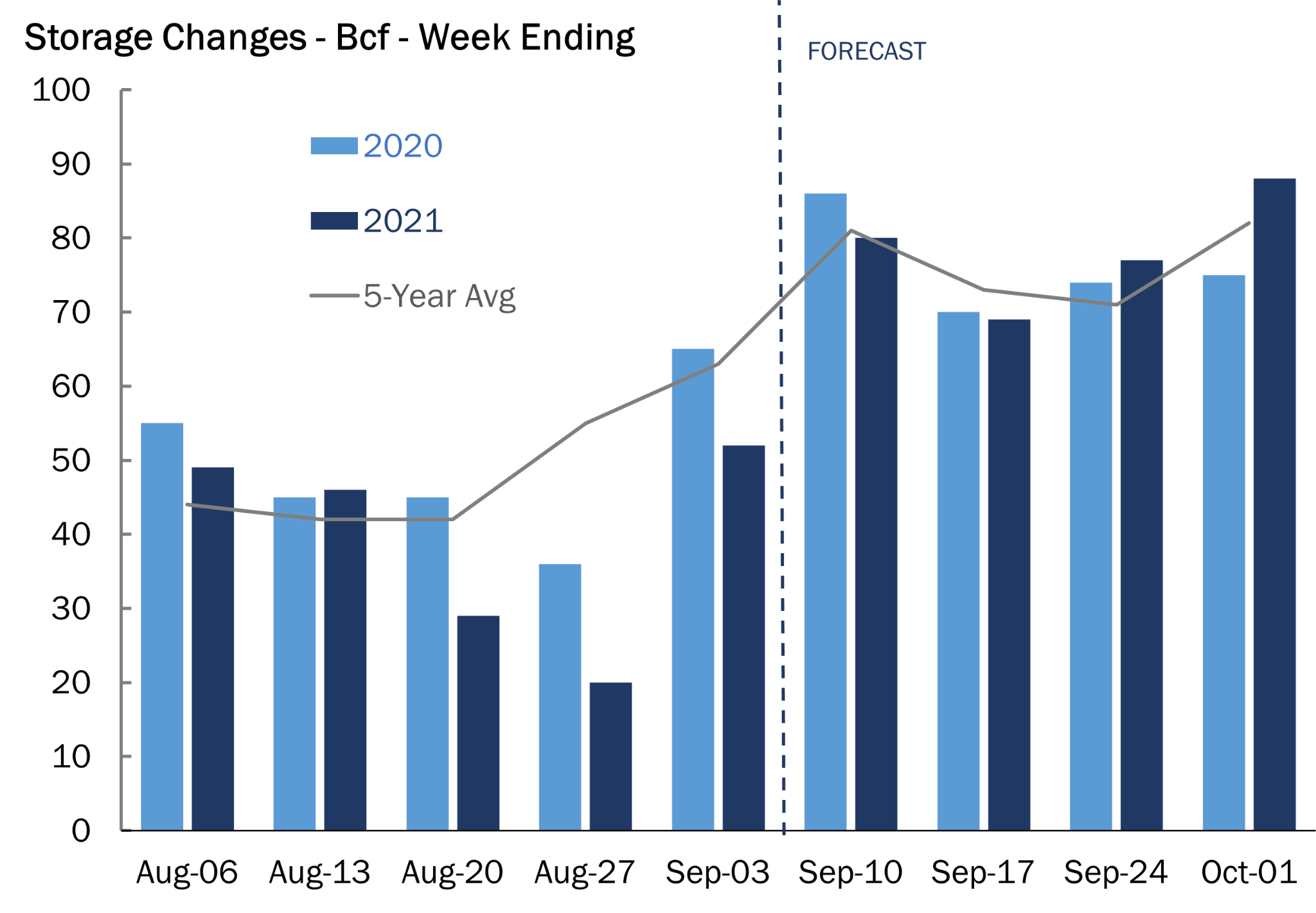

As for the weekly update on US gas-in-storage due at 10:30 AM ET (14:30 GMT), the Energy Information Administration is expected to report an injection of 76 bcf, or billion cubic feet, for the week ended Sept. 10, according to a consensus of analysts tracked by Investing.com.

In the previous week to Sept.3, the stockpile build was 52 bcf.

While the weekly change may be seen as somewhat bearish, it isn’t very far off from the 86 bcf injection during the same week a year ago and the five-year (2016-2020) average build of 79 bcf.

If the projections are on target, the injections for last week would take stockpiles to 2.999 tcf, or trillion cubic feet—some 7.4% below the five-year average and 16.7% below the same week a year ago.

Data provider Refinitiv meanwhile estimates the current week’s injection in a range of between 54 and 81 bcf, with the mean falling at 68 bcf. That would compare with an injection of 70 bcf during the same week last year and a five-year average build of 74 bcf.

Temperatures last week were slightly warmer than usual for this time of year with 68 CDDs, or cooling degree days, compared with a 30-year average of 64 CDDs for the period.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18 degrees Celsius).

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.