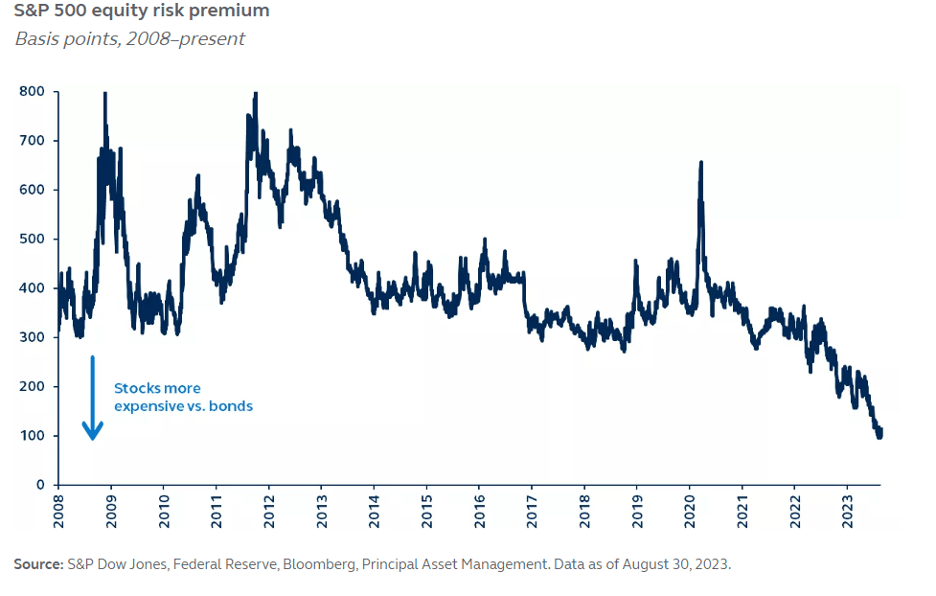

The equity risk premium (ERP), the return pickup from investing in equities compared with bonds, has become a talking point in recent months, due to the narrowing spread between the S&P 500 earnings yield and the U.S. 10-year Treasury. The earnings yield of a stock or equity index is merely the inverse of its price/earnings ratio (i.e., earnings per share/share price), which investors use as gauge to determine future earnings growth. Conventional investment wisdom holds that when the earnings yield is high relative to bond yields – equities should be considered cheap – and thus more appealing; but what if that premise does not hold?

The accelerated manner in which interest rates have risen over the past year has led to a paradigm shift in the equity-bond dynamic, which is reflected in the ERP. Bond yields have risen dramatically, and cash (i.e., Treasury instruments) has become a more viable alternative. On the other side of the pendulum, elevated stock market valuations – spurred in part by the fervor around artificial intelligence and/or the belief that central bankers quash inflation without a recession – have pushed markets higher, but also reduced the S&P 500‘s earnings yield, bringing it closer to the “safe” Treasury yield.

What should investors take from it?

While the decline in the equity risk premium is noteworthy, its occurrence should be viewed in a contextual manner, in which there is still a high degree of uncertainty in the global economy that the market may not understand or acknowledge. Though U.S. inflation has slowed, Federal Reserve Chairman Jerome Powell has stated that it remains too high; and the FOMC is prepared to raise rates further if appropriate. Regarding U.S. economic growth, restrictive monetary policy has tightened financial conditions, supporting the expectation of below-trend growth.

The decline in the equity risk premium reflects the current market conditions. Still, instead of being fearful of what it may imply, it could be used to inform one’s portfolio decision-making. Academic research and empirical data have shown that investing in equities remains a proven method to generate wealth over time, so investors should remain invested in U.S. equities. However, given the increase in interest rates and the implication from the FED that rates will remain ‘higher for longer’, having exposure to bonds can prove to be a valuable portfolio hedge, offering income, capital stability, and diversification within one’s portfolio.

Floating Rate Bonds as a consideration

Given the dynamic nature of the current interest rate environment, investors should consider floating rate bonds as an inclusion within their portfolio. Floating rate debt can play an important role in a diversified portfolio, due to its ability to generate a relatively high level of income and low price sensitivity to interest changes. Beyond its income-generating capabilities, floating rate debt can be a stabilizing component within one’s portfolio. Given the inverse relationship between prices and yields of fixed-rate bonds, as market interest rates rise, a low fixed coupon rate may no longer be attractive—the price will generally fall to make its yield more in line with market interest rates. But floating rate instruments don’t suffer from this dynamic - because their coupons adjust with market interest rates, their prices don't need to, making them very stable.

For investors interested in gaining exposure to floating rate debt, the iShares Floating Rate Bond ETF (FLOT) and SPDR Bloomberg Investment Grade Floating Rate ETF (FLRN) are two passively managed investment offerings that provide direct exposure to the floating rate bond market. The Pacer Pacific Asset Floating Rate High Income ETF (FLRT) focuses on floating-rate loans of non-investment-grade companies, which can serve as both an income driver and a hedge against rising interest rates.

This content was originally published by our partners at ETF Central.