“Net zero” refers to a situation where greenhouse gases (GHGs) discharged into the atmosphere are removed from it. The Conference of the Parties (COP) 15 Paris Agreement and the COP 26 Glasgow summit mandated that participants announcing pledges achieve net zero by 2050/2060. Net-zero commitments require regulators, entire countries and global organisations to take practical measures to decarbonise the environment, and also encourage disengaged stakeholders to take comparable action to remove hindrances to implementation.

The transition to net zero could see capital spending on physical assets for energy and land-use systems of c.USD275tn from 2021 to 2050. While the transition is likely to generate potential employment opportunities, sectors with high-emission products or services — which account for c.20% of global GDP — would face a considerable impact on demand, production expenditure and employment. Under the International Energy Agency’s (IEA’s) Net Zero 2050 scenario, coal production for energy use would almost cease by 2050, while oil and gas production volumes would be c.55% and c.70% lower, respectively, from 2022 levels. While this is a pivotal long-term goal, there has not been enough progress on commitments and associated action by countries and organisations, highlighting the degree of urgency and aggressive action required by the various stakeholders. In this blog, we look at countries’ and organisations’ progress towards net zero through strategy conceptualisation and implementation.

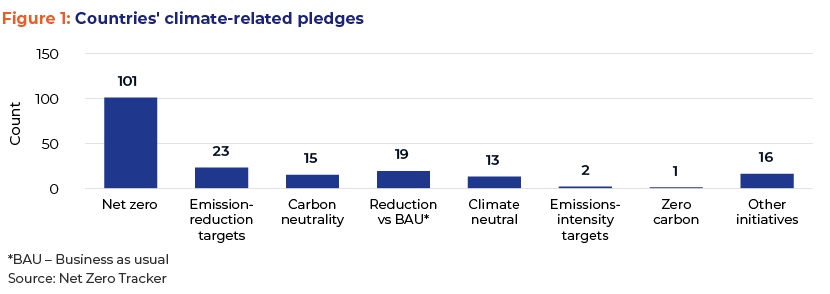

Data from the Net Zero Tracker(as of 24th June, 2022) shows that c.190 countries have initiated climate-related pledges including net zero, carbon neutrality, emission-reduction targets and zero emissions; 101 countries have pledged to transition to net zero, 15 countries are committed to achieving carbon neutrality and 23 countries have set emission-reduction targets to minimise their carbon footprint.

Progress towards net zero

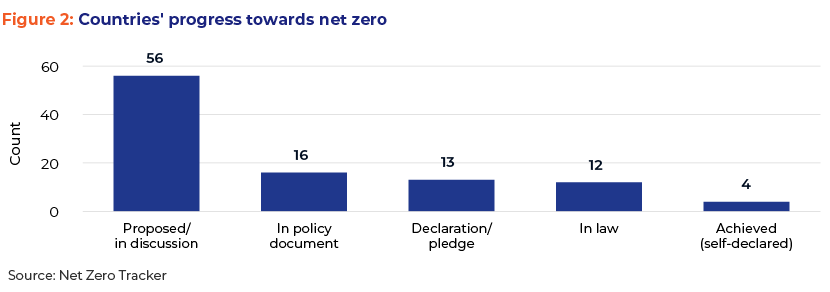

Around 55% of the countries that have pledged to transition to net zero have yet to finalise their overall strategy and provisional targets. Around 12% of the countries have legally binding net-zero commitments.

Acuity Knowledge Partners’ (Acuity’s) view

-

Most country-level pledges are still in the proposal or discussion stage; hence, much of the transition to net zero needs to be fast-tracked based on the target timeline

-

Economies will be under scrutiny and compelled to implement concrete and effective climate-related actions in line with their provisional deadlines; hence, policy developments and economy-wide interventions need to be practical and workable

-

Around 83% of global GHG emissions are covered by country-level net-zero pledges; if these are fulfilled, it would reduce global emissions significantly

Companies’ progress on the transition to net zero

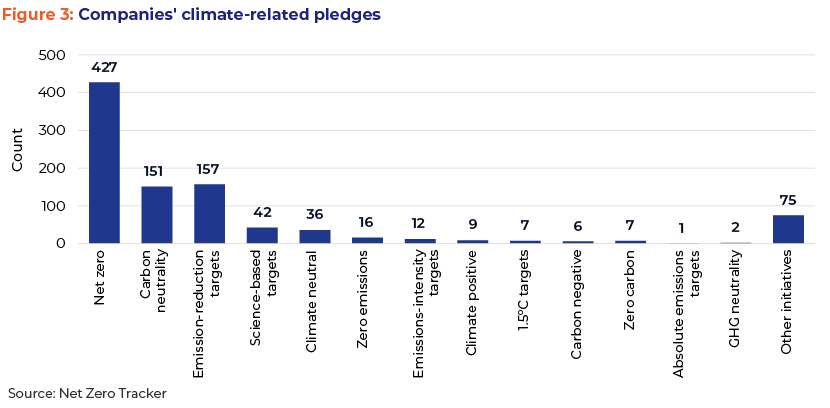

Nine hundred and forty-eight companies have committed to climate-related pledges including net zero, carbon neutrality, emission-reduction targets and zero emissions: 427 companies have promised to transition to net zero, 151 companies have pledged to achieve carbon neutrality and 157 companies have set emission-reduction targets to minimise their carbon footprint.

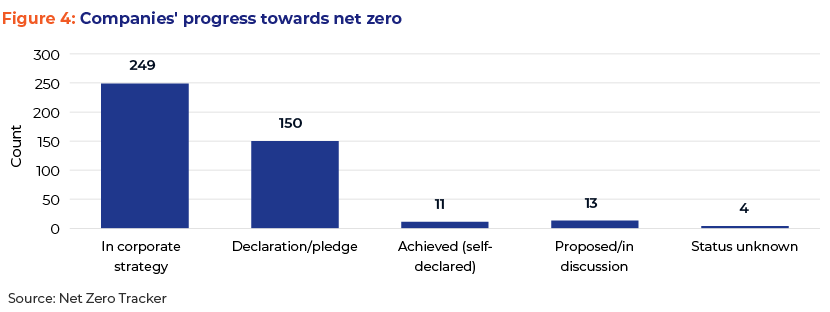

Around 58% of the organisations have included net-zero commitments in their corporate strategy. Around 35% of them are still stuck in the declaration phase, with no considerable activity towards reducing their carbon footprint.

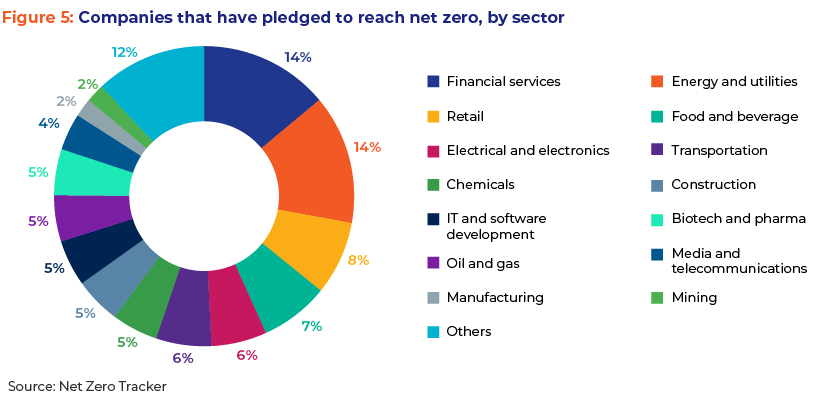

Around 14% of the companies that have pledged to reach net zero are from the financial services sector, followed by the energy and utilities (c.14%) and retail (c.8%) sectors. Companies from the oil and gas and mining sectors form a meagre c.5% and c.2%, respectively, of the companies that have pledged to reach net zero.

Acuity’s view

-

Most companies have included achieving net zero in their corporate strategy, but they need to act on short- and long-term targets to achieve net zero. Otherwise, asserting their products and services are sustainable when they are far from actually being sustainable would become just another marketing and PR strategy

-

Companies in carbon-intensive sectors such as oil and gas and metals and mining need to proactively include and follow the Science Based Targets initiative’s (SBT’s) sectoral decarbonisation approach (SDA) to achieve net zero; otherwise, they are likely to face large financial and reputational losses, with their assets stranded due to regulatory mandates

Snapshot of measures to achieve net zero

Analysis of the measures adopted by companies to achieve net zero highlights that c.48% of the companies have set net-zero targets that cover their carbon dioxide (CO2) emissions and emissions of at least one other GHG while 40% of the companies have set net-zero targets that cover only their CO2 emissions. Around 71% of the companies that have pledged to reach net zero have developed/included an annual (or more regular) reporting mechanism to track their carbon footprint in the business value chain. Around 99% of the companies use/plan to procure carbon credits to offset emissions to reach their net-zero goals.

Acuity’s view

-

Knowledge of its GHG footprint is a key requirement for any organisation to develop and implement effective climate-related A proper assessment of GHG emissions would help organisations design standardised GHG reporting guidelines

-

Annual or more frequent GHG reporting encourages businesses to manage risks and identify new opportunities. Regular GHG reporting also increases transparency and accountability and boosts investor sentiment

-

Carbon credits incentivise organisations to reduce emissions and avoid heavy carbon taxes. These credits can be used to offset internal emissions and avoid emission-related penalties; they are also a high-return, long-term investment instrument