Netflix (NASDAQ:NFLX)'s stock has surged by over 80% year-on-year, adding to its illustrious success story. Although consistent product uptake and successful company-level execution likely warrant its latest gains, revising Netflix's stock might be prudent as headwinds have emerged. For example, streaming-as-a-concept has matured, concurrently enhancing Netflix's competitive environment. Moreover, Netflix's stock has outperformed most high-beta technology stocks in the past year, suggesting mean reversion is possible.

The abovementioned factors illustrate a juxtaposition, providing latitude to assess Netflix stock's near-term prospects; herewith is an examination of Netflix's salient variables.

Operating Review

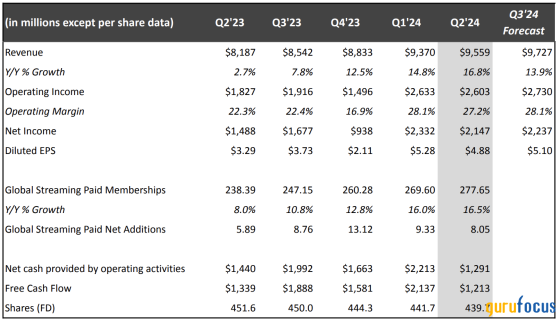

Headline FiguresNetflix's broad-based revenue has grown at a staggering pace this year. For example, the company delivered $9.56 billion in second-quarter revenue, a 16.8% year-over-year increase, illustrating Netflix's ability to sustain real growth and pass inflation to its consumers. Furthermore, Netflix's operating profit margin settled at 27.2% in its second quarter, a 4.9% improvement from a year earlier, which affirms Netflix's constant shareholder value additivity.Source: Netflix

Segmental Analysis: Geographically GroupedNetflix's United States and Canada (UCAN) segment, which accounts for about 45% of the company's revenue mix, delivered $4.296 billion in second-quarter earnings, up 7% year-over-year. Although the segment's real growth was positive, its average revenue per membership pulled back by 13 cents quarter-over-quarter to $17.17, while its paid net additions decelerated to 1.45 million from 2.53 million a quarter ago.

Despite experiencing showing slower per-user growth, UCAN provides a solid revenue base while Netflix expands into international markets. Additionally, the segment offers advertising revenue conversion potential amid its consistent demand and high per-user monetization ratio.

Source: Author's Work, Data Provided By Netflix (UCAN)

As previously mentioned, Netflix's international expansion might be pivotal. Netflix generated around $1.2 billion in second-quarter revenue through its Latin American (LATAM) operations. As illustrated in the following diagram, Netflix's LATAM segment has grown considerably, with double-digit fx-adjusted growth recorded in its past three quarters.

Source: Author's Work, Data Provided By Netflix (LATAM)

Netflix LATAM expansion suggests it has benefitted from growing emerging economies, consumer density, and revenue diversification.

The company's EMEA expansion follows a similar route as it hosts European, Middle Eastern, and African consumers. Headline metrics and anecdotes suggest that Netflix needs to optimize regional content to EMEA consumers' preferences to accelerate growth. Although other factors might contribute, data sampling, accelerated partnership growth, and marketing attempts will likely play a pivotal role in enhancing Netflix's EMEA reach.

Source: Author's Work, Data Provided By Netflix (EMEA)

The Asian Pacific consumer base provides Netflix with a potential hidden asset.

Netflix generates approximately 11% of its revenue from its Asia Pacific operations, which have delivered negative growth in each of Netflix's last five quarters. While segmental growth has slowed, China is set to inject a reported $1.07 trillion stimulus package into its economy. A stimulus package might propel the APAC region's consumer sentiment and inflate interrelated economies, resulting in an enhanced systematic outlook for Netflix's APAC segment. Even though the stimulus package might not cure APAC's structural concerns, a better consumer environment provides a starting point.

Source: Author's Work, Data Provided By Netflix (APAC)

Current Fundamental Value Drivers

Advertising RevenueAdvertising through streaming can be successful if robust data aggregation and prudent advert insertion are emphasized. For example, anecdotal evidence points toward YouTube's successful advertising model, which is subtle yet effective.Netflix didn't disclose its second-quarter advertising revenue in a separate line item, yet its management stated that it increased its advertising member base by 34% quarter-over-quarter.

Although disputed by some, Netflix's tier-based membership likely provides a revenue multiplier and target market differentiation, allowing the company to be more dynamic with its price structure while diversifying its end market.

Cross-Selling GamingNetflix's expansion into gaming provides an exciting angle. An isolated view suggests that Netflix's gaming segment isn't a world-beater on a standalone basis. However, uptake in gaming can be amplified through cross-selling Netflix's core streaming products and vice versa.

Furthermore, to enhance the gaming segment's engagement, Netflix aims to dial in on its gaming initiatives in the coming years.

According to Netflix's management: "Starting in July, we'll launch about one new title per month like Emily in Paris and Selling Sunset. Separately, we will premiere a multiplayer game based on the Squid Game universe later this year, timed to the launch of season two of our biggest TV series ever."

If successful, Netflix's enhanced focus on gaming lends it a new market opportunity with cross-sales synergies.

Product and Content PartnershipsA more extensive subscriber reach has benefitted Netflix's revenue mix. Nonetheless, challenges such as content preferences, language barriers, and marketing budgets have emerged. While posing a threat, Netflix's substantial product development budget can mitigate systemic challenges, allowing it to aggregate and assess data to refine its end-market delivery. Therefore, geographic content inefficiencies will likely submerge.

As for partnerships, Netflix's comprehensive market share provides it access to best-in-class partnership programs, consequently allowing the company to benefit from on-device accessibility, cross-marketing, and business-to-business synergies.

Emerging MarketsNetflix's LATAM and APAC exposure illustrate its desire to expand into emerging markets. Emerging markets provide Netflix with renewed growth opportunities, especially as its hefty brand name often leads to seamless market entry.

The following diagram illustrates emerging markets' potential through gross domestic product growth. Netflix's market representation might be independent of regional growth rates. Nevertheless, systematic support provides a telling baseline.

Source: Statista

Challenges

CrowdingNielsen recently published a report that alluded to streaming's share of U.S. screen time and Netflix's role within it. According to Nielsen, Netflix possesses a robust point-in-time market share of 8.4%. However, a closer observation shows that market fragmentation has occurred. For example, middle-market players such as Pluto, Paramount, Peacock, Hulu, Tubi, Roku (NASDAQ:ROKU), and Max have earned noteworthy market shares. Moreover, Netflix has noteworthy competition in foreign markets, with industry participants like iQIYI, Tencent Video, and Le.com threatening Netflix's APAC market share through their foreign expansion intiatives.Coalition tactics, such as mass acquisitions or excess internal investment, might keep Netflix from touching distance. However, market saturation risk will likely remain as the streaming business exits its initial growth phase.

Source: Nielsen

F/X ManagementAn overlooked risk factor is Netflix's operational hedging duties, which include managing its currency basket.

The company's global diversification means its currency exposure is diversified. Nonetheless, Netflix's content-based expenses, operating liability structure, and employee wages must be matched by guiding its fx-adjusted income into the necessary channels. Executing such hedges can be difficult as the company derives much of its revenue from LATAM, an unstable currency environment. For instance, Netflix recently pointed out that the Argentinian Peso played a significant part in its average revenue per member line item when it stated that "the primary difference between F/X neutral and reported growth was large peso price increases in Argentina due to local inflation and the devaluation of the Argentine peso relative to the US dollar."

Valuation

Forward P/EThe price-to-earnings expansion formula provides a valuable guidepost when assessing a stock's valuation outlook, especially for a stock such as Netflix, which has abundant influencing variables. Although merely an indicator, the formula embodies Occum's Razor Law, which states that the simplest explanation is usually the one the one closest to the truth.According to the expanded price-to-earning formula, Netflix is undervalued by about 38.7%, presenting investors with a noteworthy value gap.

Source: Author's Work - Data Provided By Market Screener & Yahoo Finance

Stock Buybacks and Capital StructureNetflix completed $1.6 billion in stock buybacks during its second quarter, which naturally lowered the cost basis of its existing investors. The company's current buyback plan has $5 billion in remaining capacity, suggesting additional buybacks are on the horizon.

Furthermore, Netflix has $1.8 billion in debt maturing within the next twelve months, which it plans to refinance. Although debatable, lower U.S. interest rates and sustained stock buybacks likely translate into a favorable valuation outlook through a lower cost of capital and a reduced share float.

Technical AnalysisNetflix's stock is above its 10-, 50-, 100-, and 200-day moving averages, yet its 14-day relative strength index remains below 70, suggesting the stock has yet to reach overbought territory.

Source: Gurufocus

The options market supports Netflix's technical outlook as its Put /Call ratio of 1.38 implies a bullish short-term outlook from options traders. Even though the Put-Call ratio can be countercyclical, it would likely require a cataclysmic event to swing traders' sentiment.

In Summary

Netflix has experienced scintillating growth in Latin America, which has spurred its broad-based earnings. In addition, the company's advertising wing has benefitted from stable, broad-based growth.Furthermore, Netflix possesses overlooked tailwinds from cross-selling its gaming division, delivering curated products to its various segments, and possessing best-in-class corporate partnerships.

Although mean-reversion is a noteworthy consideration, the price-to-earnings expansion formula conveys that Netflix is undervalued, which is supported by the company's comprehensive share buyback plan. Moreover, a technical analysis indicates that Netflix has yet to reach overbought territory.

Certainty is never a given in the financial markets. Nonetheless, Netflix's stock seems poised for additional gains!

This content was originally published on Gurufocus.com