- Netflix's stock price has soared in 2024.

- The company's new account-sharing policy is behind the bullish sentiment.

- Going forward, expectations are high for sustained growth in new subscribers.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Netflix (NASDAQ:NFLX) stock has soared over 26% year-to-date, extending the bullish trend that began in mid-2022, although the journey wasn't without its ups and downs.

All eyes are now on the company's quarterly results coming out after today's trading session, which will be crucial for determining if the stock can maintain the uptrend.

Beyond traditional metrics like earnings per share and revenue, investor focus will also be on new subscriber numbers. Here, Netflix saw a significant jump in Q4 2023 thanks to its new account-sharing policy.

However, it's important to remember that broader economic factors – particularly the Federal Reserve's potential decision to hold interest rates high into early 2025 to combat disinflation – could pose a challenge for the overall market, including Netflix.

Netflix's Password Sharing Crackdown Is Working

Netflix's gamble to restrict password sharing appears to be paying off. Since implementing the policy, subscriber numbers have surged as anticipated.

In Q4 2023 alone, Netflix added a whopping 13.1 million new subscribers, bringing the total to 260.8 million, a healthy 12% increase quarter-over-quarter.

This move has solidified Netflix's position as the streaming leader, widening the gap between them and competitors like Disney+ and Amazon (NASDAQ:AMZN) Prime.

Most forecasts point to this positive trend continuing into Q1 2024, potentially exceeding the 1.75 million new users acquired in the same period last year.

These figures strongly suggest that Netflix's new strategy is working. Users seem to be accepting the new rules and haven't abandoned the platform.

The company's increased focus on ad-supported revenue is also contributing to the positive financial picture.

Focus Now Shifts to Earnings

Traditionally, earnings per share and revenue are the key metrics for gauging positive, negative, or neutral performance.

Here's a breakdown of what to watch for in Netflix's upcoming earnings report:

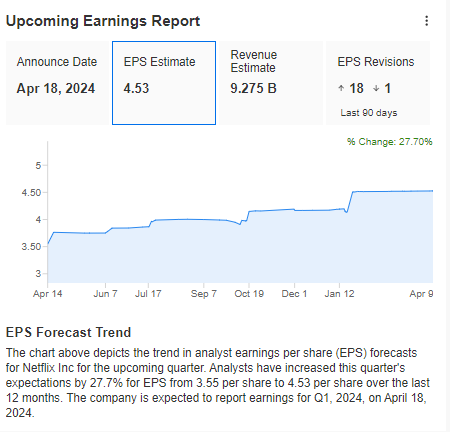

Source: InvestingPro

The bullish sentiment is further fueled by the fact that analysts have overwhelmingly revised their earnings forecasts upwards – 18 revisions higher with only one downward revision.

The importance of these quarterly results is underscored by investor reactions to the past two reports, which triggered 10%+ rallies each time.

Source: InvestingPro

Netflix Stock: Technical View

Similar to the broader NASDAQ, Netflix's stock price has seen its gains slow down since early March, forming a consolidation pattern. Today's earnings report will be a key catalyst, potentially triggering a breakout in either direction.

Bullish Scenario: A positive earnings surprise could fuel a bullish breakout, potentially reaching new all-time highs of around $700 per share.

Bearish Scenario: Disappointing results could spark correction, with bears targeting initial support in the $570-$580 per share range.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.