Shares of Nike Inc. (NYSE:NKE) plunged nearly 20%, their worst day on record, after the company cut guidance for the first quarter and fiscal 2025. This drop adds to recent struggles for the stock as shares have delivered a total return of roughly -33% over the past year. Comparably, the S&P 500 has delivered a total return of around 27%.

The athletic apparel and footwear company's recent struggles have been driven by a number of factors, including cost pressures due to inflation, weakness in China and increasing competition. Intensifying competition is especially problematic as it suggests the moat around Nike's business has narrowed, which could weigh on margins and revenue growth over the long term.

Despite recent challenges, the stock continues to trade at a premium to peers and the broader market. For these reasons, I continue to view the stock as overvalued despite the recent drop.

Earnings miss and guidance cutNike reported fiscal fourth-quarter 2024 results on June 27. Quarterly revenue came in at $12.6 billion, down 2% on a year-over-year basis. Adjusted earnings per share came in at $1.01, which was slightly better than consensus estimates.

However, the most significant part of the earnings release was the cut to guidance. Nike expects first-quarter 2025 revenue to be down approximately 10% on a year-over-year basis. This represents a significant miss versus previous expectations for a drop of 3.20%. Moreover, Nike also cut its full-year guidance. The company projects a revenue drop in the mid-single digits for 2025, down from a prior expectation for growth. the company blamed its subdued outlook on a number of factors, including a stronger U.S. dollar, weakness in China and aggressive actions to rebalance its product portfolio.

Nike's wide moat appears to be narrowingWhile Nike did not mention increased competition in its guidance cut, I believe it is a factor. The global footwear business, which is the company's largest business, accounting for approximately 67% of total sales, posted a roughly 4% year-over-year decline in sales to around $8.20 billion. Sales dropped 2% on a constant currency basis. Comparably, key competitors have been reporting better results. For instance, On Holdings (NYSE:ONON) reported record revenue in the most recent quarter with sales up 29.20% on a constant currency basis to 508.20 million Swiss francs ($565.18 million). On Holdings expects full-year 2024 sales growth of 30%. Deckers (NYSE:NYSE:DECK) reported that revenue for its Hoka brand increased 34% on a year-over-year basis to $533 million during the most recent quarter. Nike's largest competitors in the global footwear business, Adidas (ETR:ADSGN) (XTER:ADS), reported first-quarter 2024 footwear revenue growth of 13% on a currency neutral basis.

The gains seen by Hoka, On and Adidas appear to be coming at the expense of Nike, suggesting the legacy company might be losing its edge in terms of innovation. While it remains the dominant brand in the athletic footwear business, the recent divergence between its sales growth and those of its competitors suggests Nike's moat is narrowing as its products are losing market share.

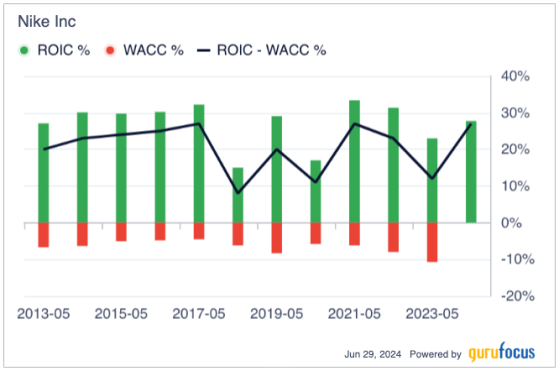

Historically, Nike has enjoyed a wide moat around its business, driven by a strong brand that has given it pricing power despite operating in a highly competitive industry. Additionally, the company has been able to consistently generate strong margins due, in part, to its scale and dominance of the footwear business. As illustrated in the chart below, Nike has historically generated very strong returns on invested capital. However, the company may be forced to offer better prices in order to more aggressively compete with On and Hoka. While Nike currently expects gross margin expansion of 10 to 30 basis points for fiscal 2025, increasing competition may result in a more challenging pricing market and, therefore, worse-than-expected gross margins.

A recent survey suggests Nike's brand is losing traction relative to peers more broadly. In particular, the company appears to be losing ground in China relative to key rival Adidas. While the Nike brand is still viewed favorably overall, the loss of ground on a relative basis is a concern as its brand image is the key to the moat around its business.

Unattractive valuation relative to the broader market and peersDespite the recent drop, Nike currently trades at 27 times consensus fiscal 2025 earnings. Comparably, the S&P 500 trades at roughly 22 times forward earnings. Given the company's muted near-term growth prospects, I do not believe this premium is warranted. Currently, consensus estimates call for Nike to post a 7.30% decline in earnings per share for fiscal 2025, followed by 10% growth in earnings per share for fiscal 2026. Comparably, the S&P 500 is expected to grow earnings by 11.30% in 2024 and 14.40% in 2025.

In addition to trading at a premium to the broader market, Nike is trading at a premium to peers such as Lululemon (NASDAQ:LULU) and Skechers (NYSE:SKX), which trade at 21 and 17 times forward earnings.

Moreover, these peers are also growing faster, with Lululemon expected to post earnings per share growth of 12.20% and 11.30% over the next two years, while Skechers is expected to grow earnings per share by 17.50% and 18.30% over the same period. On Holdings and Deckers, which trade at 35 and 31 times forward earnings respectively, trade at a premium to Nike but are expected to grow earnings much more rapidly over the next several years. Moreover, On Holdings and Deckers are much smaller companies and thus, have a longer growth runway than Nike.

Wall Street downgrades The significant drop in price has not stopped Wall Street analysts from downgrading the stock. A number of key firms, including JPMorgan (NYSE:JPM), Morgan Stanley (NYSE:MS), UBS and others downgraded the stock to neutral or hold following the company's first-quarter earnings report.

The wave of downgrades suggests Wall Street analysts do not believe the company is likely to deliver a turnaround anytime soon. Moreover, the fact these analysts have downgraded the stock to hold rather than sell or underweight suggests additional downgrades are likely if the company continues to deliver weak results.

CEO change would be a positiveOne potential upside catalyst for Nike shares would be the replacement of CEO John Donahoe. Since his appointment in January 2020, Nike's stock has delivered a total return of approximately -22%. Comparably, over the same period, the S&P 500 achieved a total return of about 77%, while competitors such as Lululemon and Skechers delivered total returns of roughly 22% and 63%. Donahoe was a proponent of Nike's Consumer Direct Acceleration (CDA) plan, which has failed to deliver. While cost cuts have helped stabilize margins, cost savings may have also led to a lack of innovation.

While Donahoe appears to still have the support of Nike founder Phil Knight, some Wall Street analysts have suggested a leadership change could be coming. I believe a leadership change would be viewed positively by the market as a new CEO may be able to refocus the company's attention to innovation and help revive the brand to keep up with competitors.

Conclusion Nike shares recently experienced their biggest decline since becoming a public company. Despite this drop and lackluster performance over the past several years, the stock continues to trade at a valuation premium to the broader market.

Increased competition from new brands in the footwear business is an especially concerning development for bulls as it suggests the moat around Nike's business is narrowing.

For these reasons, I view the stock as overvalued at current levels and not an attractive investment.

This content was originally published on Gurufocus.com