- Bank of Japan raises upper range of 10-year government bond yields to 1%

- Inflation remains high but not high enough for BOJ officials

- Meanwhile, Nikkei225 could still target new all-time highs

Last week, the Bank of Japan shocked markets by deciding to raise the yield curve tolerance range of the Japan 10-Year Treasury bond yield to 1%. This marked a significant step towards reversing years of ultra-accommodative monetary policy. However, Bank Governor Ueda emphasized that this move is just a correction, and their main focus remains to achieve sustained inflation.

If their words hold true in the coming months, the overall situation is unlikely to change, and the Japanese yen will continue to face selling pressure. As for Japan's main stock market index, Nikkei 225, not much has changed. It's probably going through a correction phase but still has the potential to continue its upward trend.

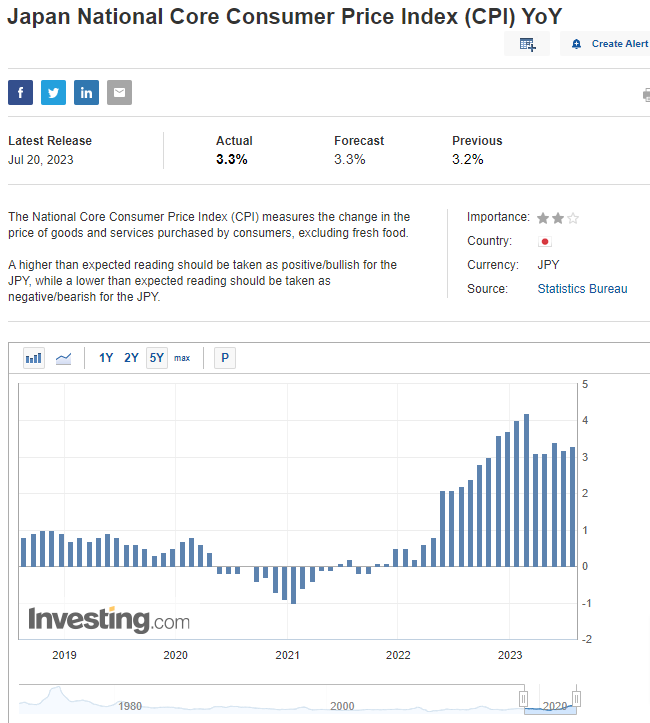

Over the past few decades, Bank of Japan officials have been worried about the persistently low inflation, occasionally dipping into deflationary territory with a few isolated spikes above 2%. With the outbreak of war in Ukraine, the rising global price dynamics have also affected Japan, leading to the highest levels of inflation in over 40 years.

Currently, both headline CPI and core remain above the inflation target, and the BOJ board has legitimate concerns that this might only be a temporary situation based on recent years' patterns.

Considering forecasts, although the median for 2023 was raised to 2.5% from 1.8%, the projections for 2024 were revised downward to 1.9%. This shows that with the stabilization of prices in global markets, the specter of disinflation or even deflation is real, so the BoJ's ultra-dish policy should be maintained despite Friday's revision.

Nikkei: All-Time Highs in Sight?

The continuous printing of yen to buy securities is one of the main drivers of the Japanese stock market, where a wide stream of newly created currency is flowing into markets. Currently, the index is undergoing a local correction and forming a flag pattern, providing grounds for the upward trend to continue.

In the event of an upward breakout and successful penetration of the 33,000-point level, it would generate a bullish signal, potentially leading to a retest of this year's highs.

Unlike many European or U.S. indexes that have recently made new all-time highs, the Nikkei faces a significant resistance level at its previous peak of around 39,000 points, established in late 1989 and early 1990.

This level serves as a crucial medium-term target, and if the Bank of Japan continues its accommodative policy despite raising the long-term bond yield's upper range, there is a possibility of attaining it later this year.

USD/JPY Remains in an Uptrend

Regarding the USD/JPY currency pair, the uptrend remains intact. Despite a somewhat hawkish move by the BOJ and a dynamic corrective phase, the exchange rate between the U.S. dollar and the Japanese yen is still in an overall upward trajectory. The key factor supporting the uptrend was the successful defense of the support zone in the 137-138 yen per dollar price range.

Despite an ultimately hawkish move by the BOJ and a rather dynamic correction, the quotations of the main currency pair with the Japanese yen remain in an uptrend. The key, in this case, was the defense of the support area falling in the 137-138 price area.

The increasing demand suggests that the USD/JPY currency pair is likely to move higher, with the first target around 145 yen. If it manages to break above this level, it could continue rising towards a long-term peak just below 152.

***

Hurry up and enjoy the final day of our InvestingPro summer sale!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are evaluated from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.