The Canadian cash and money market ETF and mutual fund landscape is about to undergo a shift. One of those leading the way is Ninepoint Partners LP, which recently announced a set of significant changes for the Ninepoint High Interest Savings Fund (NSAV).

On August 3rd, 2023, Ninepoint effectively expanded the fund's investment objective and temporarily waived the management fee for NSAV. This allows the Fund to also invest in high-quality money market securities and comes in the wake of recent clarifications around cash-like ETFs announced by the Office of the Superintendent of Financial Institutions (OSFI).

Moreover, until the earlier of June 30, 2024 or the Fund's net asset value (NAV) exceeding $1 billion, Ninepoint Partners will temporarily waive NSAV's 0.14% management fee for the ETF Series, and Series F to 0.00%. The Series A management fee will be reduced from 0.39% to 0.25% under the same terms.

Here's all you need to know about investing in NSAV.

Overview of NSAV

Previously, NSAV invested solely in high interest-paying cash accounts offered by Schedule One Canadian banks, which allowed it to payout monthly interest income. The gross annual yield on NSAV moves in lockstep with prevailing interest rates. As of Jule 13th, the current interest rate for NSAV is 5.39%*

By expanding NSAV's investment objectives to also include money market instruments (like high-quality commercial paper, Bankers Acceptances and Treasury bills), Ninepoint is attempting to get in front of the anticipated upcoming OSFI regulations that may reduce the yield or availability of high interest deposits at Schedule One Canadian banks. This change has turned NSAV into one of the more attractive money market ETFs available on the Canadian market given the fee holiday.

“By expanding the universe of securities available to NSAV to include both high interest deposits and traditional money market type securities, we get the best of both worlds; enhanced flexibility and access to a larger universe of securities to generate low-risk yield for investors.” says Mark Wisnieski, Partner and Senior Portfolio Manager at Ninepoint Partners.

The temporary reduction of the management fee from 0.14% to 0.00% is a rare move in the Canadian industry which may help attract more investors’ capital. This could greatly benefit NSAV, making it the lowest fee HISA/money market fund in the industry during this temporary period.[1]

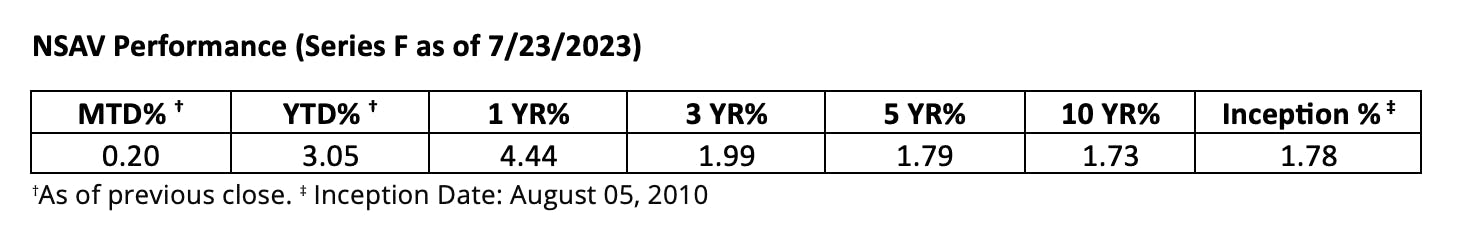

†As of previous close. ‡ Inception Date: August 05, 2010

[1] Trackinsight data as of August 17, 2023

This content was originally published by our partners at the Canadian ETF Marketplace.