by Chaim Siegel of Elazar Advisors, LLC

This Friday we'll get the all-important Nonfarm Payrolls report (NFP). ADP came out yesterday with a barn-burner upside surprise of 263K versus consensus of 187K. But weekly jobless claims in March predict NFP will slow down on Friday. There isn’t a more important economic metric.

It’s a cliffhanger, but we’re leaning bullish. Add to that the Trump-Xi meeting which begins later today, and we think, like other meetings where he talked tough beforehand, Trump ends up being a softy.

If that's correct, look out markets, we’re preparing for liftoff.

Jobless Claims And ADP Both Predict Friday’s Jobs Report

But… This Time They Both Say Something Different

NFP should be a market driver. Many look at all kinds of economic indicators. The two main indicators that the US Federal Reserve focus on are PCE-Price for inflation and NFP for the economy’s strength. All other economic reports are nice, but don’t carry the significance for the economy and stock market like NFP on Friday.

So this Friday’s news now turns into a cliffhanger. Jobless claims, which come out weekly, have typically correctly predicted NFP directionally. ADP has also correctly predicted NFP directionally.

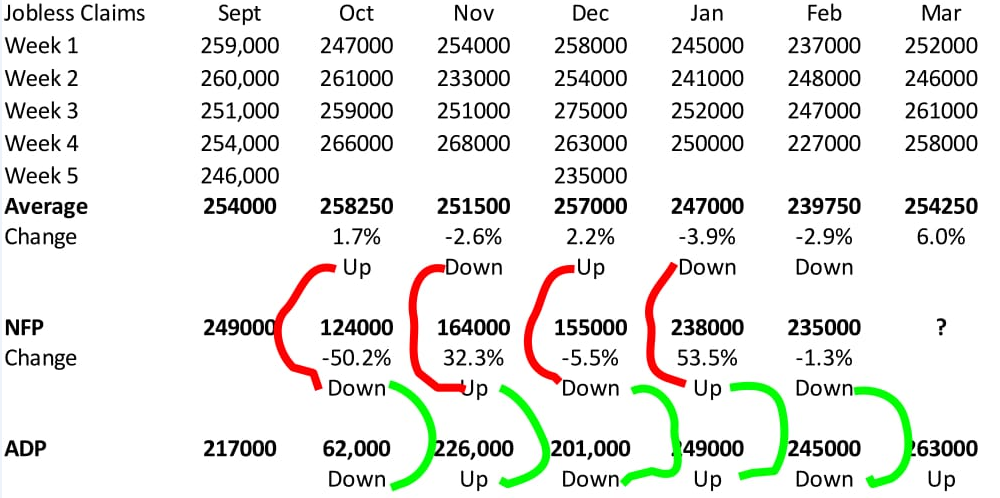

This is the first month in recent history though where ADP and jobless claims have diverged, making Friday a stock market cliffhanger. Don’t worry, the chart below is easier to figure out than it looks at first glance.

This is how the pros predict Friday’s all-important NFP number.

Jobless claims are inversely related to NFP. You can see that when the month’s jobless claims average goes up from the previous month, NFP goes down (red semi-circles).

ADP however is directly related to NFP. You can see that when ADP goes up or down from the previous month, NFP tends to follow (green semi-circles).

This month though, you can see average jobless claims are up for March which predicts what? Down NFP...very good.

On the other hand ADP is up, predicting what? Up NFP...well done.

So, one predicts up while the other predicts down.

What’s Your Call For Friday Then?

We have a Friday cliffhanger. But we're bullish.

Since ADP got it right last month and jobless claims didn’t, we’re going with ADP this month. If correct we expect the stock market—including the S&P 500, SPY, Dow, DIA, NASDAQ, QQQ, the Russell 2000 and IWM among others—to have a bullish outcome.

Presidential Tweet Expectations

If the NFP release manages to print a good number we expect bullish Trump tweets. If not, we expect silence or rumors that Obama tinkered with the math.

Trump – Xi Meeting: Could Be Incredibly Bullish

President Donald Trump meets with Chinese President Xi Jinping at President Trump’s Florida resort today. We expect this to end up being bullish for markets as well.

If we rewind back to Trump’s golf outing with Japan’s PM Shinzo Abe two months ago, Trump previewed tough but finished soft. We expect a similar outcome with President Xi.

Ahead of the golf outing with PM Abe, Trump was calling Japan currency manipulators. When the outing was finished, the two leaders promised a historic collaboration.

If that’s the trend, this Trump-Xi meeting could be as bullish as you get for geo-politics. There was no bigger risk to the Trump presidency then his tough talk on China throughout his campaign. He called China currency manipulators, threatened trade sanctions, tariffs and law suits. If Trump flips like he did with Japan, then this major risk disappears and markets can breath a big, bullish sigh of relief.

And that would likely mean up-markets.

Add That To The Opportunity We Received Late Yesterday From The Fed Minutes

The market made a fast move late in the day yesterday, in reaction to the release of the FOMC meeting minutes. The Fed minutes said:

"A change to the Committee's reinvestment policy would likely be appropriate later this year."

We don't view this as "new" news because NY Fed President William Dudley already publicly previewed this fact. The Fed also appeared to signal that they are leaning toward a gradual reduction in reinvestment which means they will still be in the market buying, only less so.

Also, the Fed has ultimately reacted much differently than they often predict, so we can't be sure if this will actually take place later in the year.

Putting this into context alongside today's Trump meeting and tomorrow's jobs news, it may set up as a great buying opportunity if both events end up positive tomorrow.

Markets: Where Are We?

Let’s put it all together for Friday. In case you didn’t notice, thanks to the storm of bearish media reports, we’re inches away from fresh all-time highs.

If on Friday we in fact get the combination of a cordial Trump-Xi meeting and strong jobs number—in unison—this market could easily push up through new record highs.

In fact, right now, I feel like a flight attendant: “Market participants please buckle up and prepare for lift off.”

Disclaimer: ETFs reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this article may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.