-

Post (NYSE:POST) the Fed's dovish-leaning meeting, stocks, gold, and bonds surged, with yields dipping, prompting speculation about whether the post-Fed rally will last.

-

For the QQQ, attention is on critical support levels like 434.00 and 439.00, which have acted as strong floors amid recent market volatility.

-

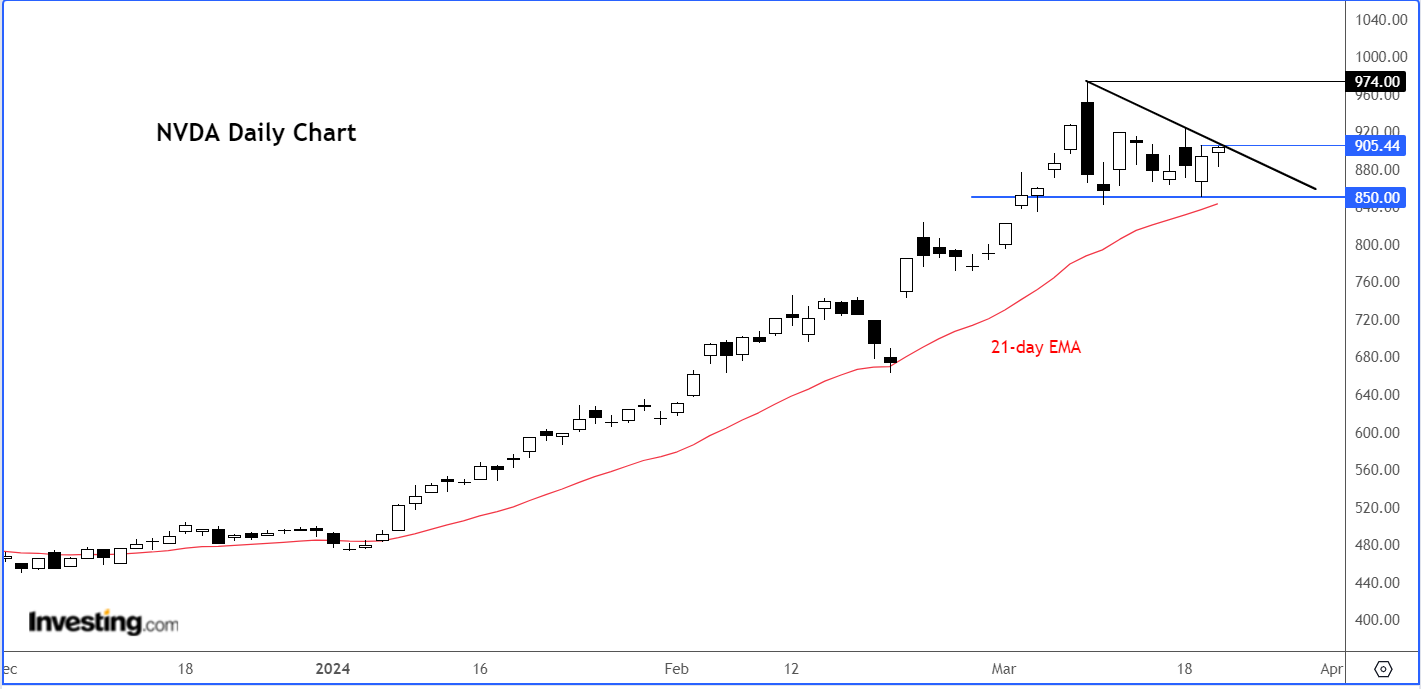

Nvidia's stock is approaching a pivotal point around the $905.00 area, where breaking resistance could signal a new record high, while failure to do so might indicate a bearish trend reversal.

-

Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Following the Fed’s dovish-leaning policy meeting on Wednesday, we saw stocks, gold and bonds all surge higher, causing yields to dip.

Today we will see whether those moves have further legs to run or whether we get the usual post-Fed fade, as traders book profit.

As the bull market rages on, don't miss out on the best AI-powered stock selection in the market. For less than $9 a month, you can have a monthly selection of 100+ winners for sustained market outperformance.

Subscribe now and never miss another bull market again by not knowing which stocks to buy and sell!

*Readers of this article get an extra 10% off on all plans using my exclusive OAPRO1 coupon at checkout.

Futures Extend Gains

Index futures managed to extend their gains and some European indexes like the DAX opened in fresh unchartered territories, before pulling back.

We also saw gold prices jump to a new high during the early Asian session, before easing somewhat amid profit-taking and as investors made a more sober assessment of the Fed’s assessment of interest rates.

The FOMC maintained interest rates unchanged for the fifth consecutive meeting on Wednesday, reiterating its stance of waiting for stronger confidence from the inflation data before considering rate cuts.

The key takeaway was that despite recent high inflation readings, the Fed's statement suggests an inclination towards future rate reductions, indicating a potential shift in monetary policy.

Contrary to analysts’ prior expectations, the Fed still expects three rate cuts for this year, but now is more cautious about 2025 cuts.

However, the recent hot core inflation readings and strong performances of some key commodity prices like crude oil and especially cocoa could lead to inflation remaining higher than expected.

This will prevent the Fed and other central banks from being able to ease their policies in the way they envisage.

While the markets remain buoyant for now, and as traders, we have to go with the flow until the charts tell us otherwise. Let's take a look at Nasdaq and QQQ) charts to gain further insight regarding our next moves.

QQQ technical analysis and trade ideas

Following Wednesday’s FOMC decision, the major US indexes rallied with the S&P 500 hitting a fresh record high.

The Nasdaq almost got to a fresh unchartered territory too but fell short. However, given the bullish price action, it appears like a new record could potentially be hit for the tech-heavy index, possibly as early as today.

As per the chart of Invesco QQQ ETF, which tracks the Nasdaq 100 Index, it broke above the bearish trend of its triangle consolidation pattern that had been for about one and a half weeks.

It climbed back above the 21-day exponential moving average in the process to provide a fresh objective signal indicating that it has regained its strong short-term bullish momentum.

The latest rally comes as QQQ held key support around 434.00, which has provided a floor since February 22. This level is now the line in the sand insofar as the short-term bullish trend is concerned.

While above it, the path of least resistance would remain to the upside even if we see a small pullback in the days ahead.

There’s also an additional level of support at 439.00, which marks Tuesday’s high and the base of Wednesday’s FOMC-related rally.

Ideally, the bulls would not like to see the index go back below this level, before a fresh break to a new high above the record 448.64 level that was hit a couple of Fridays ago.

Is Nvidia about to break higher again?

Whether the Nasdaq can go to new highs and remain above the support level will depend pretty much on the big tech stocks, none more so than Nvidia (NASDAQ:NVDA).

The Nasdaq’s recent consolidation has coincided with NVDA also doing the same thing. That big bearish engulfing candle that formed on Friday, March 8 is still playing at the back of traders’ minds.

It could potentially be a sign that the stock may have topped. However, what is lacking is bearish follow-through.

Bullish traders have managed to chip away at that engulfing candle and now around half of that day’s losses have been made back, suggesting that investors are still not too worried about its overstretched valuations, etc.

Anyway, let’s see if NVDA will break its bearish trend line and resistance around the $905.00 area today and hold there.

If so, then we could well see a run to a new record on NVDA and a continuation of the rally in the Nasdaq.

Key support comes in at $850.00, the pre-FOMC low. A potential break below this level would be a bearish outcome, not just for NVDA but for Nasdaq too.

What is QQQ?

Invesco QQQ ETF is designed to track the performance of the Nasdaq-100 Index.

It has a big exposure to the technology sector and other non-financial companies listed on the Nasdaq. The fund and the index are rebalanced quarterly and reconstituted annually.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.