After a dismal start to the year, shares of NVIDIA (NASDAQ:NVDA) seem to be regaining last year's bullish momentum. The Santa Clara, California-based chipmaker jumped about 13% during the past month, becoming one of the best-performing chip stocks this year. NVDA closed Tuesday at $259.31.

This rally for NVDA shares comes amid a broad sell-off in technology stocks that cut NVIDIA's market cap by 11.8% year-to-date. As investors remain concerned about rising inflation and ongoing supply chain bottlenecks, stocks with nose-bleed valuations like NVIDIA—formerly market darlings—are likely to remain volatile.

However, despite the current macro environment, there are many indications that the semiconductor giant is on track to produce impressive growth.

At its Mar. 22 Investor Day meeting, NVIDIA told investors it remains focused on developing new products and technology, particularly in artificial intelligence processing and speedier data-center chips.

Furthermore, the company's graphics chips based on the new "Hopper" design will debut later this year. According to a report in Bloomberg, these processors will massively speed up the development of software that understands human speech and is used for genomic research.

50% Revenue Growth

Some of the world's largest data centers, run by Amazon (NASDAQ:AMZN), Alphabet's (NASDAQ:GOOGL) Google Cloud, and Microsoft's (NASDAQ:MSFT) Azure, use NVIDIA's technology to power the artificial intelligence software needed to make sense of the growing flood of digital information.

NVIDIA has averaged more than 50% revenue growth over the last nine quarters. That performance has helped make it one of the top 10 companies by market value on the S&P 500. And that's made NVDA one of the most loved chip stocks.

Over the past five years, the company has consistently topped analyst estimates for earnings and has beaten Street revenue estimates for 11 consecutive quarters, including in its latest earnings report.

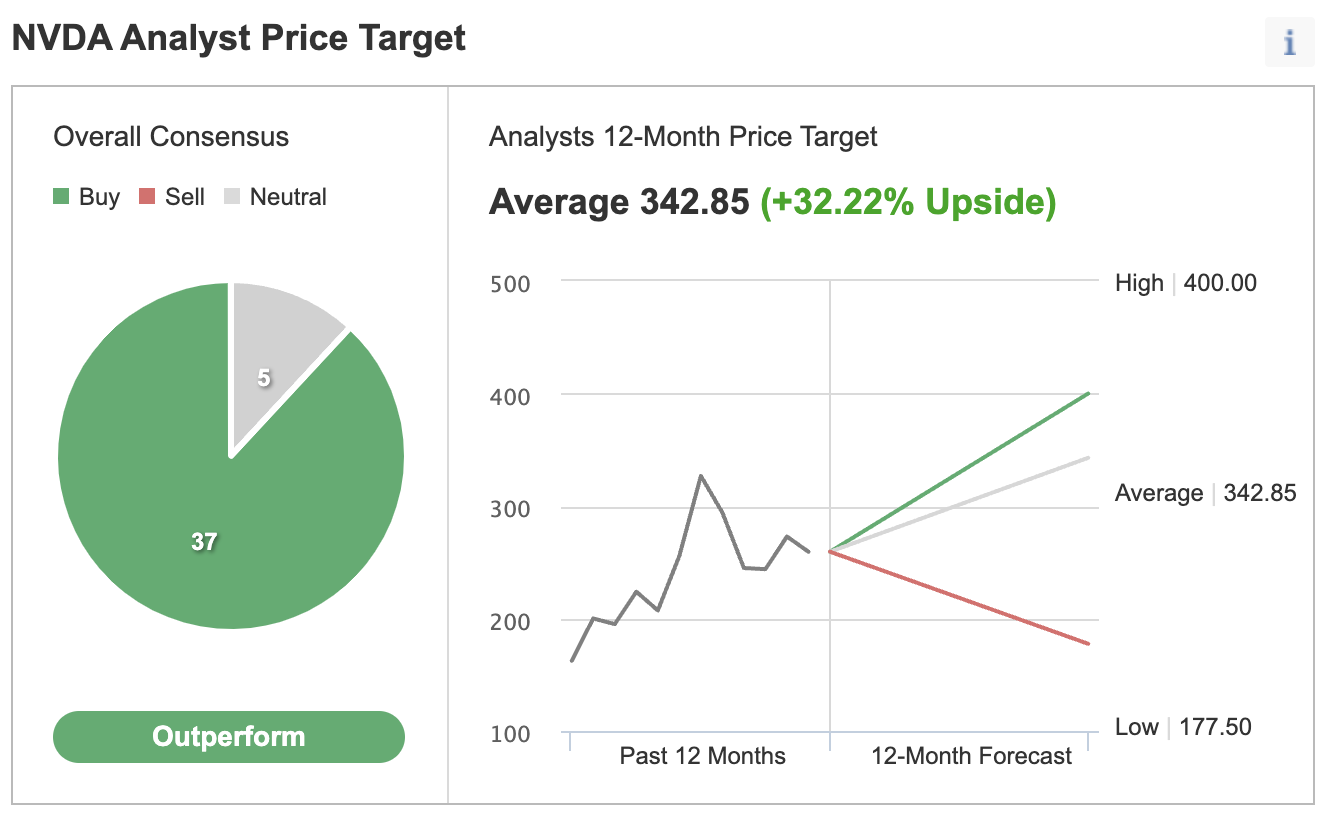

Due to this impressive track record, most analysts continue to rate NVDA favorably. In a poll of 42 analysts conducted by Investing.com, 37 gave the stock a buy rating with a consensus 12-month price target of $342.85, implying a 32.2% upside potential from the current market price.

Source: Investing.com

Bank of America, in a recent note, cited NVIDIA as one of the best semiconductor stocks to buy. According to its note, companies tied to cloud sales and artificial intelligence industries should continue to see massive growth.

In a recent note to clients, Citibank said it sees several positive catalysts for the chipmaker in 2022, including a strong holiday gaming season, solid data center demand trends, and gaming/networking supply improvements in the second half of this year.

Bottom Line

The recent rally in NVIDIA shares indicates that it's one of the best chip stocks to keep on your buy-on-the-dip list in the current volatile trading environment.

With solid growth momentum, NVIDIA will likely produce yet another impressive earnings report next month, showing the company's remarkable mix of growth and profitability.