Meta Platforms surges in afterhours after delivering blowout Q2 results

Stocks finished mostly lower as Nvidia (NASDAQ:NVDA) reported earnings results. The S&P 500 fell by 0.6%, while the Nasdaq 100 declined by approximately 1.2%.

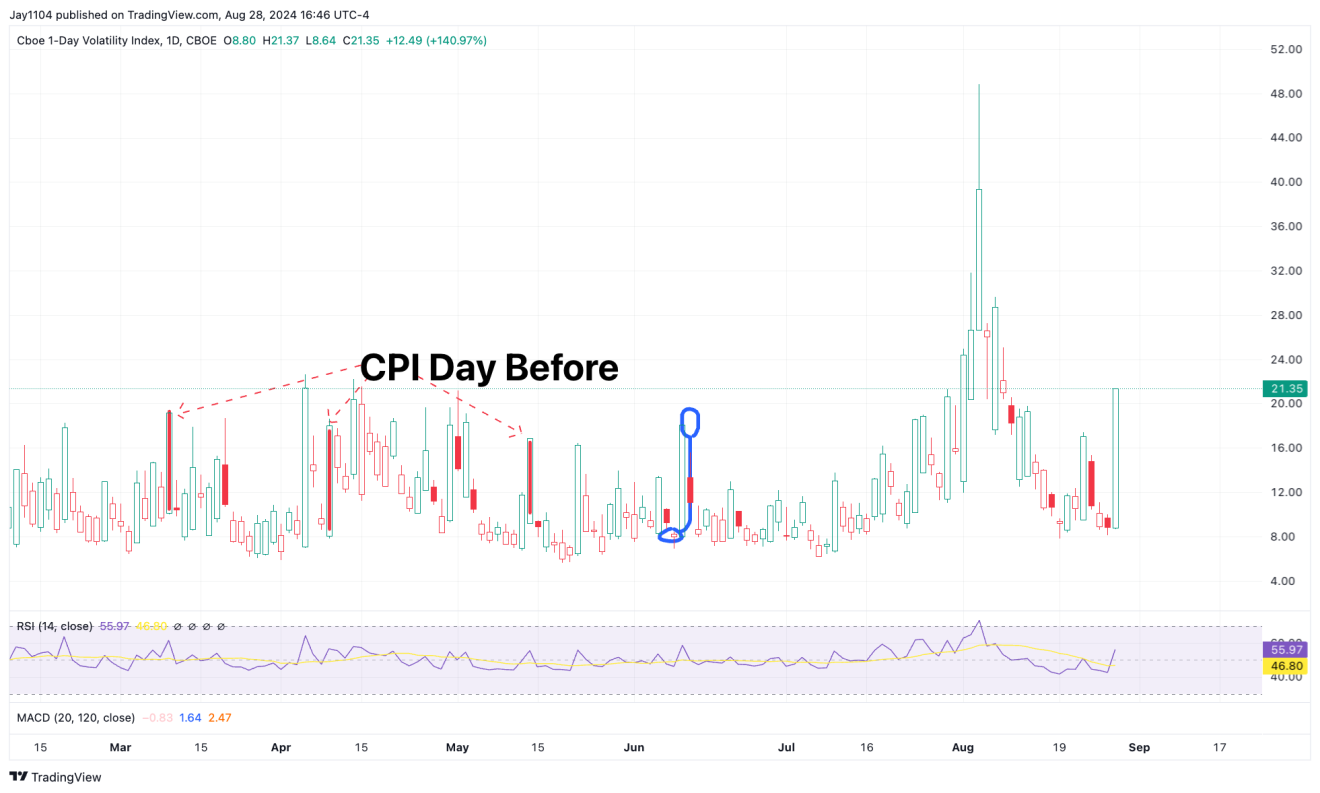

The market’s movements were primarily driven by nervous anticipation surrounding Nvidia’s results, as evidenced by the VIX 1-Day climbing above 21.

It appears that Nvidia’s earnings have taken on the significance of a Fed meeting, jobs report, or CPI release.

Nvidia Tops Expectations, Stock Drops

Speaking of Nvidia, the company reported—no surprise—$30 billion in revenue and guided the street to $32.5 billion for the next quarter. It seems they’re living on the edge with that extra $0.5 billion in the guidance.

That makes five quarters in a row where they’ve beaten guidance by $2 billion and raised the next quarter’s guidance by $4 billion. I can’t say I’ve seen that before.

So, I guess for next quarter, we should expect $34.5 billion in revenue and guidance of $36.5 billion—give or take 2%, of course.

(BLOOMBERG)

That has the stock trading down about 6% as of right now. Technically, there is some support around the $118 level. However, it also appears that the stock has completed a diamond reversal top, which could suggest a further decline beyond the $118 level, potentially back to the gap around $109.

The same pattern is evident in the S&P 500 futures contracts, presenting an opportunity to unwind much of the gains from the past few weeks.

The one factor that could potentially disrupt this is a reset in implied volatility (IV) today at the opening, as the VIX 1-Day returns to earth.

Finally, the yield curve continued to steepen yesterday and is now at -0.03%, with much further to climb.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI