Many investors were questioning whether Nvidia Corp.'s (NASDAQ:NVDA) valuation was sustainable a month ago. My sentiment was that a correction was due, and this has already happened.

Despite the long-term growth outlook for the company remaining strong, there is a considerable likelihood of further downside, presenting an undervaluation for the stock over the next six to 12 months. As a result of this analysis, Nvidia is currently a long-term buy but could potentially become a strong buy in 2025 if the stock drops further and becomes undervalued.

AI capex slowdown concerns and future trendsDespite Nvidia's recent $900 billion market value decline, major tech companies such as Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Meta (NASDAQ:META) continue to invest heavily in artificial intelligence infrastructure, which is crucial to its long-term growth sustenance. That being said, there is now growing consensus that the AI capex is not sustainable, including questions arising related to the return on investment in the short to medium term. This is likely to induce periods of market panic and open up undervaluations among major AI companies. Nonetheless, the AI infrastructure market could reach a trillion dollars of investment over the next five years if current trends continue.

Nvidia is likely to continue to capitalize on rapid advancements in AI and machine learning, impacting robotics, including the integration of generative AI for intuitive robot programming, predictive maintenance and the rise of collaborative robots working alongside humans. The company is actively supporting these developments through its Isaac robotics platform, which is facilitating the adoption of AI-enabled autonomous machines by industry leaders. I believe this is going to be the next big wave for Nvidia's growth when AI meets the physical world more acutely.

Despite my bullishness, Nvidia is a chip company, and semiconductor stocks are usually cyclical. I estimate that its position in the long-term AI boom will be no different, with periods of high growth and periods of lower growth. The company's growth over the past two years has been fueled by the surge in AI, but as the market matures and the bulk of the data center buildout is fulfilled, it is likely to meet slower growth in data center GPU sales. This is why my long-term thesis related to robotics is of paramount importance for investors buying in at the present valuation, as it could help to sustain Nvidia's growth somewhat.

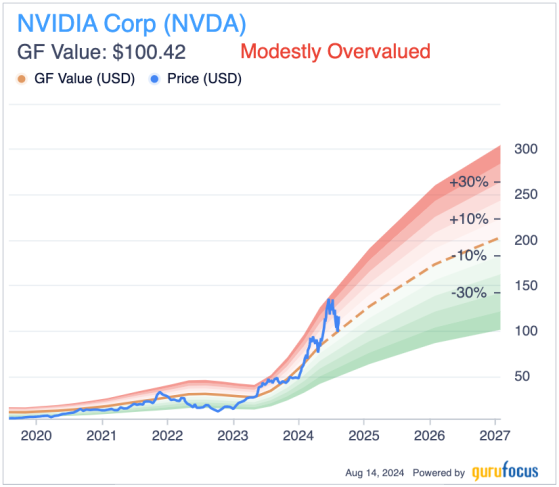

Fair valuation, sentiment analysis and one-year price targetThe GF Value Line currently shows Nvidia to be modestly overvalued and, while I think this is accurate, I also believe the market could drive the stock into undervalued territory based on bearish sentiment in the market that could grow surrounding AI momentarily.

Nvidia currently has a forward price-earnings ratio of 45.50, which is reasonable to me despite a high trailing 12-month price-earnings ratio of 68. The price-sales ratio of 36.30 is far higher than its 10-year median of 13.40. I believe the price-sales ratio is one of the biggest concerns with the company's valuation, which is worth noting and explains why there is some likelihood of further downside to come based on sentiment factors moving into 2026 when fundamental growth rates are estimated by Wall Street to be lower.

To outline this more specifically, Wall Street predicts Nvidia will achieve 110% earnings per share growth in 2025, but only 38% in 2026. Therefore, a sentiment shift is definitely warranted. While a correction down 15% may seem to fulfill this sentiment shift, the market could potentially continue to price the stock lower over the coming quarters.

A one-year price target based on the GF Value Line would be roughly $150. However, I think there is a significant chance of this not being achieved due to the market sentiment factors I outlined above. I believe the price target of $200 at the calendar 2027 start, also indicated by the GF Value chart, is, in practice, more likely to be achieved than the calendar 2026 start price target of $175.

In other words, I think the probability of significant volatility ahead is likely despite good fundamental growth continuing. As a result, Nvidia is a buy based on a medium-term horizon, but should be held at a small allocation to mitigate the downside risk of sentiment and valuation factors.

Robotics growth concerns, competition risks and long-term market contraction risksDespite the potential in robotics that will help Nvidia sustain growth after the initial AI infrastructure build-out, the robotics market is not expected to be as large as the AI market (at least initially). That being said, AI's occurrence was largely unpredicted by most people and large growth forecasts appeared quickly. Therefore, the company has the potential to position itself to capitalize on what could be massive growth in robotics, which is currently potentially underestimated by analysts as most of the focus is on AI. At present, the robotics market could be worth $200 billion by 2033, based on a report from GlobalData, but AI is expected to achieve a trillion-dollar investment. Therefore, the difference between both industries in the consensus view is currently stark. It is also worth noting that AI is the foundation of robotics, as well as other information-based automation, like SaaS enhancements; this is fundamental to why AI is a much larger industry than robotics.

The AI market is now also becoming diverse and saturated by more players. AMD's (NASDAQ:AMD) MI300X chip is targeted at large language model training and claims to outperform Nvidia's offerings in certain aspects. Cerebras is introducing new architectures, such as wafer-scale engines, that offer high memory bandwidth, which is gaining traction in pharmaceutical research and large language models. Furthermore, major cloud service providers, including Google, Amazon and Microsoft, are developing their AI chips for internal use, potentially reducing reliance on Nvidia's products. AMD and Intel (NASDAQ:INTC) are part of the UXL foundation, which is aiming to create free alternatives to the company's CUDA software ecosystem, a key competitive advantage for Nvidia.

Overall, the near-term future for the stock looks quite unpredictable and unstable, in my opinion. Some analysts are suggesting Nvidia could encounter a Cisco (NASDAQ:CSCO) moment from the year 2000 when its stock dropped dramatically in price after the dot-com boom. Despite the possibility of this, I do not think the decline will be as pronounced. As I mentioned, I think Nvidia could continue to decline in price in the short term but also potentially reach new highs within a couple of years as ity capitalizes on robotics trends and continued AI capital expenditures. There is likely to be a contraction in valuation multiples, but a forward earnings multiple of 45 does not seem unreasonably high to me. The AI infrastructure build-out is much more tangible in many respects than the dot-com boom was. As a result, Nvidia is a buy at these levels, but likely a strong buy if the price falls further over the next few quarters.

Second-quarter earnings implicationsNvidia posts its second-quarter earnings on Aug. 28. If the company beats expectations and raises its guidance, this could be an inflection point that sees its shares climb higher. On the other hand, if the company reports an earnings miss and lowers guidance, I believe the opposite could happen and the stock could fall in price on fears of downward momentum and further contraction in fundamental growth expectations to come.

That being said, the major players have all said that they are scaling their AI infrastructure investments and expect the capex in fiscal 2025 to be higher than in 2024. This bodes well for Nvidia this year, in my opinion, and I am more bullish than bearish on the stock in the near term. Despite what happens with earnings, I think it is a long-term buy.

ConclusionNvidia is currently in buy rating territory, but there is the potential for further downside to occur. Despite this, the GF Value Line indicates the stock is currently only modestly overvalued. As of the time of writing, shares fell 19% from all-time highs before regaining approximately 10% over the past five days.

I am bullish on Nvidia, but I also think the stock could face downside volatility over the next several quarters. As a result of this and the high valuation, I am still not buying the stock yet, but I might if it becomes undervalued after a potentially unjustified sell-off based on short-term sentiment factors.

This content was originally published on Gurufocus.com