Nvidia Corp. (NASDAQ:NVDA) still has some scenarios where an attractive upside is possible, even after its shares rose more than 160% year to date. However, this scenario is only possible if optimistic assumptions come true, since in more reasonable scenarios, it is possible to find a fair price close to the current one or even a downside.

Combining the possibility of a more modest scenario materializing at some point in the future (even if the next few quarters remain strong and above expectations), with the fact earnings should be cyclical, I believe the stock currently has a narrow margin of safety.

If we consider the company will continue to benefit from this secular trend, there is an upside of just over 20% (bullish scenario). On the other hand, the downside could be of the same intensity (or even worse) if the growth discount rate is slightly reduced and the discount rate increases.

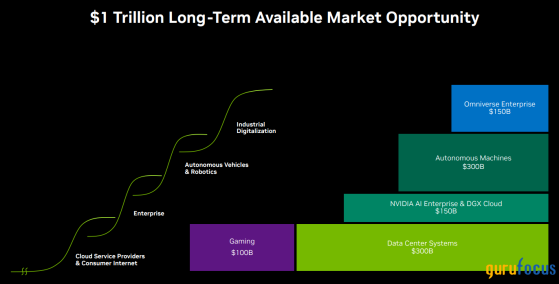

Nvidia has great prospects, but should be cyclicalIt is very easy to find studies that show the bullish prospects for Nvidia. The company itself provides a vision of the $1 trillion long-term available market opportunity, divided between $300 billion in data center systems, $300 billion in autonomous machines and the remainder in other complementary lines such as omniverse, artificial intelligence enterprise and gaming. Just considering this total addressable market, where Nvidia is the leader and has competitive advantages and technological barriers, we would already have justification for drawing up a bullish scenario.

Source: Nvidia Investor Presentation

But we do not need to consider only this information. According to P&S Intelligence, the data center market size by 2030 should reach $622.40 billion, with a compound annual growth rate of 10.10%. Grand View Research believes the U.S. Data Center Market should reach a CAGR of 10.70%, while the global market size will grow at a rate of 10.90% per year over the same period. The Autonomous Robots Market, according to Fact.MR, should have a CAGR of 9.20% by 2033. An even more bullish view is that of Skyquestt, which projects the GPU Market size should reach a CAGR of 33% in the period from 2024 to 2031 due to its diverse application possibilities in a range of sectors, including automotive, aerospace and cryptocurrency, among others.

In short, the increased need for GPUs has become a secular trend. But at the same time, these massive purchases should be cyclical, and this needs to be reflected in the company's projections. In recent years, companies such as Amazon (NASDAQ:AMZN), Meta (NASDAQ:META), Alphabet's (NASDAQ:GOOGL) Google and Microsoft (NASDAQ:MSFT) have substantially increased their capital expenditures. Because they are developing artificial intelligence technology and have relevant cloud infrastructure, they end up being a big part of Nvidia's revenue. In the earnings call, it was mentioned that "public-cloud hyperscalers" still represented close to 50% of all data center revenue.

Source: Koyfin

To illustrate this further, Meta continues to invest billions to buy Nvidia's GPUs and develop its generative AI initiatives. Even if this continues in the short and medium term, at some point the company will have had enough and will want to reduce this capex to increase its free cash flow. In my opinion, this is where Nvidia's main point of doubt lies: after the bulk of capex from the big companies, will occasional technology updates (during card swaps) and penetration into new industries be enough to sustain this level of multibillion-dollar revenue and sustainable growth?

Bullish scenario - 20% upsideFor the bullish scenario, let's consider a high but still feasible growth rate for Nvidia. For example, in revenue for this year, there is similar growth to that seen in previous quarters, and that is indicated in next quarter's guidance. This higher pace starts in 2025 (calendar year) at 20% and gradually declines to 10% in 2030. We might think this revenue CAGR, although high, is achievable, but it would be necessary for the Data Center segment to remain strong for a few more years, capturing new industries and with Nvidia unlocking new revenue lines to sustain this growth.

In this scenario, we also consider margins to be high, with a slight normalization of the gross margin, which falls to 76%, a level that is still very robust. This correction in the gross margin is more than offset by possible (even greater) gains in scale and efficiency, with selling, general and administrative as well as research and development costs gradually reducing compared to revenue, so that the Ebitda margin continues to expand. With this, we have the following projected income statement for the coming years:

Source: Nvidia and Author's projections

In addition, the cash flow assumptions considered a capex of -2% of revenue, decreasing to -1.50% in 2027 and a variation in working capital that reduces cash generation by about $800 million per year. Assuming a growth rate of 5% in the terminal stage of this cash flow, we have a fair price of $156 for Nvidia. But note this fair price, in addition to all these optimistic assumptions, still depends on a discount rate of 8.41%, implying an equity risk premium of 2.50%.

Source: Nvidia and Author's projections

Base scenario - 24% downsideSlightly modifying the assumptions to make the scenario more reasonable, revenue growth from 2026 onwards was slightly reduced, with the company achieving 8% growth per year from 2030 onwards. The other margin assumptions with gradual progress were maintained. As a result, 2030 Ebitda falls from $184 billion to $168 billion. Based on this, we have the following projected income statement for the coming years:

Source: Nvidia and Author's projections

Maintaining the other cash flow assumptions, but reducing terminal stage growth from 5% to 4.50% and increasing the equity risk premium from 2.50% to 3.50%, we have a discount rate of 9.40% and a fair price of $98 for Nvidia, which would imply a downside of 24%.

In my opinion, a 24% downside seems very pessimistic, but the assumptions that justify this fair price are not so bad since, in reality, a relevant growth in revenue has been maintained, the high margins have been maintained, a certain perpetuation of growth has been maintained and a discount rate consistent with the reality of the market has been applied.

Of course, being a premium company and one that the market rewards a lot, a lower discount rate may make more sense given the possibility of positive surprises in conjunction with Nvidia's relevance to today's technology segment. But the opposite is also true since the current valuation leaves little room for negative surprises.

Final thoughtsAs shown above, in a DCF model with optimistic assumptions, it is still possible to find an interesting upside for Nvidia. This, coupled with the quality and competitive advantages, can serve as a bullish argument to justify exposure to the stock.

I believe the company deserves a premium valuation, rewarding not only its recent high growth and competitive advantages, but also its very interesting prospects, which are one of the most robust trends today.

But this also comes at a price: Nvidia should be able to continue surfing the growth of its markets, but this does not leave it immune from a cyclicality that may eventually arise, especially if the big tech and cloud companies reduce their capex without compensation from new industries.

As a result, Nvidia's shares are currently at a level where there is a strong dependence on this momentum continuing to justify the rich valuation since a good part of the thesis' value lies in the growth it will have over the years.

This content was originally published on Gurufocus.com