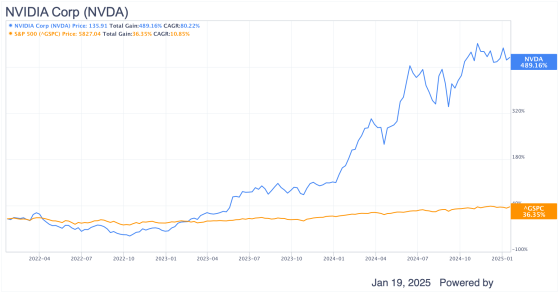

Nvidia (NASDAQ:NVDA) has established itself as the undisputed leader in manufacturing GPUs, a critical component in powering AI servers and data centers. The surge in demand for these products has led many to refer to this trend as the "AI chip gold rush." Over the past two years, NVDA's stock price has skyrocketed, gaining over 489% (at a CAGR of 80.2%), driven by its GPU segment, which has achieved an annualized revenue growth rate of 67.11% over the past three years. Analysts now forecast GPU revenue to reach $129B by 2025.

NVDA Data by GuruFocus

The big question for investors, however, is what Nvidia's growth trajectory will look like over the next several years. Much of this hinges on how AI technology evolves in the coming decade. I believe the company's future lies in the groundbreaking products unveiled at the CES Convention in Las Vegas. While the market reacted negativelyNvidia's stock dropped 6% on January 7th, 2025, following Jensen Huang's keynoteit's clear there is plenty to be excited about. CEO Jensen Huang's presentation at CES was particularly insightful. He laid out Nvidia's roadmap for advancing AI technologies and highlighted the innovations that could shape the company's future. Among the announcements were cutting-edge AI hardware and a new AI model that could serve as the foundation for the next phase of AI's evolution. Nvidia is making significant strides to stay ahead of the competition, and I'm confident these efforts will translate into sustained market dominance. While I've previously approached the AI hype with caution, it's evident that we're still in the early stages of this transformative technology. Nvidia's positioning as the market leader today and its commitment to innovation ensure its relevance for years to come.

A Strong Start to 2025: Nvidia at CESThe CES event in Las Vegas kicked off the year with significant excitement for chip stocks, with Nvidia stealing the spotlight. During his keynote, CEO Jensen Huang unveiled several major innovations. Leading the announcements was the GeForce RTX (NYSE:RTX) 50 Series GPUs, powered by Nvidia's Blackwell architecture. These GPUs incorporate DLS44 and AI multi-frame technology, delivering improved efficiency. The RTX 5090, priced at $1,999, targets high-end users, while the more affordable RTX 5070 comes in at $549, offering options for a broader audience.

Nvidia also revealed key collaborations in the automotive sector. A partnership with Toyota (NYSE:TM) focuses on integrating Nvidia's DriveOS for autonomous car development, while a collaboration with Aurora aims to advance autonomous truck technology. These partnerships signal Nvidia's push into a rapidly growing market with substantial long-term potential.

One of the standout announcements was Project DIGITS, an AI supercomputer priced at $3,000. Capable of running 200 billion parameters independently, DIGITS aims to reduce the cost of AI adoption by minimizing reliance on cloud solutions. Nvidia also unveiled Cosmos, an AI model designed to produce photorealistic videos and images. More importantly, Cosmos bridges digital training environments with real-world applications, enabling AI systems to generate physical responses. From robotics to autonomous vehicles, Cosmos could revolutionize industries by enabling safer and more efficient systems.

The Potential of DIGITSThe introduction of DIGITS marks a potential game-changer for AI accessibility. Powered by Nvidia's GB10 Grace Blackwell Superchip, it delivers 1 petaflop of AI performance, capable of running large language models with up to 200 billion parametersor double that with Nvidia's ConnectX technology. To put this into perspective, ChatGPT 3.5 utilized 175 billion parameters, making DIGITS an extremely powerful tool. What sets DIGITS apart is its affordability and portability. At $3,000, it offers smaller businesses and individual developers access to AI capabilities previously reserved for large corporations. According to Marketresearchfuture, the AI supercomputer market is projected to grow at a CAGR of 19.18% through 2034, reaching $38.79 billion. Nvidia's ability to dominate this space could add billions to its bottom line, solidifying its leadership in the AI sector.

[Market Research Future]

Robotics RevolutionNvidia's Cosmos platform highlights the company's forward-thinking approach to AI integration in robotics. By leveraging AI models to respond to physical stimuli, Cosmos could transform industries such as manufacturing, healthcare, and transportation. Robots trained with Cosmos can perform tasks more safely and efficiently, whether it's a humanoid-style robot assisting in production or an autonomous vehicle reacting dynamically to its surroundings. The robotics technology market is projected to reach $350 billion by 2032, growing at a CAGR of 15.2%. While this market might seem small relative to Nvidia's current size, the company's technological leadership and partnerships with automotive giants like Toyota position it to capture a significant share. Over the long term, Nvidia's shift toward software platforms like Cosmos may diversify its business beyond GPUs, paving the way for new revenue streams.

Topline DriversNvidia's financial performance underscores its dominance in the AI space. For the most recent fiscal year, the company reported $35.08 billion in revenue (+90% YoY) and normalized earnings of $0.81 per share (triple-digit YoY growth). Both metrics surpassed analyst expectations, with revenues exceeding estimates by 2.81% and earnings beating by 4.63%. A key driver of this growth has been the increasing demand for GPU-based servers. In 2024, hyperscalers invested approximately $200 billion in data center CAPEX, a figure expected to grow 50% YoY in 2025 to $300 billion, according to Morgan Stanley (NYSE:MS) research. Nvidia, which commands an estimated 90% share of the AI GPU market, is poised to benefit directly. Analysts project Nvidia's revenue to grow 50-55% in 2025, supported by demand for its Blackwell GPUs.

Is Nvidia Overvalued?Nvidia is not cheap, but for a company that commands an estimated 70-95% of the AI chip market, it shouldn't be. The premium valuation is justified in my view, especially when considering the firm's ability to meet or exceed anticipated growth in the coming quarters. While a traditional price-to-earnings (P/E) analysis might make Nvidia appear expensive, I believe intangible investments play a critical role in delivering long-term shareholder value. This makes conventional valuation tools less relevant when evaluating Nvidia's potential. A more meaningful metric to assess Nvidia's valuation is its return on invested capital (ROIC) compared to the weighted average cost of capital (WACC). By this measure, the company has consistently delivered strong returns, justifying the stock's price appreciation.

Historical Comparisons and Wall Street Analysts Support the ValuationAdditionally, Nvidia's forward P/E ratio of ~45x for FY2025 may seem high at first glance, but on a forward basis, this multiple is expected to fall below 30x by FY2026, as per consensus estimates. Over the past five years, Nvidia has rarely traded below a P/E ratio of 50x, and given the company's strong competitive moat and projected revenue CAGR of 50-55%, there's little reason to believe this trend will change anytime soon. Based on Wall Street projections, Nvidia's EPS is expected to reach $4.44 in FY2026 and $5.61 in FY2027. However, I believe these estimates may be conservative, as Nvidia has a history of beating analyst expectations. Adjusting for this, actual EPS figures could carry a 3-5% premium over current forecasts.

If the stock price continues to follow its historical pattern of tracking earnings growth, Nvidia's shares should trade well above $130 in 2026. Applying a 35x forward P/E multiple to the likely FY2026 earnings (adjusted for a 5% upward revision), I estimate a 12-month target price of $163.20 per share, representing a 24% upside from current levels. This would value Nvidia at nearly $4 trillion in market capitalization, underscoring its dominant position in the AI and GPU markets. Wall Street remains overwhelmingly bullish on Nvidia. Out of 65 analysts covering the stock, 59 rate it as a buy, while the remaining six recommend holding it. Median and mean price targets from sell-side analysts suggest an upside potential of 24-28%, aligning with my own analysis.

DCF ValuationFrom a discounted cash flow (DCF) perspective, I remain confident in Nvidia's ability to maintain its leadership in the GPU market. This leadership is underpinned by groundbreaking innovations such as the H200 and Blackwell architectures, as well as the company's potential to capitalize on the growing AI supercomputer and robotics markets.

Using conservative assumptions in my DCF model, I arrive at a one-year target price of $156.86 per share. This reflects a robust growth outlook while offering a margin of safety of approximately 12%. While some may view this target as optimistic, I believe it is reasonable given the early stages of the AI revolution. Nvidia is positioned at the forefront of this wave, uniquely equipped to benefit from its transformative impact.

Final ThoughtsHyperscalers like AWS, Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), and Google (NASDAQ:GOOGL) are expected to invest a staggering $300 billion in AI-driven data centers in 2025a 50% increase from the previous year. Nvidia, with its commanding 90% share of the AI GPU market and the forthcoming Blackwell architecture offering up to 15x performance gains, is perfectly positioned to capitalize on this surge in spending. As AI continues to transform industries, Nvidia's role as a critical enabler of this technological evolution sets the stage for sustained growth and shareholder value creation.

Jensen Huang, Nvidia's CEO, demonstrated a clear vision for the future of AI during recent announcements, instilling confidence in the company's ability to execute and innovate. Nvidia's strategic push into robotics development and its broader view of this emerging market significantly expand its growth horizons. These efforts are already being reflected in analysts' optimistic upward revisions of long-term EPS forecasts. While the stock isn't cheap, its premium valuation is justified by its industry dominance, strong growth prospects, and leadership in cutting-edge technology. For investors, having exposure to Nvidia, even indirectly through the S&P 500, seems like a logical move. I believe smoother and more consistent growth will emerge post-2029, driven by the firm's diversification into high-potential areas like robotics and AI supercomputing. In my view, Nvidia's ability to innovate, adapt, and lead in AI hardware and software markets solidifies its position as a must-have in a growth-focused portfolio.

This content was originally published on Gurufocus.com