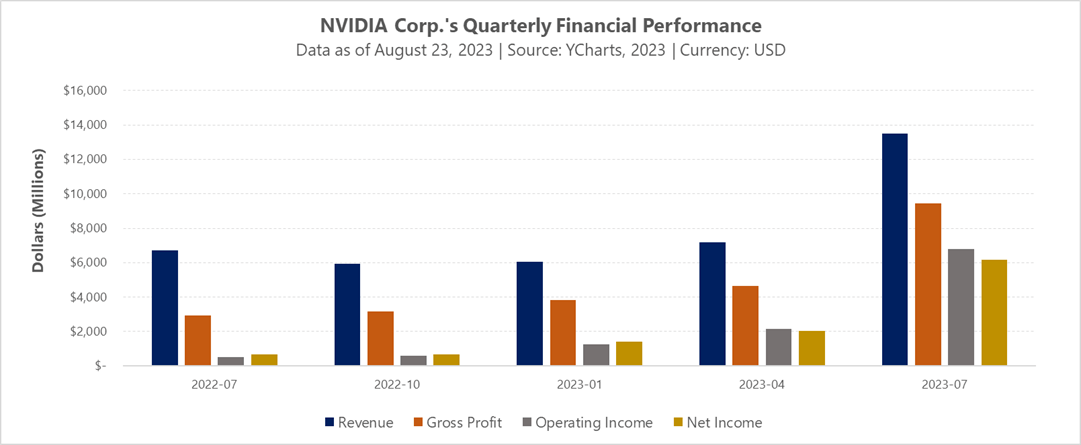

Sometimes a performance is so great that you have to applaud it, but when it repeats – then you know something special is occurring. This was recently the case with NVIDIA Corporation (NASDAQ:NVDA). The firm released its earnings report, which detailed a superb performance for the quarter. As illustrated in the following chart, for the quarter the firm reported record revenue of $13.51 billion, up 101% from a year ago and 88% from the previous quarter. Additionally, net income for the period was $6.188 billion, up 843% from a year ago and up 203% from the previous quarter.

NVIDIA has become a bellwether company for the new age of computing and its rapid advancement. As stated by Jensen Huang, founder and CEO of NVIDIA in the most recent earnings call, “During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructure. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry”. A new era of computing has begun, as companies worldwide are transitioning from general-purpose to accelerated computing. As the prominence of artificial intelligence grows, NVIDIA’s involvement will continue to become more entrenched and integral to the computing infrastructure of the future.

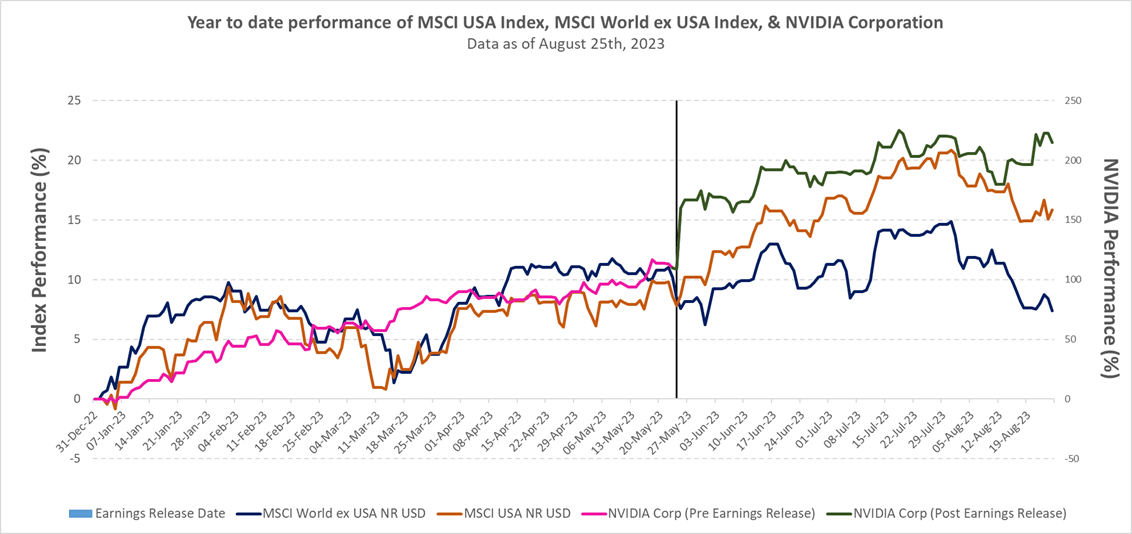

Beyond the landscape of computing, NVIDIA’s performance within the US equities landscape has been catalyzing. As observed from the following chart, through May 24th, US and Ex-US equities performed about the same. What happened on May 25th was NVIDIA’s Q1 earnings not only beat expectations, but they surpassed them entirely. This ultimately spurred the performance of the big tech firms, colloquially referred to as the Magnificent Seven, resulting in a widening of the performance between US equities and the rest of the world.

ETFs with Exposure to NVIDIA and other Magnificent Seven Companies

The exceptional returns of NVIDIA and the other big tech firms may lead curious minds to inquire which ETF solutions have exposure to these companies. For Canadian investors, the following ETF solutions provide material exposure to these companies:

BMO (TSX:BMO) Global Equity Active ETF Series (NLB:BGEQ)

The ETF provides exposure to a portfolio of global equities across sectors and market capitalizations. A ‘Core’ investment style with the ability to tilt to Value or Growth as market conditions dictate. As of July 31, 2023 holdings data, NIVIDA Corp. was a top holding with a 3.65% allocation. Other prominent big tech companies within the fund’s top ten holdings were Amazon.com Inc (NASDAQ:AMZN) (2.66%), Microsoft Corp (NASDAQ:MSFT). (2.05%), and Netflix (NASDAQ:NFLX) (1.86%).

BMO Global Innovators Active ETF Series (NLB:BGIN) (Ticker: BGIN)

The ETF provides exposure to a portfolio of the most innovative global companies across sectors and market capitalizations. Using a thematic, top-down process to screen for companies involved in the development of innovative products, processes or services that will shape the next decade involved in artificial intelligence, biotechnology, semiconductors and automation. As of July 31, 2023 holdings data, the top five companies were Meta Platforms Inc. (5.39%), NVIDIA Corp. (4.99%), Alphabet (NASDAQ:GOOGL) Inc. (4.49%), Apple Inc (NASDAQ:AAPL). (3.91%), and Microsoft Corp. (3.85%).

Fidelity Global Innovators ETF (NLB:FINN) (Ticker: FINN)

The Fidelity ETF invests primarily in companies located anywhere in the world that have the potential to be disruptive innovators and seeks to identify companies that are positioned to benefit from the application of innovative and emerging technology or that employ innovative business models. As of June 30, 2023 holdings data, NVIDIA Corp was a top holding with 11.80%, followed by Microsoft (11.71%) and Meta Platforms Inc (7.07%).

RBC (TSX:RY) Global Technology Fund (NLB:RTEC) (Ticker: RTEC)

The ETF seeks to provide long-term capital growth by investing in equity securities of companies around the world in the Information Technology and/or Telecommunications Services sectors. The fund will invest in companies developing or marketing technology and telecommunications products and services. As of July 31, 2023 holdings data, Apple Inc. (11.27%), Microsoft (11.23%), Alphabet (9.91%), NVIDIA Corp. (6.96%), and Meta Platforms Inc. (5.12%) were the top five holdings in the fund.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.