TSX futures drop as oil prices surge above $100/bbl amid escalating Iran conflict

1: Introduction

I have been a long-term investor in Occidental Petroleum (NYSE:OXY), one of my domestic oil producers, for over a decade. Most of the stocks I have discussed on Gurufocus share similar attributes, which helps me preserve objectivity, even if it may seem improbable at first glance.

Many investors overlook a critical aspect of decision-making by idealizing their investments and only considering opinions that confirm their biased views. This mindset can seriously harm your finances, resulting in a loss of perspective and an inability to recognize early signs of potential future failure.

Analyzing the fundamentals and recognizing potential financing instability, as well as the company's excess in managing operations or highlighting external or intrinsic imbalances, is a responsibility I strive to undertake and communicate to my readers.

Occidental Petroleum faces an ongoing risk of overheating. While Buffett's financial backing provides solid support, it can be inconsistent at times, leading to potentially costly errors in judgment. This was evident when the stock dropped below the anticipated strong support level of $59.62, the buying price of its 89.2 million shares warrants.

Up until now, Warren Buffett (Trades, Portfolio) , through Berkshire Hathaway (NYSE:BRKa) (BRK.A., BRK.B.), has purchased Occidental Petroleum whenever the stock price fell below the warrants' buy price.

However, he chose not to buy this time when the stock closed below this support level around August 1, 2024. As a result, the stock plummeted, reaching a low of $45.17 on December 19, 2024. Following this, Buffett began purchasing shares again starting on December 17, establishing a new lower support level of around $45.50.

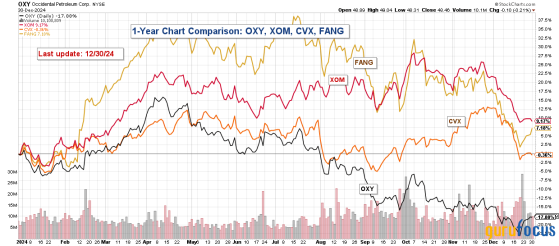

2024 is almost over, and despite apparent great results in the third quarter, OXY's stock performance has been disappointing. It has significantly underperformed compared to its peers, especially two major US oil companies: Exxon Mobil (NYSE:NYSE:XOM) and Chevron Corporation (NYSE:NYSE:CVX), and even its direct competitor, DiamondBack Energy (NASDAQ:FANG).

Furthermore, the company has not provided its shareholders with a satisfactory return on investment, offering a meager quarterly dividend of $0.22 per share, resulting in a yield of 1.88%. In contrast, XOM yields 3.88%, while Chevron yields 4.53%, exacerbating the gap loss in the graph above.

Please remember that OXY's quarterly dividend was $0.79 per share in 1Q20 before Anadarko's acquisition.

2: An expansion strategy that may harm shareholders' interests.The company's management continued to pursue expansion during 2023-2024, likely encouraged by a favorable environment for oil and gas prices. It was far from the only one, though. For instance, DiamondBack Energy also merged with Endeavor Energy Resource in September 2024, or Exxon Mobil and Pionneer Natural Resources.

However, such favorable conditions are always temporary and are followed by painful downturns, as we've recently witnessed.

Of course, it is too early to say for surethere are so many moving partsbut I have a feeling 2025 will be less favorable for oil than 2023-2024. If true, this casts doubt on the positive effect of the company's expansion strategy.

I never understood why OXY needed to expand again while recovering from the Anadarko acquisition. What is management's ultimate goal, and is it truly benefiting shareholders? My answer is no; the proof is in the pudding.

Despite the chaos caused by overbidding against Chevron a few years agoat an extra cost of one billionmanagement is pushing ahead with another major acquisition. Without foresight, we risk repeating the same mistakes; however, CEO Vicki Hollub appears unaware of this old adage.

Occidental has invested over a billion in share repurchases (in 2023, not in 2024). However, despite this effort, the total number of shares diluted has increased by nearly 9% since 1Q20, reaching 975.7 million shares in 3Q24. Look at the chart below:

This significant cash expenditure could have reduced the company's debt, which soared after the costly acquisition of Anadarko in November 2019 for $38 billion, or $59 per share. This acquisition led OXY to significantly reduce its quarterly dividend to a nominal $0.01 per share in 2019. Billions were lost in rain, but management remained unaffected.

Since then, despite its promise to reduce debt, the company has completed a $12 billion CrownRock's acquisition, increasing its debt burden to levels not seen since 2022. We are back at square one with a total debt of $25.85 billion.

This quarter alone, the company added nearly $7 billion in total debt, despite repaying $4 billion, or nearly 90% of its near-term target. Consequently, the company's plans to expand the dividend program have been put on hold due to the current financial situation.

3: Occidental Petroleum: An impressive and diverse portfolio. But at what cost?On November 12, 2024, the company released its results for the third quarter of 2024. This article serves as an update to my Gurufocus article from December 21, 2023over a year agowhere I analyzed the third quarter of 2023 and discussed the acquisition of CrownRock LP.

Occidental Petroleum has three distinct segments and potentially another one coming late next year.

It primarily produces hydrocarbons, including oil, natural gas liquids (NGL), and natural gas. The company is also investing in Direct Air Capture projects through a venture called Stratos, located in Ector County, Texas. Stratos is expected to be operational by mid-2025.

A great page from the 3Q24 presentation is shown below:

Source: OXY 3Q24 Presentation.

In the third quarter of 2024, Occidental Petroleum surpassed analysts' expectations, even though its net income decreased by 17.6% compared to the previous year. This decline was primarily due to asset sales and a downturn in OxyChem's performance. The company incurred a $572 million loss from selling Permian properties in 3Q24.

Additionally, Occidental reduced its substantial debt burden from the CrownRock LP acquisition, leading to a long-term debt of $25.85 billion in the third quarter.

Revenue increased slightly to $7.173 billion in the third quarter, up from $7.158 billion last year, despite a record oil equivalent production. Revenue and other were $7.154 billion.

The oil, NGL, and natural gas segment remains the most significant part of the company, accounting for 79.4% of total revenue in the third quarter of 2024, as illustrated in the graph below:

4: Oil, NGL, and Natural Gas ProductionCEO Vicki Hollub said in the conference call:

Our oil and gas segment exceeded the high end of our production guidance and set a new company record for the highest quarterly U.S. production in our history. This was an outstanding achievement, made even more impressive by three hurricanes that impacted our operations across the Gulf of Mexico.Before analyzing the oil and gas segment, let me say a few words about the midstream and chemical segments.

The company's operating profit from its chemicals division fell to $304 million, a decrease from $373 million the previous year.

In contrast, the midstream business benefited from derivatives, resulting in a $490 million gain from the sale of shares in pipeline operator Western Midstream Partners (WES). Additionally, the midstream segment reported an adjusted net income of $20 million.

The upstream segment is the most significant, accounting for 79.4% of total revenue. Despite an active hurricane season affecting the company's properties in the Gulf of Mexico, the company reported an excellent quarter in production. Total (EPA:TTEF) oil equivalent production reached 1,412K Boepd this quarter, a new record. US oil equivalent production was high with 1,186K Boepd.

It is important to notice that OXY oil production represents 50.5% of the total equivalent production in 3Q24.

US oil production has risen due to strong performance from new wells, reduced well costs, and improved uptime, particularly in the Permian Basin.

Occidental Petroleum's US production is derived from three primary segments: the Permian Basin, the Rockies, and offshore in the Gulf of Mexico. As illustrated in the graph below, the Permian segment accounts for the largest share of production by a significant margin.

Unfortunately, oil and gas prices have weakened throughout the year, especially natural gas, which has decreased to $0.76 per McF. Note: NGL price was $20.47 a barrel in 3Q24.

5: Technical Analysis: A new lower support.

Note: The chart has been adjusted to account for the dividend.Occidental is following a descending channel pattern, with resistance at $49 and support at $44.9. The relative strength index (RSI) is at 56, suggesting a potential breakout, especially after Warren Buffett (Trades, Portfolio)'s recent purchase on December 17-19. This new purchase for about $500 million indicates a strong commitment and establishes a new lower support level.

I recommend using a Last-In-First-Out (LIFO) strategy for 6070% of your position while targeting a higher price just below the 200-day moving average, around $56.75. Trading with 60-70% makes sense due to the unactractive dividend that the company is paying and the lack of potential increase anytime soon.

A descending channel is typically viewed as a bearish continuation pattern. It forms when the price steadily declines between two parallel lines that slope downward: a resistance level and a support level. This pattern originated from an ascending trend, and I expect that it will ultimately result in a breakout.

In terms of trading strategy, consider taking profits gradually between $48.5 and $49.75, with a potential higher resistance target at $55.20-$57. Alternatively, you could wait for a retracement between $45.30 and $44, with a possible lower support at $40, should the pattern conclude with a breakdown instead (though this scenario is less likely).

Caveat emptor: the major risk here is Buffett's potential change of mind. Berkshire owns approximately 30% of OXY, and if it chooses to reduce its position due to a negative oil market, OXY could decline rapidly.

It is essential to frequently update the TA chart to remain relevant, as we operate in a constantly changing environment.

This content was originally published on Gurufocus.com