Oil slipped to around $60 a barrel on Friday as concern about a slowdown in the global economy and oil demand outweighed hints of progress in the U.S.-China trade dispute.

The Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) both issued reports this week pointing to an oil surplus next year, despite an OPEC-led pact to cut supply that runs until March.

“Oil prices have been slipping in recent days even as stock markets have rallied and inventory data has reported large drawdowns,” said Craig Erlam of OANDA. “The IEA and others continue to downgrade forecasts for demand as global economic growth fears mount.”

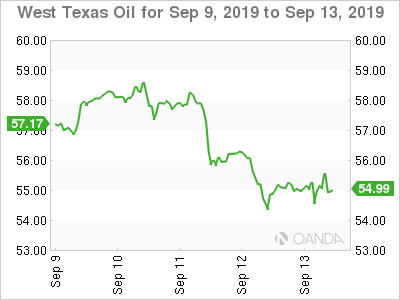

Benchmark Brent crude was down 25 cents at $60.13 a barrel by 0830 GMT, while U.S. West Texas Intermediate was up 5 cents at $55.14.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.