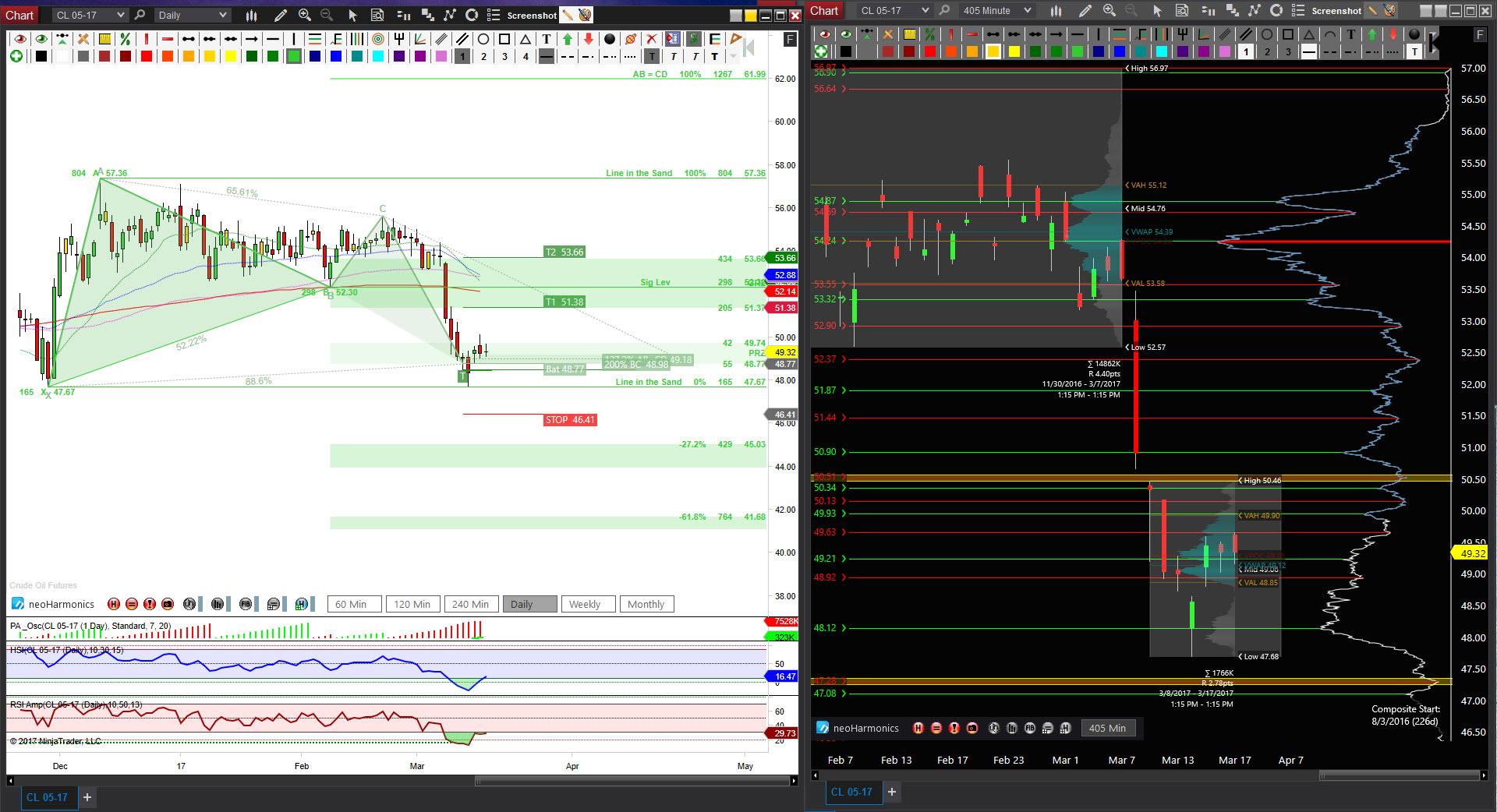

CLK17, the May contract for Oil Futures Day chart shows a completion of a harmonic pattern called a Bat and since then has been batting its eyelashes around the PRZ (Potential Reversal Zone aka the completion zone for a harmonic pattern).

My momentum indicators are OverSold so a hold above that region while price holds above 49.74 will increase the probability of going into Retrace Mode. This means buyers have a doorway to step in, if they do, the ideal minimum Retrace targets are 51.39 and 53.66. The dreamed of Retrace target is the 100% at 57.36, but first things first.

The right side of the snap shows a Composite Volume Profile chart, understanding how this chart displays price action defines where buyers and sellers either find value, seek value or fill in imbalance. I just mentioned above that price needs to hold above 49.74 to increase the opportunity of Retrace Mode, this chart says that above 49.74 may be the start but the probability will be stronger above 50.51. This is a neutral zone separating value. Until price can hold above 50.51, the strong magnet (aka Value) is 48.12 which keeps price around the harmonic PRZ. Above 50.51 has a Major magnet at 54.24, this pulling of price to it would shift the bias to up as well as shine light on that dreamed of Retrace target of 57.36.

Note there’s another neutral zone at 47.28, below there would portray sellers seeking lower value and in the world of harmonics, seeking extended pattern targets, in this case ideally at 41.68. Yikes, right? Well there are obstacles along the way, at 47.67, 46.58 and 45.03. These are considered a doorway for buyers.