WTI crude oil prices fell by about $8 over the week, their steepest weekly loss since March. As a result, futures contracts on WTI crude oil have not gained more than 3% since the start of the year. The oil market has suddenly slipped into a shadowy period of plunges and uncertainties amid weakening demand.

Oil prices suffered their most significant daily loss in over a year on Wednesday, highlighting an unfavorable shift in market sentiment despite the OPEC+ decision to maintain output cuts. Saudi Arabia has committed to sustaining a voluntary reduction of 1 million barrels per day (bpd) until the end of 2023. Meanwhile, Russia will continue with a voluntary export reduction of 300,000 bpd until December.

Nevertheless, these measures seem insufficient today to outweigh worries about fuel demand. On Wednesday last week, the U.S. Energy Information Administration reported that the finished motor gasoline supplied, a key indicator of demand, dropped to around 8 million bpd last week. This marks the lowest level since the beginning of this year.

More woes are piled onto the struggling sector by weak economic data from both sides of the Atlantic. Poor performance numbers out of Europe and America also add downward pressure to an already beleaguered market.

The escalating geopolitical risk in the Middle East should uphold oil prices. The deepening military conflict between Israel and the militant group, Hamas, raises political uncertainty and concerns about oil supply.

Group Data: Energy, US Crude Oil

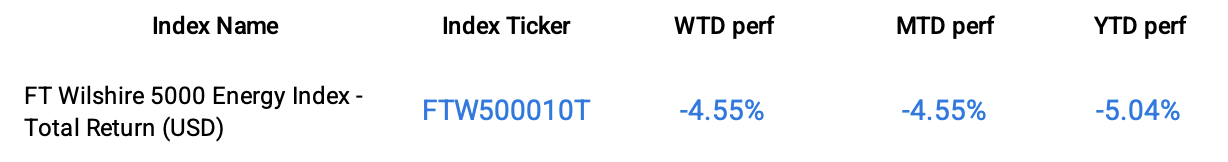

Index Data

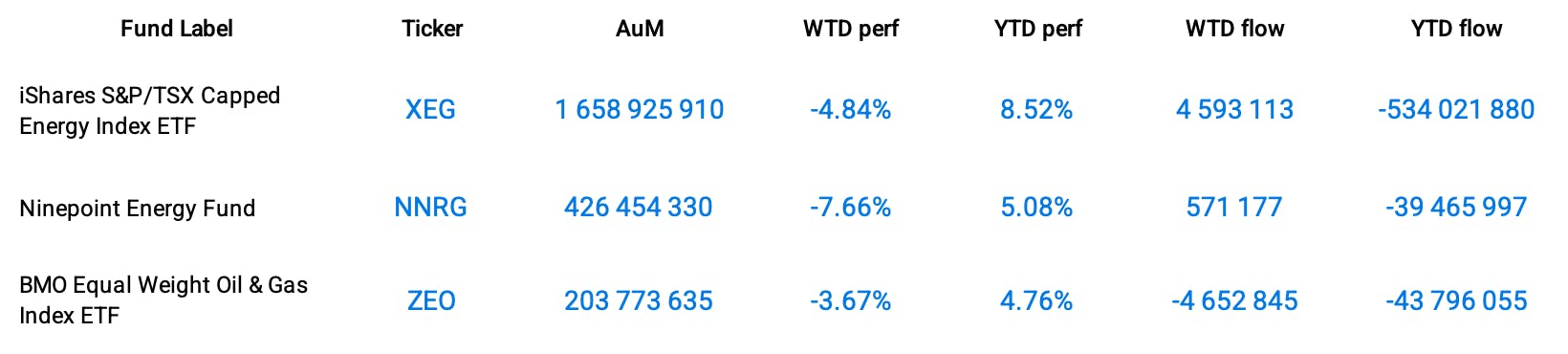

Funds Specific Data: XEG, NNRG, ZEO

This content was originally published by our partners at the Canadian ETF Marketplace.