- S&P 500 scores fresh intraday all-time high

- NASDAQ 100 notches new closing record

- IMF downgrades European economic growth

Key Events

Futures contracts on the Dow, S&P and Russell 2000 are lower in pre-US open trading on Wednesday as investors wait to hear Chairman of the US Federal Reserve, Jerome Powell speak later today.

Only futures on the NASDAQ are in the green, after Microsoft (NASDAQ:MSFT) reported fiscal second-quarter results which beat expectations on Tuesday after the US close.

Gold and Bitcoin continue to head south.

Global Financial Affairs

European stocks were under pressure, as the STOXX 600 Index opened lower after the IMF downgraded its 2021 Eurozone growth forecasts on concerns of COVID-19 vaccine shortages.

The index edged slightly higher after luxury conglomerate LVMH (PA:LVMH) reported that sales surged in its fourth quarter, and Sweden’s largest bank SEB (ST:SEBa) announced plans to return more money to shareholders, but the news failed to stop the downward momentum.

The S&P 500 Index ended a volatile session somewhat lower on Tuesday, on the on-again-off-again consideration of a negative outlook due to the persistent contagion of the coronavirus, compounded by challenges to the $1.9 trillion stimulus package that was all but taken for granted once Joseph Biden was elected president and Democrats gained control of both houses of Congress.

The S&P 500 Index scored a new all-time high, before it closed lower, and after it confirmed the integrity of a bullish flag, signaling a rally toward 4,000.

While contracts on the NASDAQ 100 leapt after the closing bell on Microsoft’s earnings beat, building on its record close.

MSFT completed a bullish symmetrical triangle exactly one week ago, suggesting smart money had confidence, or that informed money had an idea, that earnings would surprise to the upside.

Tesla (NASDAQ:TSLA) is due to report earnings after the US close today. We think the stock could move beyond $1000 per share.

Shares in Facebook (NASDAQ:FB), which is also scheduled to release corporate results after the bell, stand at a crossroad.

The stock found resistance yesterday by the top of a descending triangle, increasing the odds of a decline toward its bottom at $245. If the resistance is broken, it will create a chain of events pushing the price toward, and even below, $200. However, an upside breakout of the pattern would upend the technical domino effect, propelling the stock even higher.

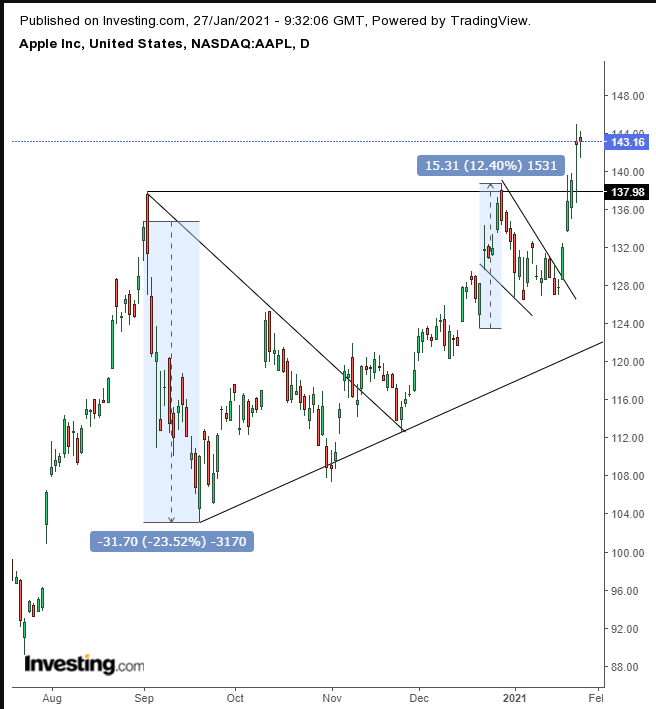

Finally, Apple (NASDAQ:AAPL) too is reporting earnings after the close, and the stock's recent price activity suggests momentum is to the upside.

Last week Apple completed an ascending triangle—bullish, and supported by an earlier bullish, symmetrical triangle, followed by a falling flag. The stock is aiming towards the $170 level.

The dollar rose within a range ahead of the FOMC policy meeting.

The US currency is wedged between a falling trend and a H&S bottom that might help complete a massive bullish wedge.

Gold fell for the fifth straight day despite high bearish bets against the dollar, as its haven status may be weighing it down.

The yellow metal is squeezed between its falling channel and potential H&S bottom.

Bitcoin fell, along with the gold, on dollar strength.

The cryptocurrency ranges within a possible falling flag, whose conservative implied target puts it above $45,000.

Oil rose within a falling flag, whose implied target, upon an upside, is expected to be $60 a barrel.

Up Ahead

- Fourth-quarter GDP, initial jobless claims and new home sales are among US data releases on Thursday.

- US personal income, spending and pending home sales come Friday.

- Canada reports its monthly GDP on Friday.

Market Moves

Stocks

- Futures on the S&P 500 Index dipped 0.1%.

- The Stoxx Europe 600 Index decreased 0.1%.

- The MSCI Asia Pacific Index declined 0.2%.

- The MSCI Emerging Markets Index fell 0.5%.

Currencies

- The Dollar Index jumped 0.25% to 90.38.

- The euro fell 0.1% to $1.2151.

- The British pound was little changed at $1.3742.

- The onshore yuan was little changed at 6.466 per dollar.

- The Japanese yen weakened 0.1% to 103.68 per dollar.

Bonds

- The yield on 10-year Treasuries rose less than one basis point to 1.04%.

- The yield on two-year Treasuries decreased less than one basis point to 0.12%.

- Germany’s 10-year yield increased less than one basis point to -0.53%.

- Britain’s 10-year yield rose one basis point to 0.274%.

- Japan’s 10-year yield gained one basis point to 0.049%.

Commodities

- West Texas Intermediate crude gained 0.8% to $53.04 a barrel.

- Brent crude increased 0.8% to $56.35 a barrel.

- Gold weakened 0.1% to $1,848.88 an ounce.