- Samsung earnings boost sentiment

- Gold recovered

- Bitcoin slipped

Key Events

Global stocks and US futures on the Dow, S&P, Nasdaq, and Russell 2000 advanced slightly on Thursday after positive earnings from electronics giant Samsung revived optimism that corporates are managing to navigate economic challenges.

A weaker dollar confirmed the argument that investors' worries about inflation are subsiding.

Global Financial Affairs

S&P futures extended the underlying gauge's 3-day rebound, and I think there is room for the rally to continue.

Contracts completed a falling flag, which they successfully retested, as they climbed along the uptrend line. Now, S&P futures are testing yesterday's high. According to the flag, the contract will bottom out, pushing it further to retest last week's high.

Investors increased risk after Samsung (KS:005930) registered the best Q2 earnings since 2018.

The shares surged 3.19%. So is this a buying or selling opportunity?

If you're looking at the short term and are a risk-taker, I expect the stock could dip toward 57,000 before heading toward 59,000. The long-term trend is down.

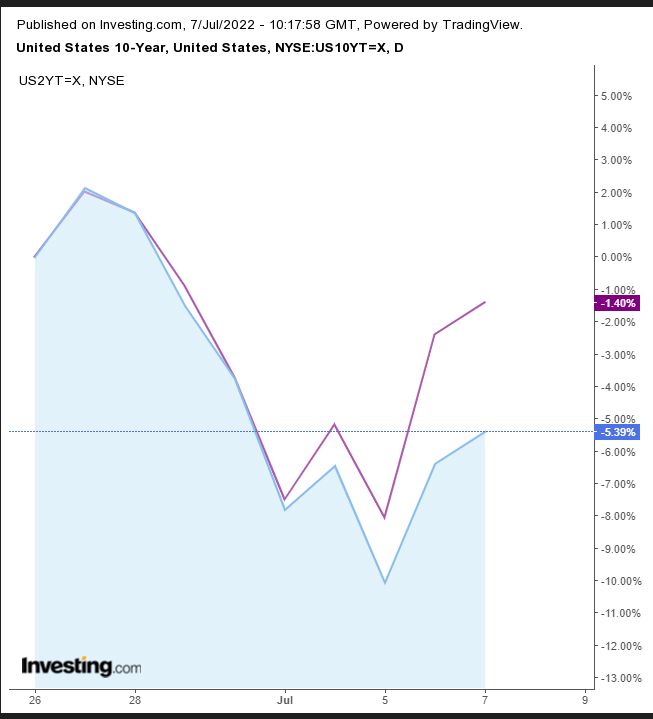

The yield curve on the 10-year Treasury note is a leading recession indicator and a sell-off impetus.

The 10-2 year Treasury Yield Spread is inverted for the third day, but it has steepened by two basis points, which means investors are more optimistic. Note, also, that yields are rebounding.

But markets are fickle, as traders often overreact to news. Bear markets have some of the strongest rallies, but are still bear markets so stocks will likely keep heading lower.

The dollar eased which some analysts think is a sign that investors' inflation concerns are easing. However, it has only been a single-day move so it is too early to confirm.

Technically, even if the greenback declines, it will be nothing more than a return move to retest the bullish pennant before continuing higher.

Dollar weakness enabled gold to find its footing.

I would like gold to rise as that would provide an even better shorting opportunity, with sellers waiting by the broken uptrend line.

Bitcoin receded somewhat from yesterday's highs, but I expect it's temporary before the cryptocurrency resumes higher—in the short term—before it syncs with the long-term downtrend.

The price bounced off the bottom of a short-term, hourly, rising channel within a broader hourly rising channel. The test will come below $21,000.

Oil prices are little changed, calming the market and reviving hopes that the Fed won't be forced to remain as aggressive at tightening interest rates.

Technically, we remain bearish.

The price completed a bearish flag that helped it achieve a much larger triangle, whose downside breakout also turned it bearish.

Up Ahead

- ECB President Christine Lagarde is due to speak on Friday.

- US nonfarm payrolls report for June on Friday.

- On Friday Canada publishes employment figures.