- Global stocks mixed despite positive earnings reports

- Yields decline as investors return to havens

- Bitcoin draws breath

Futures on the Dow, S&P, NASDAQ, and Russell 2000 slid into negative territory on Wednesday despite positive earnings reports from Wall Street yesterday. .

Although it has fallen into the red, the STOXX 600 Index opened in the green on reports that Russia's Gazprom (MCX:GAZP) may partly renew its gas exports to the continent. I remain bearish on the index, from a technical standpoint.

Although the pan-European benchmark created a small base which was confirmed by early March support, broke through a May resistance and cut through the 50 DMA, it is still within a downtrend. I will consider changing my opinion on this only if the price crosses over 450.

The euro rose for the fourth day but was well off its highs, mirroring the fizzling STOXX 600 advance and the dollar's waning selloff.

The price was creating an intraday bearish Shooting Star below an H&S continuation pattern.

It's noteworthy that the euro cannot maintain its advance despite bets on the next US interest rate hike sliding from 100 to 75 basis points and expectations of a bigger-than-expected ECB interest rate hike. Either the dollar is strengthening on its haven status, which I consider nothing more than a bear rally, or the technicals are influencing the trade or both.

The current rally is on speculation that earnings will demonstrate the ability of US corporates to grow profits while inflation is at a 40-year high and therefore the Fed will go easy on interest rate hikes.

Also, the recent equity market selloff attracted dip buying. However, although that strategy was the norm in a QE environment, it is not a foregone conclusion during when the Fed is tightening.

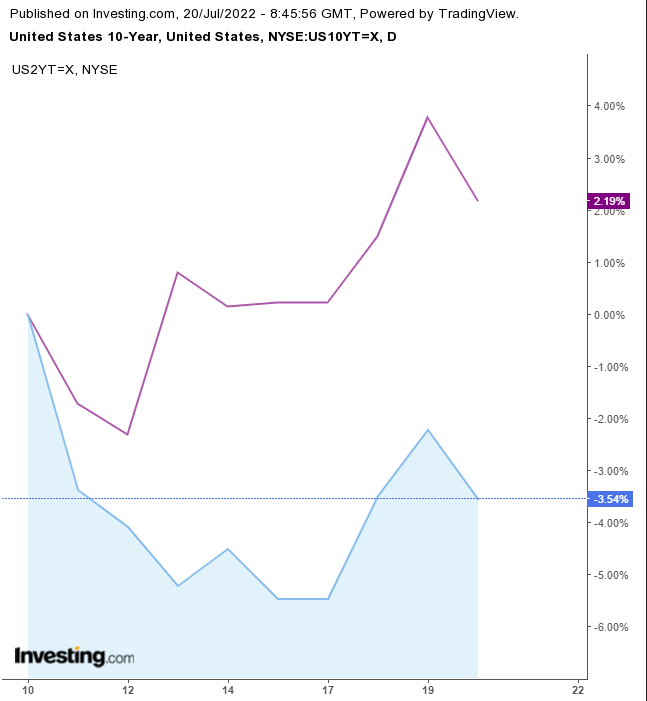

Treasury yields on the 10-year note declined as investors returned to haven bonds.

Also, the 10-2 year spread inverted yield steepened, with the 10-year yield falling about 50% more than the 2-year yield. This means that investors are willing to increase longer-dated bonds, despite the lower yield on them compared to shorter-dated bonds which indicates a lack of faith in future economic growth.

The dollar recovered slightly and fluctuated above critical support.

A rebound above a support convergence between previous highs and the greenback's uptrend lines could provide a reasonable long entry.

Gold reached its lowest since March 2020 on a weekly basis. This could be a catalyst to send the yellow metal back to its high of around $2,000. Conversely, if the support breaks, the yellow metal could retest 2018 lows. In the short term, the direction of the range's pattern will likely determine the next move.

The price is ranging in what could be a bearish triangle. I think a downside breakout is likely, but the pattern would be complete only after it happens.

Bitcoin was flat after an intense two-day run.

While the digital coin broke through a narrow rising channel and its 50 DMA, it is still too close and could return to the track. I remain bearish.

Oil fell on the stronger dollar and ahead of today's crude oil inventories release. There is also an overlapping technical drive.

The price is finding resistance for the second day at the convergence of a Falling Channel top and the bottom of a triangle. I expect oil to fall towards the $60s.

Up Ahead

- ECB interest rate decision is announced on Thursday.

- On Thursday, US initial jobless claims figures are published.

- The Philadelphia Fed Manufacturing Index is released on Thursday.