In this Pepe (PEPE) price prediction 2023, 2024-2030, we will analyze the price patterns of PEPE by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

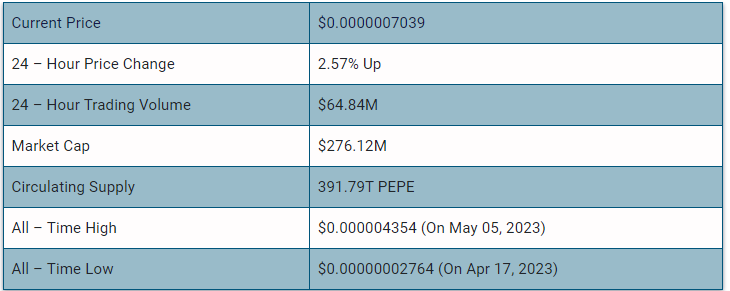

Pepe (PEPE) Current Market Status

What is Pepe (PEPE)

A deflationary memecoin launched on Ethereum is PEPE. PEPE presents a unique offering within the meme coin market by building upon the legacy of Pepe the Frog, a character with a longstanding and controversial history. PEPE‘s burning mechanism further highlights its distinct nature, aiming to maintain scarcity within the market.

PEPE is an ERC-20 token on the Ethereum blockchain, which is secured by the Proof-of-Stake (PoS) consensus mechanism. Decentralized validators stake 32 ETH to process transactions and secure the network.

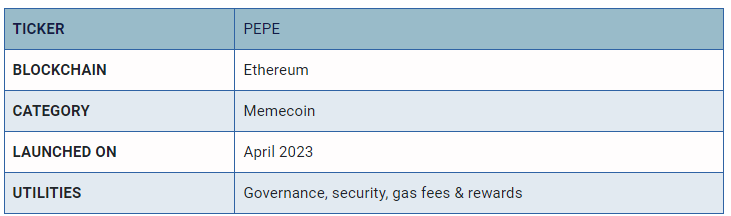

Pepe 24H Technicals

(Source: TradingView)

Pepe (PEPE) Price Prediction 2023

Pepe (PEPE) ranks 98th on CoinMarketCap in terms of its market capitalization. The overview of the Pepe price prediction for 2023 is explained below with a daily time frame.

PEPE/USDT Right Angled Broadening Descending Wedge Pattern (Source: TradingView)

In the above chart, Pepe (PEPE) laid out a right-angled broadening descending wedge. A right-angled broadening descending wedge is a bullish reversal pattern. The pattern is an inverted ascending triangle because it is made up of two converging lines with a horizontal line for the resistance and a bearish downward slant for the support.

At the time of analysis, the price of Pepe (PEPE) was recorded at $0.0000007039. If the pattern trend continues, then the price of PEPE might reach the resistance levels of $0.0000007325, and $0.0000008952. If the trend reverses, then the price of PEPE may fall to the support of $0.0000006506, and $0.0000006015.

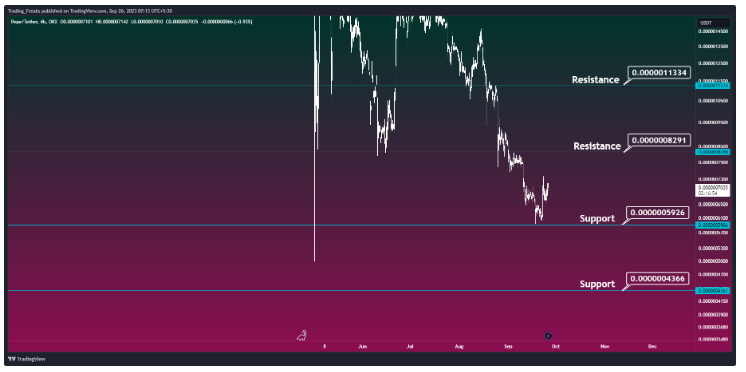

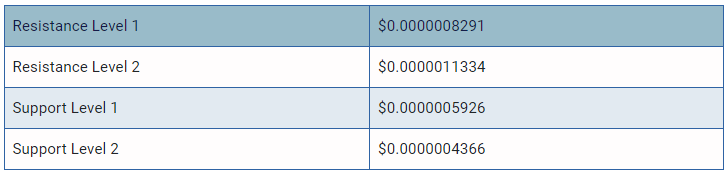

Pepe (PEPE) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Pepe (PEPE) in 2023.

PEPE/USDT Resistance and Support Levels (Source: TradingView)

From the above chart, we can analyze and identify the following as resistance and support levels of Pepe (PEPE) for 2023.

PEPE Resistance & Support Levels

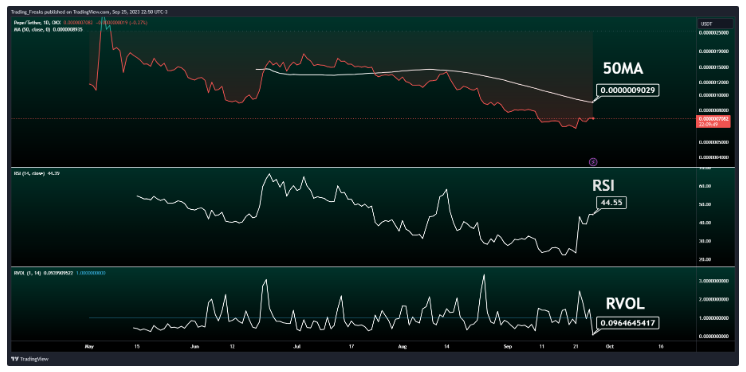

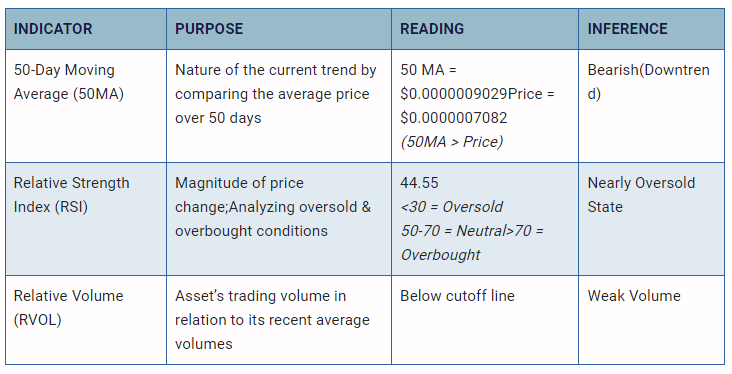

Pepe (PEPE) Price Prediction 2023 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Pepe (PEPE) are shown in the chart below.

PEPE/USDT RVOL, MA, RSI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the current Pepe (PEPE) market in 2023.

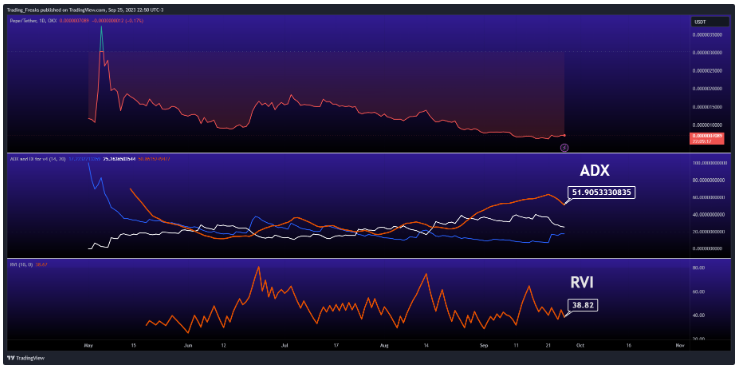

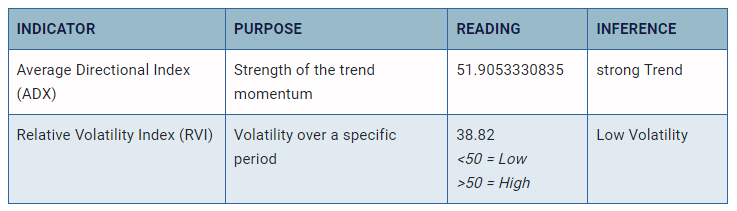

Pepe (PEPE) Price Prediction 2023 — ADX, RVI

In the chart below, we analyze the strength and volatility of Pepe (PEPE) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

PEPE/USDT ADX, RVI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the price momentum of Pepe (PEPE).

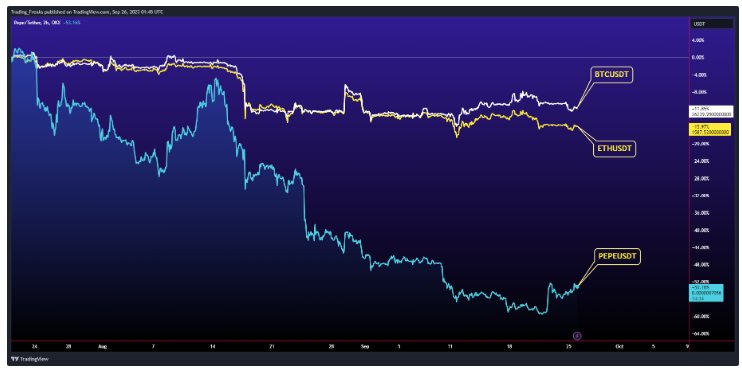

Comparison of PEPE with BTC, ETH

Let us now compare the price movements of Pepe (PEPE) with that of Bitcoin (BTC), and Ethereum (ETH).

BTC Vs ETH Vs PEPE Price Comparison (Source: TradingView)

From the above chart, we can interpret that the price action of PEPE is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of PEPE also increases or decreases respectively.

Pepe (PEPE) Price Prediction 2024, 2025 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Pepe (PEPE) between 2024, 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If Pepe (PEPE) establishes itself as a good investment in 2023, this year would be favorable to the cryptocurrency. In conclusion, the bullish Pepe (PEPE) price prediction for 2023 is $0.0000011334. Comparatively, if unfavorable sentiment is triggered, the bearish Pepe (PEPE) price prediction for 2023 is $0.0000004366.

If the market momentum and investors’ sentiment positively elevates, then Pepe (PEPE) might hit $0.000005. Furthermore, with future upgrades and advancements in the Pepe ecosystem, PEPE might surpass its current all-time high (ATH) of $0.000004354 and mark its new ATH.

This content was originally published by our partners at The News Crypto.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI