Foreign investment in Canadian securities reached a record high $38.8 billion in February, led by issuances of new Canadian shares to non-resident investors. At the same time, Canadian investors acquired $6.3 billion of foreign securities, mainly US instruments.

Foreign investment in Canadian securities led by issuances of new shares

Foreign investment in Canadian securities reached a record high $38.8 billion in February. This investment was largely in Canadian equities with the vast majority resulting from cross-border merger and acquisition activities. Foreign investors also acquired $3.0 billion of Canadian debt securities in February.

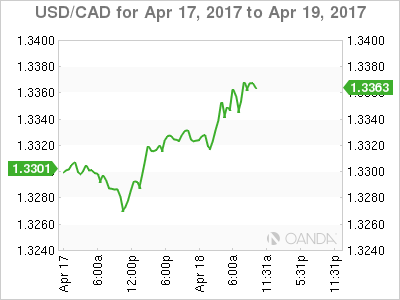

Foreign investment in Canadian equities amounted to $35.9 billion in February, the largest such investment on record. Issuances of new Canadian shares to non-resident portfolio investors resulting from cross-border mergers and acquisitions led the investment during the month. Sales by non-residents on the secondary market slightly moderated the overall inflow of funds. Canadian stock prices edged up and the Canadian dollar was down by 1.6 US cents against its US counterpart in February.

Foreign acquisitions of Canadian bonds slowed to $7.1 billion in February, following a $10.1 billion investment in January. Foreign investors acquired $5.1 billion in provincial government bonds, mainly new issues denominated in foreign currencies. This was the largest investment since January 2015. Foreign investors also acquired $4.5 billion of federal government business enterprises bonds. On the other hand, they reduced their holdings of federal government bonds by $2.1 billion as large retirements were moderated by secondary market purchases during the month. Canadian long-term interest rates were down by 11 basis points in February.

Non-resident investors reduced their holdings of Canadian money market instruments by $4.1 billion in February. The decline was mainly in provincial government paper and, to a lesser extent, federal government paper. Acquisitions of provincial government business enterprises paper moderated the overall divestment. Canadian short-term interest rates edged up in the month.

Canadian investors continue to acquire foreign securities

Canadian investors added $6.3 billion of foreign securities to their portfolios in February. For a second consecutive month, the activity was led by purchases of US instruments.

Canadian investment in foreign equities amounted to $4.8 billion in February, following acquisitions of $3.8 billion in January. Canadian investors acquired $4.9 billion of US shares, the highest investment since November 2015. US stock prices were up by 3.7% in the month.

Canadian investors also added $1.5 billion of foreign debt securities to their holdings in February, mainly acquisitions of US instruments. US long-term interest rates were down by one basis point and short-term interest rates were up by one basis point.