Bitcoin, the world's most prominent digital currency, achieved a new peak over the past week. Surpassing the $43,000 threshold - and more than doubling in worth this year with a 160% increase – the cryptocurrency reached its highest point since April 2022.

Heightened speculation surrounding the potential authorization of a US spot ETF focused on Bitcoin, has served to boost sentiment across financial markets. Meanwhile, expectations of a decrease in US interest rates next year, which may attract more institutional investment in cryptocurrencies, are further driving optimism. However, the remarkable performance of crypto assets this year may well lead some investors to cash in on their gains before the year is out.

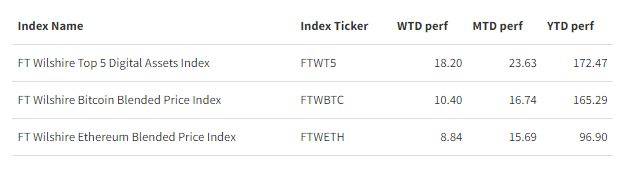

The FT Wilshire Top 5 Digital Assets Index, which reflects the broader trend in virtual currencies, increased by 18.20% over the week. As an illustration, Ethereum, another popular digital currency, also experienced growth in this bullish market, as shown by the 8.84% increase in the FT Wilshire Ethereum Blended Price Index for the week.

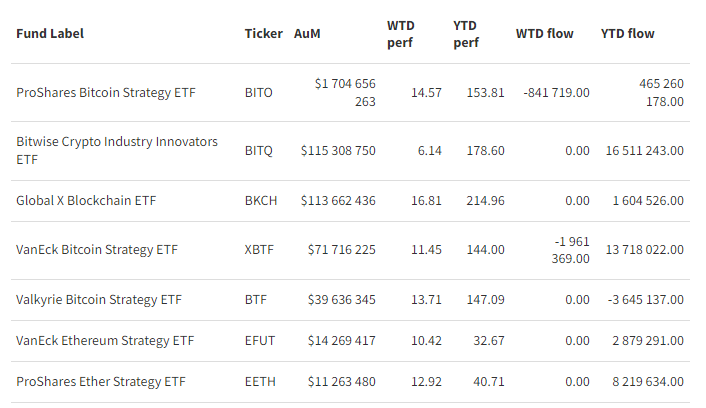

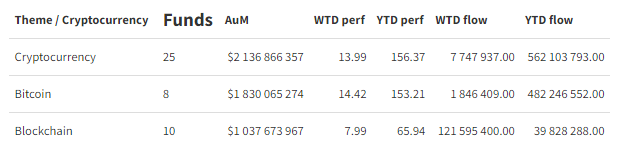

Indeed, cryptocurrency ETFs as a group have been gaining ground. Collectively, crypto funds were up 14% last week, posting an impressive 156.37% year-to-date growth. On a fund-specific level, the remarkable rise of ProShares Bitcoin Strategy ETF (BITO) is worthy of mention. With a surge of 14.57% over the past week, leading to annual cumulative returns of an impressive 153.81%, the fund has garnered $465 million of positive flows despite challenging market conditions. This represents an increase of +70% in AUM after removing gross performance.

In addition, certain Blockchain funds have benefitted from cryptocurrency performance and appear strategically placed to capitalize on the positive trends observed on cryptocurrency exchanges recently. As an example, the Global X Blockchain ETF (BKCH) experienced substantial 16.81% growth last week.

Group Data

Index Data

Funds Specific Data