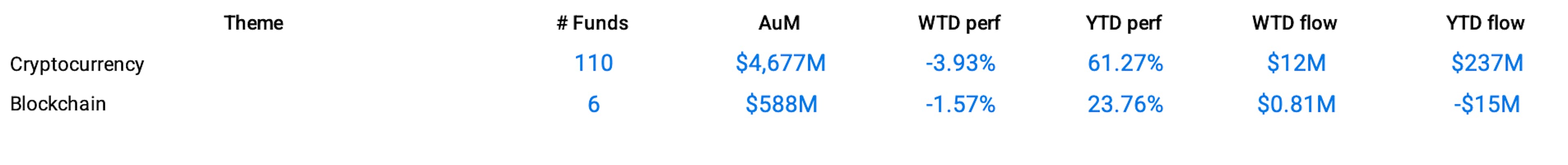

Blockchain ETFs slumped -1.58% over the course of last week, following their outstanding performance (+5.85%) the previous week. Similarly, the cryptocurrency theme also experienced a loss, shedding 3.94%.

As a decentralized and distributed digital ledger technology that securely records and verifies transactions across multiple computers, Blockchain’s design prevents alterations of previously stored information, thus providing high levels of transparency and security. It is notably used for cryptocurrency transactions, smart contracts, and supply chain management.

Blockchain ETFs offer investors exposure to companies that are engaged in the development and utilization of this impactful technology. Despite high volatility, their outstanding year-to-date performance highlights the prevailing financial market trend: blockchain and cryptocurrency sectors are extending their reach and influence.

The negative performance suffered last week can be attributed to traders engaging in profit-taking following the previous week's stellar gains. However, the overall projection remains positive. Aggregated year-to-date performance of blockchain ETFs stands at a robust 23.77%, meanwhile crypto ETFs have posted impressive year-to-date gains of 61.28%.