Nvidia, Warner Bros Discovery and CVS Health rise premarket; Toll Brothers falls

In this Pyth Network (PYTH) price prediction 2024, 2025-2030, we will analyze the price patterns of PYTH by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

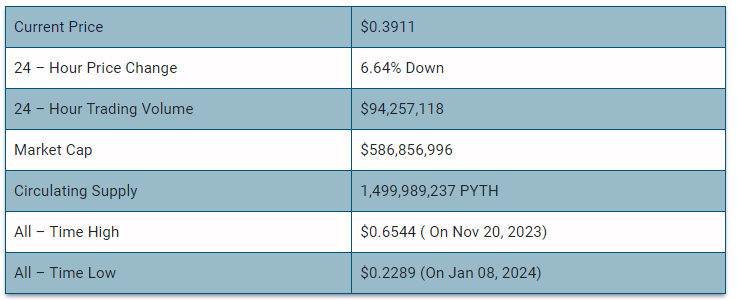

Pyth Network (PYTH) Current Market Status

What is Pyth Network (PYTH)

Pyth Network, established in 2020, addresses the shortcomings of traditional oracles by providing ultra-low-latency, institutional-grade market data for decentralized finance (DeFi). Serving as a decentralized marketplace for financial data, Pyth incentivizes over 90 first-party publishers, including major exchanges and market-making firms, to contribute their proprietary data directly to the blockchain. This innovative “first-party” data model future-proofs Pyth for the evolving DeFi landscape. The Pyth Protocol aggregates data from these providers on the Pythnet blockchain, producing unified price feeds every 400 milliseconds.

Notably, Pyth stands out with a “Pull Oracle (NYSE:ORCL)” architecture, allowing users to request updates when needed, minimizing gas fees. With over 350 low-latency price feeds and high-frequency updates, Pyth Network excels in speed, coverage, and sourcing/quality of data, making it a game-changer among blockchain oracles. Pyth’s transparency, multi-chain availability, and high-resolution data contribute to its significance in the DeFi space.

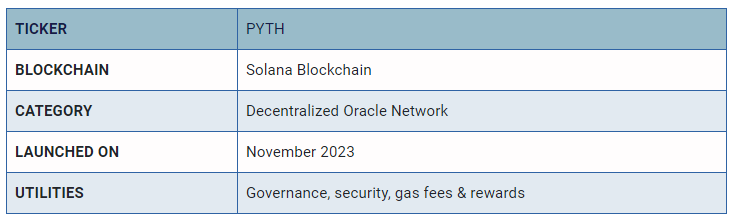

Pyth Network 24H Technicals

(Source: TradingView)

Pyth Network (PYTH) Price Prediction 2024

Pyth Network (PYTH) ranks 101st on CoinMarketCap in terms of its market capitalization. The overview of the Pyth Network price prediction for 2024 is explained below with a daily time frame.

PYTH/USDT Right Angled Descending Broadening Wedge Pattern (Source: TradingView)

In the above chart, Pyth Network (PYTH) laid out a ight-angled descending broadening wedge pattern. A right-angled descending broadening wedge is a bullish reversal pattern. The pattern is an inverted ascending triangle because it is made up of two converging lines with a horizontal line for the resistance and a bearish downward slant for the support.

Within a descending channel, a trader could make a selling bet when the security price reaches its resistance trendline. An ascending channel is the opposite of a descending channel. Both ascending and descending channels are primary channels followed by technical analysts.

At the time of analysis, the price of Pyth Network (PYTH) was recorded at $0.3911. If the pattern trend continues, then the price of PYTH might reach the resistance level of $0.4350, and $0.8297. If the trend reverses, then the price of PYTH may fall to the support of $0.2276.

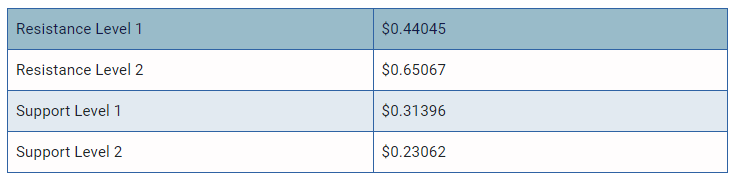

Pyth Network (PYTH) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Pyth Network (PYTH) in 2024.

PYTH/USDT Resistance and Support Levels (Source: TradingView)

From the above chart, we can analyze and identify the following as resistance and support levels of Pyth Network (PYTH) for 2024.

PYTH Resistance & Support Levels

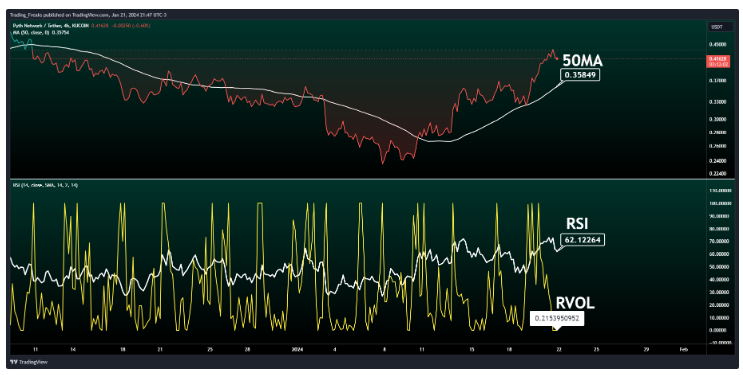

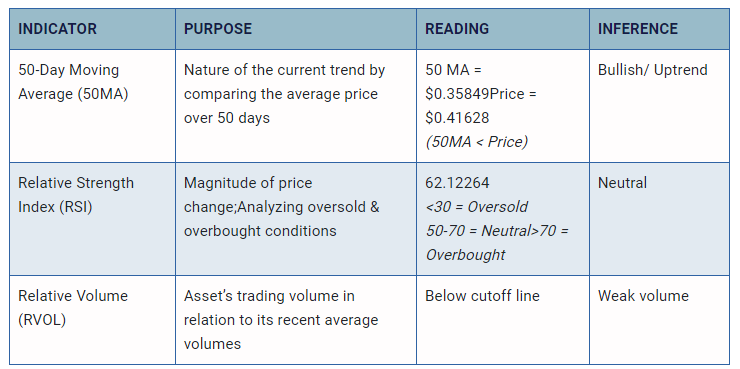

Pyth Network (PYTH) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Pyth Network (PYTH) are shown in the chart below.

PYTH/USDT RVOL, MA, RSI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the current Pyth Network (PYTH) market in 2024.

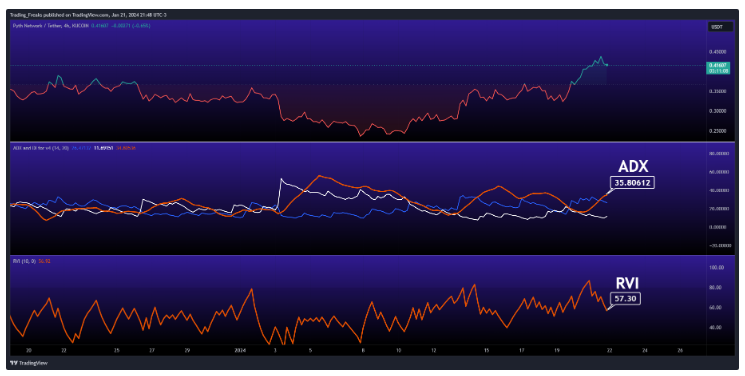

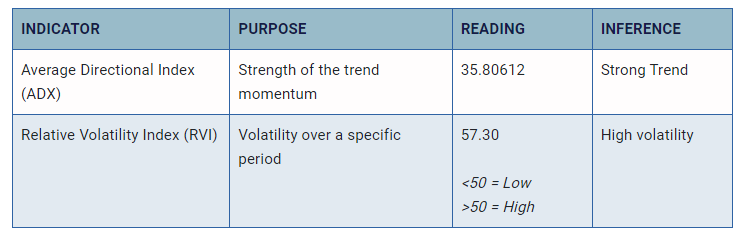

Pyth Network (PYTH) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Pyth Network (PYTH) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

PYTH/USDT ADX, RVI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the price momentum of Pyth Network (PYTH).

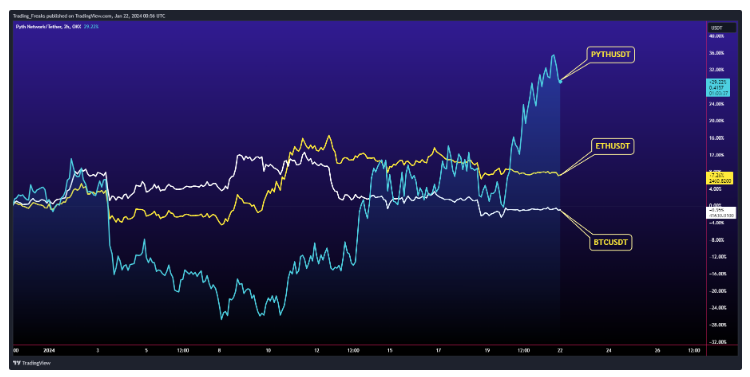

Comparison of PYTH with BTC, ETH

Let us now compare the price movements of Pyth Network (PYTH) with that of Bitcoin (BTC), and Ethereum (ETH).

BTC Vs ETH Vs PYTH Price Comparison (Source: TradingView)

From the above chart, we can interpret that the price action of PYTH is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of PYTH also increases or decreases respectively.

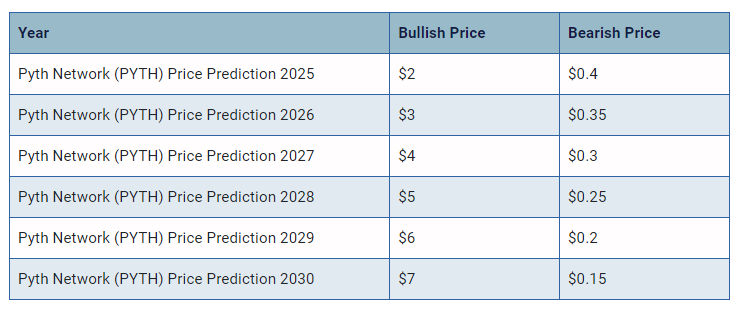

Pyth Network (PYTH) Price Prediction 2024, 2025 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Pyth Network (PYTH) between 2024, 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If Pyth Network (PYTH) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish Pyth Network (PYTH) price prediction for 2024 is $0.65067. Comparatively, if unfavorable sentiment is triggered, the bearish Pyth Network (PYTH) price prediction for 2024 is $0.23062.

If the market momentum and investors’ sentiment positively elevate, then Pyth Network (PYTH) might hit $1. Furthermore, with future upgrades and advancements in the Pyth Network ecosystem, PYTH might surpass its current all-time high (ATH) of $0.6544 and mark its new ATH.

This content was originally published by our partners at The News Crypto.