Here’s Why Q4 Could be Rough for the Dollar

The best-performing currencies in the third quarter could become the worst performers in Q4. Between July and September we saw strong gains in the U.S. dollar and Japanese yen. The yen performed better than the greenback but both currencies led the charge as risk aversion drove equities and high-beta currencies lower. Concerns about the global economy is the primary reason why the JPY performed so well but investors also bought dollars betting that the Federal Reserve would raise interest rates before the end of the year. We’re on board with that idea and have been buying dollars on every dip in anticipation.

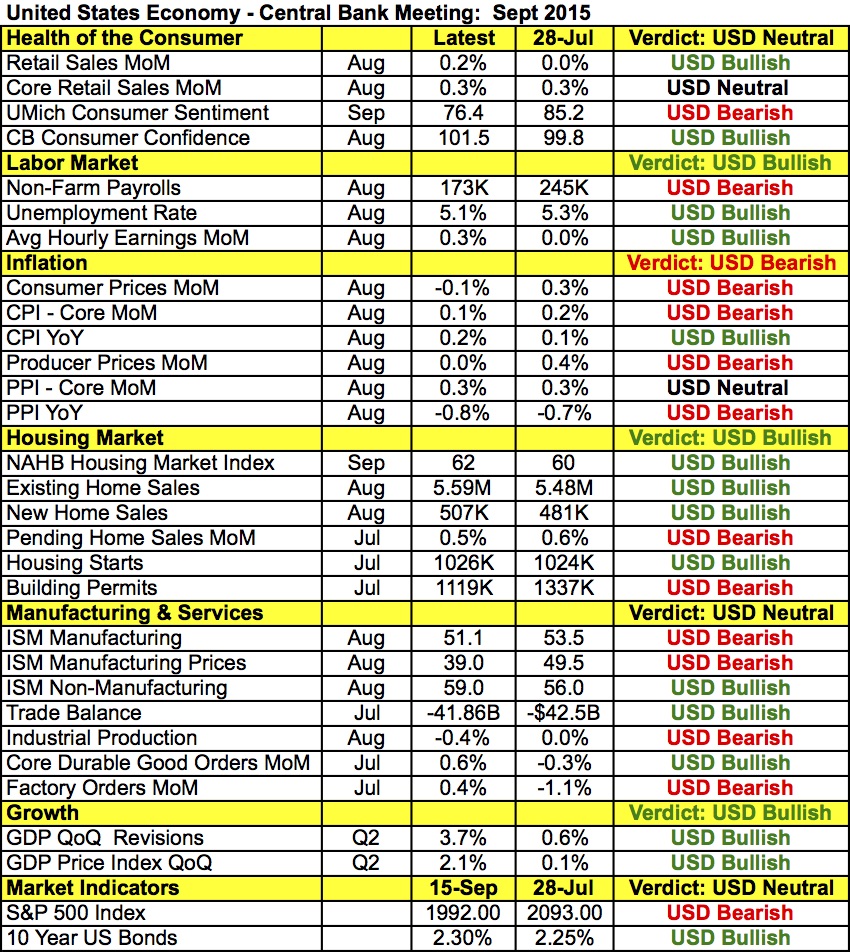

However if the Federal Reserve raises interest rates in October, our outlook for the greenback could be very different. Over the past 30 years, there have been 4 major tightening cycles in 2004, 1999, 1994 and 1986. On each occasion, USD/JPY rallied the day that the Fed raised interest rates for the very first time. But 3 months later, the dollar (as measured by DXY) is generally worth less. 90 days after the first hike, the dollar index dropped an average of 3.8% with relatively strong losses seen against the euro and Japanese yen. What is interesting about these moves is that the dollar weakened even though further hikes were made during these 90-day periods. So rather than encourage demand for U.S. dollars, Fed tightening discouraged it. This counterintuitive price action could be driven by a number of factors from the central bank downplaying the tightening cycle to the negative impact of rate hikes on growth and the classic buy-the-rumor, sell-the-news price action. Of course, how the dollar behaves will depend on how aggressively the Fed decides to move again but based on Yellen’s comments, the whole point of starting early is to avoid raising rates too fast.

The Japanese yen is also at risk of severe losses in the fourth quarter if the Bank of Japan increases its asset-purchase program next month. Japan’s economy is performing much worse than anticipated. To everyone’s surprise, industrial production declined for the second month in a row when economists had been looking for an increase. Retail sales also stagnated while construction orders dropped a whopping 15.6% yoy. Wednesday night’s quarterly Tankan report should show Japanese businesses becoming less optimistic and paring their capital expenditure plans. Last week, we learned that core consumer prices dropped for the first time since April 2013 and all of these problems have the market talking about the possibility of another recession in Japan. It's too early to tell, but the arguments for more stimulus from the BoJ is growing and the last time they surprised the market with more stimulus in 2014, the yen fell more than 8% against the euro, sterling and U.S. dollar over the course of 6 weeks.

The euro was hit hard on Wednesday by weaker than expected economic data. In Germany, retail sales dropped 0.4% against expectations for a 0.2% rise. German unemployment rolls increased by 2k and consumer prices in the Eurozone dropped 0.1%. This was the first time that euro area inflation turned negative since March 2015 and despite Bundesbank President Weidmann's recent comment that deflation has become less of a concern, the drop in inflation at a time when commodity prices are very low raises the risk of the low inflation sticking, which could revive talk of additional ECB easing.

Nine trading days have now past without a rally for the British pound versus the U.S. dollar, the longest stretch of weakness since August 2008. The latest U.K. economic reports were mixed. House prices increased at a faster pace according to Nationwide but annualized GDP growth was revised down to 2.4% from 2.6%. The main focus this week for sterling is Thursday’s UK PMI manufacturing report. Between the drop in industrial production and the sharp decline in the CBI Industrial Trends report, the risk is to the downside. However if the data is good and sterling rallies, the turn should last (as long as NFPs aren’t horrid). GBP/USD is a high volatility pair and when it reverses, the move can be strong, ranging from 200 to 800 pips.

USD/CAD ended the North American trading session lower for the first time in 9 trading days on the back of stronger GDP growth. Canada’s economy expanded by 0.3% in July against expectations for a 0.2% rise. On an gdp, GDP growth in Canada accelerated to 0.8% from 0.5%. Considering that the past month’s report was revised lower, oil prices were unchanged and the latest EIA data showed an unusually large increase in crude stockpiles, we believe that Wednesday’s reversal is a reflection of trend exhaustion.

The Australian and New Zealand dollars also traded higher ahead of China’s PMI Manufacturing report. This week’s Chinese numbers are the second-most important event risk on the calendar behind Nonfarm Payrolls. According to Caixin, manufacturing activity in September slowed significantly but we are skeptical about how much weakness China will actually show. Australia will also release its PMI manufacturing report and given the weakness in China, softer activity is expected. Even though both New Zealand and Australia reported lower housing-market data, NZD outperformed AUD because business confidence in New Zealand improved in September after the recent increase in dairy prices.