By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The fourth quarter begins with a mild rally in the U.S. dollar. Monday’s U.S. economic reports were very strong with the ISM manufacturing index hitting a 13-year high. The data shows that factories are booming and prices are rising. Although part of this strength can be attributed to hurricane related supply-chain disruptions and energy costs, there is still underlying strength in the manufacturing sector as we’ve seen similar improvements in the Philadelphia and Chicago regions – two areas not affected by the recent hurricanes. Construction spending also increased 0.5% in August and is likely to rise further on rebuilding efforts. These positive reports along with new record highs in stocks should have driven USD/JPY to 113 and while the pair got very close to that level post data, the gains were given back quickly as bond traders struggle to keep yields up. The beginning and end of the month/quarter are always tricky to trade but this week could be a challenging one for the greenback with nonfarm payrolls expected to come in much lower. However between now and then, the market clearly prefers dollars over other currencies and as long as yields and stocks continue to rise, so will USD/JPY.

Monday's big story in the forex market was Catalonia’s independence referendum, which apparently passed with 90% of the vote. Catalonia’s desire to split with Spain spells big trouble for the euro because it threatens the very fabric of the Eurozone. If Catalonia is allowed to succeed it could affect the regional referendums later this month in 2 of Italy’s wealthiest regions. The Spanish government plans to challenge the vote as they see the referendum illegitimate and illegal, so Catalonia may not be any closer to independence. Either way, this constitutional crisis in Spain is going to hold the euro down for now but eventually these political troubles will fade from the minds of EUR/USD traders who will view this as a regional issue. The only problem is that it may be another week before that happens.

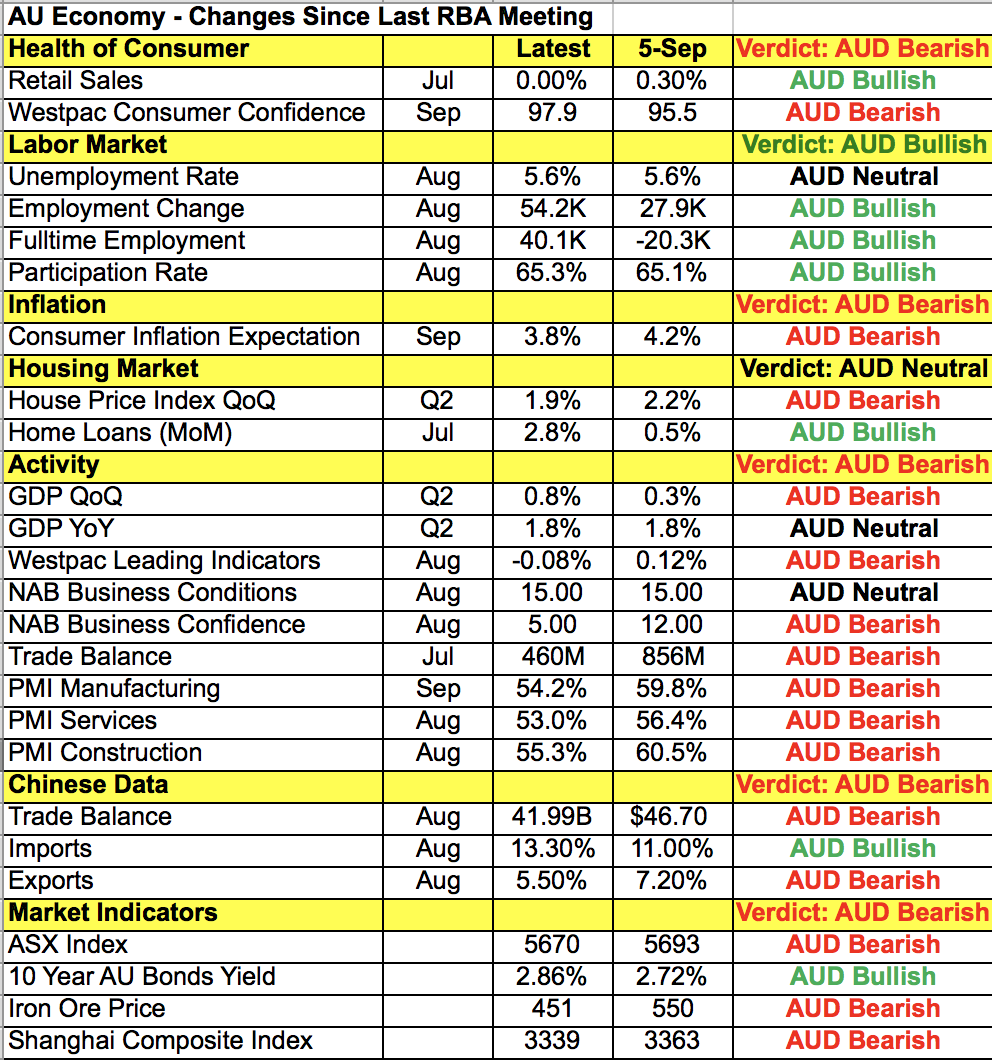

The main focus Monday night will be the Reserve Bank of Australia’s monetary policy announcement. AUD was trading strongly ahead of the rate decision but we believe the risk is to the downside. Taking a look at the table below, there’s been widespread weakness in Australia’s economy since the last policy meeting. Data has taken a turn for the worse over the past month with manufacturing activity plunging according to the latest report, consumer and business confidence falling, GDP growth easing, inflation expectations declining and service-sector activity slowing. Copper and iron ore prices have also fallen sharply with China slowing. There’s very little for the RBA to be excited about, which is why we believe they will emphasize the challenges the economy faces over the prospects for growth. This would be a departure from RBA Governor Lowe’s view back in September when he said lower rates would add to risk in household balance sheets, which sent AUD/USD sharply higher. Still, there’s no doubt that the economy has weakened. If the RBA is less optimistic, AUD/USD will break support at 78 cents and in the unlikely scenario that they maintain the same level of hawkishness, AUD/USD could bounce to 79 cents.

The Canadian and New Zealand dollars also traded lower Monday. There was no news from New Zealand but there’s a dairy auction Tuesday and it will be interesting to see if the uptrend continues. Manufacturing activity in Canada accelerated according to Markit Economics’ latest report but oil prices dropped 2%. With that in mind, Canadian 10-year bond yields increased 3bp Monday, which should have been positive for the Canadian dollar. We’ll continue to monitor yields closely as a further increase could cap the gains for USD/CAD.

Monday's worst-performing currency was sterling, which fell sharply on the back of softer data. The manufacturing PMI index dropped to 55.9 from 56.7, which is consistent with the fall in the Confederation of British Industry’s industrial trends report. This is an important week for GBP because all 3 PMI reports are due for release. The drop in the manufacturing data tilts the risk to the downside for the construction- and service-sector reports. GBP/USD closed below the 20-day SMA for the first time since August 29 and on a technical basis looks poised for a move down to the 50-day SMA near 1.3130.